Pro Forma Analysis Excel Templates

That’s why we offer a suite of professionally developed Excel models

for apartment building development financial modeling.

All of our templates are 100% unlocked Excel files without restrictions.

That’s why we offer a suite of professionally developed Excel models

for apartment building development financial modeling.

All of our templates are

100% unlocked Excel files

without any restrictions.

Note: the interactive Excel sample below is not fully functional, by design.

To get the functional tool, you must download the file by clicking

Add to Cart below, then View Cart, and then checking out.

$0.00Add to cart

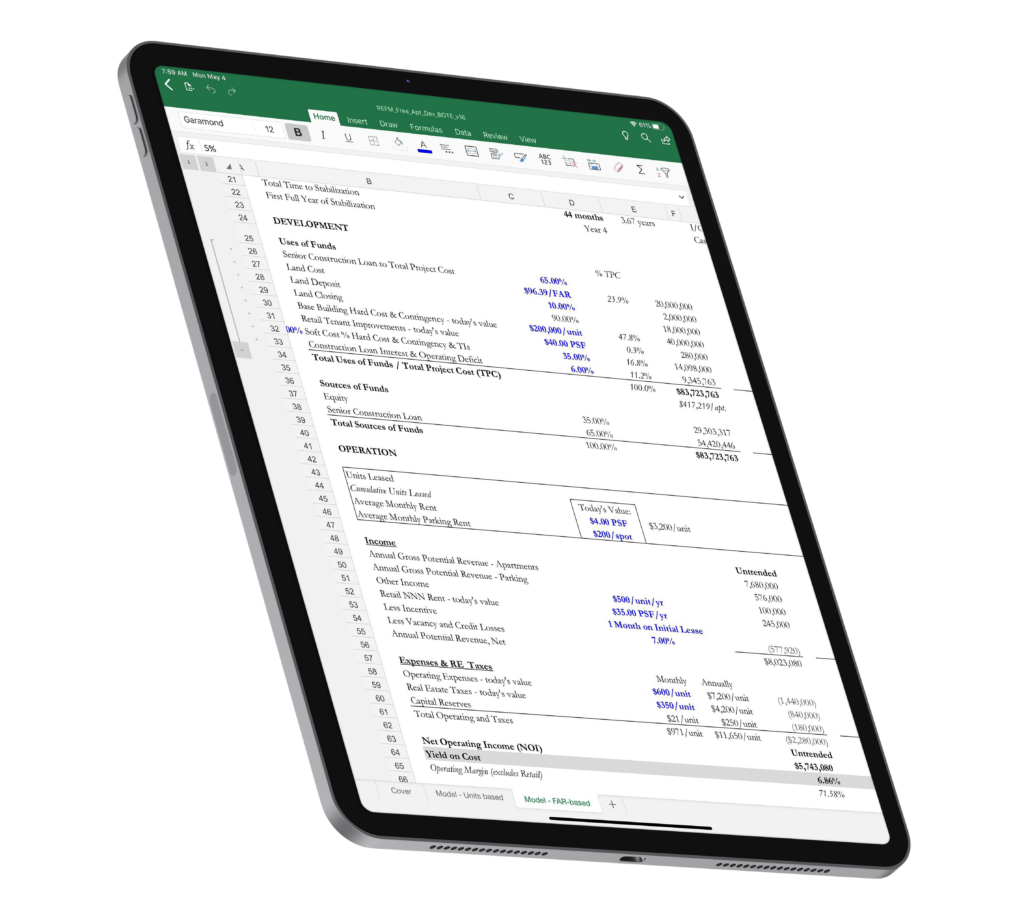

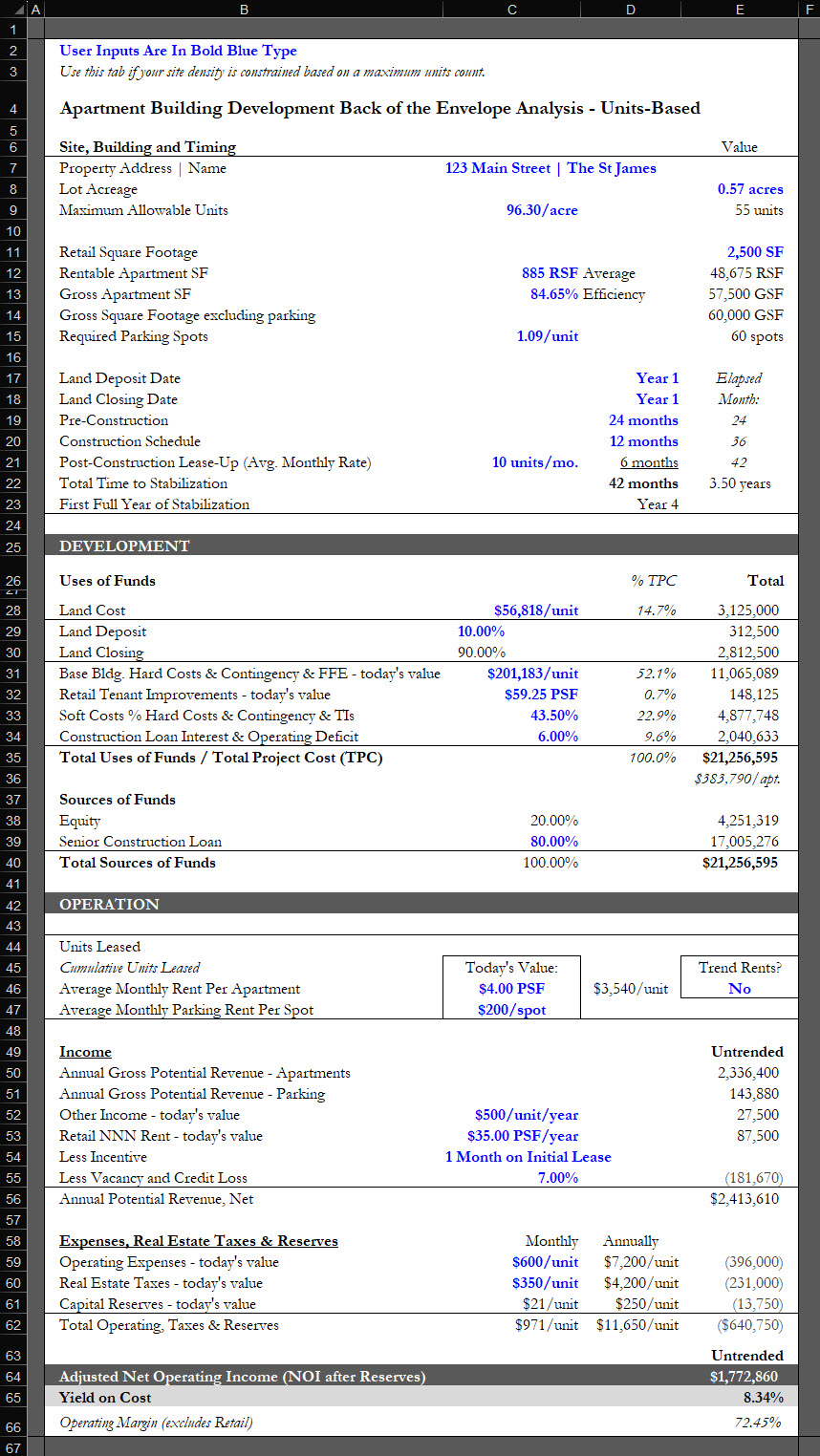

The free Excel B.O.T.E. tool is suited for the fastest basic apartment building development feasibility assessment by solving for a stabilized yield on cost and residual land value. By design, it does not output profit or IRR values because it is purposefully not a multi-period analysis.

The free Excel B.O.T.E. tool is suited for the fastest basic apartment building development feasibility assessment by solving for a stabilized yield on cost and residual land value. By design, it does not output profit or IRR values because it is purposefully not a multi-period analysis.

For an apartment building development, BOTE feasibility analysis focuses in on the Land Purchase Price as it relates to the going-in (Year 1) yield on cost (the Year 1 stabilized cap rate). Land Purchase Price is typically solved for on a residual basis, meaning the land value is what is left over after a targeted initial level of yield has been achieved.

The development back of the envelope thought experiment

Development BOTE analysis assumes the hypothetical situation where you could purchase the land at an assumed price today and then snap your fingers and the contemplated building would instantly appear and be at stabilized occupancy. As such, today’s hard and soft development costs, cost of debt and rents and expenses are used as inputs. The logic behind doing this is that if the deal does not look good using today’s values, about which we have a very high level of certainty, it’s not worth pursuing because we have significantly less certainty about the amounts to use for these variables years into the future.

