Pro Forma Analysis Excel Templates

Fastest possible basic feasibility by solving for a stabilized yield on cost and residual land value

Rapid feasibility that generates a before-tax IRR, net profit, multiple on equity and NPV outputs

Detailed analysis that generates a before-tax IRR, net profit, multiple on equity and NPV outputs

Detailed analysis that generates before- & after-tax IRR, net profit, equity multiple and NPV outputs

$5,599.00Add to cart