FAR-Based vs. Units-Based analysis

A development site zoned for multi-unit residential use will typically have a density constraint in terms of the total gross square footage of building allowed on the site or a ceiling on the residential unit count. Our calculator has the ability to analyze a site both on an FAR basis as well as on a Units basis, and you can toggle between the two within a single analysis file. FAR stands for “floor area ratio”, but we like to think of it as “floor area to lot size ratio”. FAR is simply the ratio of the allowable above-ground gross building area to the site area. An example of an FAR ratio of 5.00 would be a 10,000 square foot development parcel with an allowable above-ground building area of 50,000 gross square feet.

Sponsor Equity and a Senior Construction Loan are supported.

The analysis prints neatly on a single 8.5 x 11 page in portrait orientation.

Support is available through our online ticket system.

The Multi-Year B.O.T.E. Excel tool is suited for rapid apartment building development feasibility and residual land valuation based not only on a stabilized yield on cost, but also on goal-seeking to a targeted before-tax IRR, net profit, multiple on equity or NPV metric. Includes an optional refinancing after stabilization.

The analysis prints neatly on a single 8.5 x 11 page in landscape orientation.

Support is available through our online ticket system.

The Multi-Year B.O.T.E. Excel tool is suited for rapid apartment building development feasibility and residual land valuation based not only on a stabilized yield on cost, but also on goal-seeking to a targeted before-tax IRR, net profit, multiple on equity or NPV metric. Includes an optional refinancing after stabilization.

The analysis prints neatly on a single 8.5 x 11 page in landscape orientation.

Support is available through our online ticket system.

$799.00Add to cart

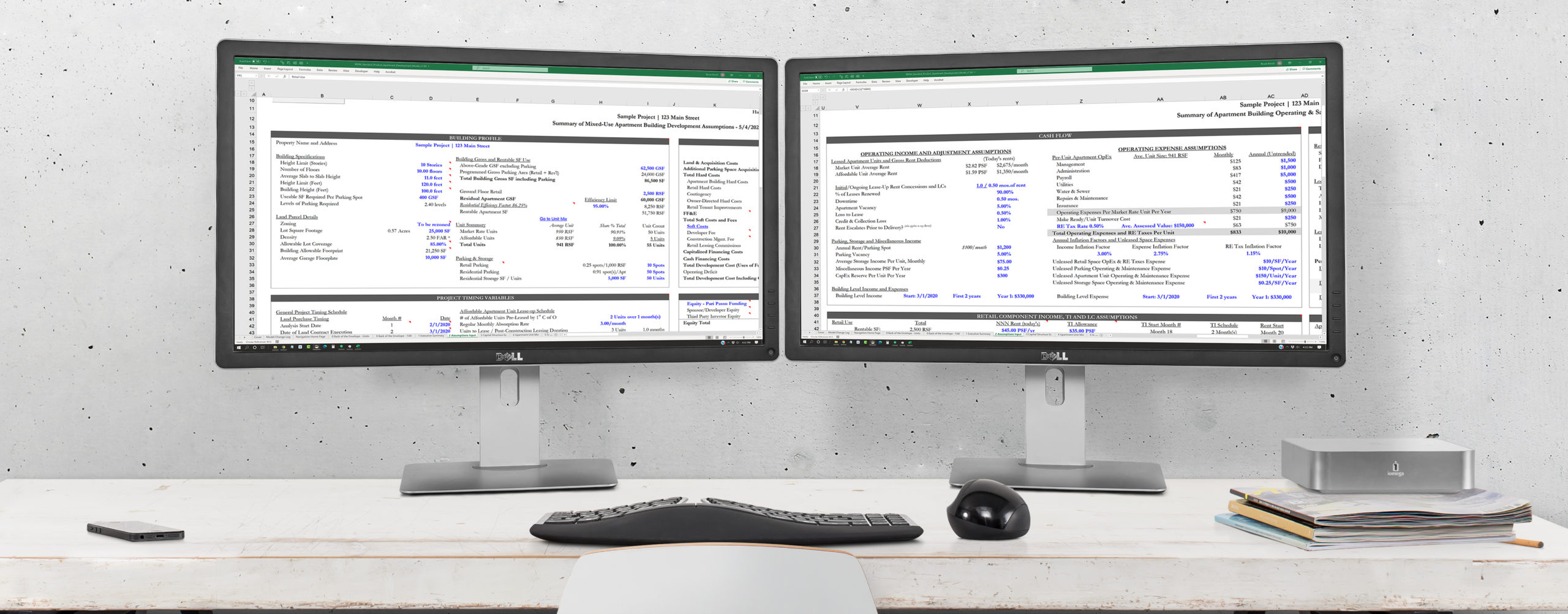

The Standard Pro Forma is a robust Excel-based analysis tool for modeling the ground-up development, operation and sale of an apartment/multi-family rental building with or without ground-floor retail and income-producing parking. It is suited for detailed monthly-based analysis and it generates before-tax IRR, net profit, cash on cash, equity multiple and NPV outputs, among others.

Support is available through our online ticket system.

A comprehensive, searchable, hyperlinked PDF User Guide is included with purchase. A sample is below.

1 Home Page

2 Assumptions Input

3 Capital Structure Exhibit

4 Apartment Unit Mix Input

5 Monthly Sources and Uses of Funds Input

6 Monthly Cash Flow Exhibit

7 Partnership Structure Exhibit

8 Waterfall Profit Splitting Exhibit

9 Annual Sources & Uses Exhibit

10 Annual Cash Flow Exhibit

11 Joint Venture Partnership Returns Summary Exhibit

12 Permanent Loan Amortization Schedule

13 Construction Loan Interest Rates

14 Monthly Construction Bell Curve Lookup Table

15 Land Acquisition Costs Schedule Input

16 Hard Costs Budget Schedule Input – Phase 1

17 Soft Costs Budget Schedule Input – Phase 2

18 Floating Rate Index

The Standard Pro Forma is a robust Excel-based analysis tool for modeling the ground-up development, operation and sale of an apartment/multi-family rental building with or without ground-floor retail and income-producing parking. It is suited for detailed monthly-based analysis and it generates before-tax IRR, net profit, cash on cash, equity multiple and NPV outputs, among others.

Support is available through our online ticket system.

A comprehensive, searchable, hyperlinked PDF User Guide is included with purchase.

1 Home Page

2 Assumptions Input

3 Capital Structure Exhibit

4 Apartment Unit Mix Input

5 Monthly Sources and Uses of Funds Input

6 Monthly Cash Flow Exhibit

7 Partnership Structure Exhibit

8 Waterfall Profit Splitting Exhibit

9 Annual Sources & Uses Exhibit

10 Annual Cash Flow Exhibit

11 Joint Venture Partnership Returns Summary Exhibit

12 Permanent Loan Amortization Schedule

13 Construction Loan Interest Rates

14 Monthly Construction Bell Curve Lookup Table

15 Land Acquisition Costs Schedule Input

16 Hard Costs Budget Schedule Input – Phase 1

17 Soft Costs Budget Schedule Input – Phase 2

18 Floating Rate Index

$1,499.00Add to cart

The Professional Pro Forma is a highly-flexible Excel-based analysis tool for modeling the ground-up development, operation and sale of an apartment/multi-family rental building with or without ground-floor retail and income-producing parking. It is suited for presentation to a wide array of debt and equity capital sources, including institutional players.

Support is available through our online ticket system.

A comprehensive, searchable, hyperlinked PDF User Guide is included with purchase. A sample is below.

1 Executive Summary

2 Assumptions Input

3 Building Stacking Plan Input

4 Apartment Unit Mix Input

5 Monthly Sources and Uses of Funds

6 Monthly Cash Flow Exhibit

7 Master Retail Leasing Exhibit

8 Retail Tenant 1 Exhibit

9 Retail Tenant 2 Exhibit

10 Retail Tenant 3 Exhibit

11 Retail Tenant 4 Exhibit

12 Retail Tenant 5 Exhibit

13 Annual Sources & Uses Exhibit

14 Quarterly Sources & Uses Exhibit

15 Annual Cash Flow Exhibit

16 Quarterly Cash Flow Exhibit

17 Capital Structure Exhibit

18 Joint Venture Partnership Structure Exhibit

19 Monthly Waterfall #1 Exhibit

20 Monthly Waterfall #2 Exhibit

21 Joint Venture Partnership Returns Summary Exhibit – 3 Equity Players

22 Joint Venture Partnership Returns Summary Exhibit – 2 Equity Players

23 Land Acquisition Costs Schedule Input

24 Soft Costs Budget Schedule Input – Phase 1

25 Soft Costs Budget Schedule Input – Phase 2

26 Hard Costs Budget Schedule Input – Phase 1

27 Hard Costs Budget Schedule Input – Phase 2

28 Monthly Retail TI and LC Amortization Schedule Exhibit

29 Monthly Permanent Loan Amortization Schedule Exhibit

30 Mezzanine Loan Interest Rates

31 Senior Construction Loan Interest Rates

32 Project Gantt Chart

33 Monthly Construction Cost Curves Lookup Table

34 Floating Rate Index

The Professional Pro Forma is a highly-flexible Excel-based analysis tool for modeling the ground-up development, operation and sale of an apartment/multi-family rental building with or without ground-floor retail and income-producing parking. It is suited for presentation to a wide array of debt and equity capital sources, including institutional players.

Support is available through our online ticket system.

A comprehensive, searchable, hyperlinked PDF User Guide is included with purchase. A sample is below.

1 Executive Summary

2 Assumptions Input

3 Building Stacking Plan Input

4 Apartment Unit Mix Input

5 Monthly Sources and Uses of Funds

6 Monthly Cash Flow Exhibit

7 Master Retail Leasing Exhibit

8 Retail Tenant 1 Exhibit

9 Retail Tenant 2 Exhibit

10 Retail Tenant 3 Exhibit

11 Retail Tenant 4 Exhibit

12 Retail Tenant 5 Exhibit

13 Annual Sources & Uses Exhibit

14 Quarterly Sources & Uses Exhibit

15 Annual Cash Flow Exhibit

16 Quarterly Cash Flow Exhibit

17 Capital Structure Exhibit

18 Joint Venture Partnership Structure Exhibit

19 Monthly Waterfall #1 Exhibit

20 Monthly Waterfall #2 Exhibit

21 Joint Venture Partnership Returns Summary Exhibit – 3 Equity Players

22 Joint Venture Partnership Returns Summary Exhibit – 2 Equity Players

23 Land Acquisition Costs Schedule Input

24 Soft Costs Budget Schedule Input – Phase 1

25 Soft Costs Budget Schedule Input – Phase 2

26 Hard Costs Budget Schedule Input – Phase 1

27 Hard Costs Budget Schedule Input – Phase 2

28 Monthly Retail TI and LC Amortization Schedule Exhibit

29 Monthly Permanent Loan Amortization Schedule Exhibit

30 Mezzanine Loan Interest Rates

31 Senior Construction Loan Interest Rates

32 Project Gantt Chart

33 Monthly Construction Cost Curves Lookup Table

34 Floating Rate Index

As the founder of Real Estate Financial Modeling (REFM), Bruce Kirsch has trained thousands of students and professionals around the world in Excel-based projection analysis. In addition, REFM’s self-study products, Excel-based templates and its Valuate® property valuation and investment analysis software are used by more than 250,000 professionals. Mr. Kirsch’s firm has assisted with modeling for the raising of billions of dollars of equity and debt for individual property acquisitions and developments, as well as for major mixed-use projects and private equity funds. Mr. Kirsch has also maintained a blog on real estate financial modeling, Model for Success, authoring more than 500 posts.

Mr. Kirsch began his real estate career at CB Richard Ellis, where he marketed highrise New York City office buildings for re-development in the Midtown Manhattan Investment Properties Institutional Group. After CBRE, Mr. Kirsch was recruited to lead acquisitions at Metropolis Development Company, and later joined The Clarett Group, a programmatic development partner of Prudential.

While at The Clarett Group, Mr. Kirsch was responsible for making development site recommendations for office, condominium and multi-family properties in the greater Washington, D.C. metropolitan area. In addition, Mr. Kirsch had significant day-to-day project management responsibilities for the entitlement, financing and marketing of the company’s existing D.C.-area development portfolio.

Mr. Kirsch holds an MBA in Real Estate from The Wharton School of the University of Pennsylvania, where he was awarded the Benjamin Franklin Kahn/Washington Real Estate Investment Trust Award for academic excellence. Prior to Wharton, Mr. Kirsch performed quantitative equity research on the technology sector at The Capital Group Companies. Mr. Kirsch served as an Adjunct Faculty member in real estate finance at Georgetown University School of Continuing Studies. Mr. Kirsch graduated with a BA in Communication from Stanford University.

Click on Add to Cart for the product of your choice, and then View Cart (which will appear to the right of the Add to Cart button) and complete the checkout process. Upon successful payment, you will get instant access to the Excel model(s).

Yes, we offer the chance to pay for the course over time through Affirm. You can apply for this option during the checkout process.

No, there is only one price.

Yes; yes. There are no access or use restrictions whatsoever.

If you are looking for a way to analyze the ground-up development of an apartment building, you might be interested in our Excel-based templates for sale. These templates are designed to help you estimate the costs, revenues, and returns of your project, as well as the risks and opportunities involved.

With our templates, you can:

Our templates are easy to use, customizable, and reliable. They are based on industry standards and best practices, and they have been tested and verified by experienced real estate professionals. Whether you are a developer, investor, lender, or consultant, our templates can help you make better decisions and achieve your goals.

Have a question that’s not addressed above? Email [email protected].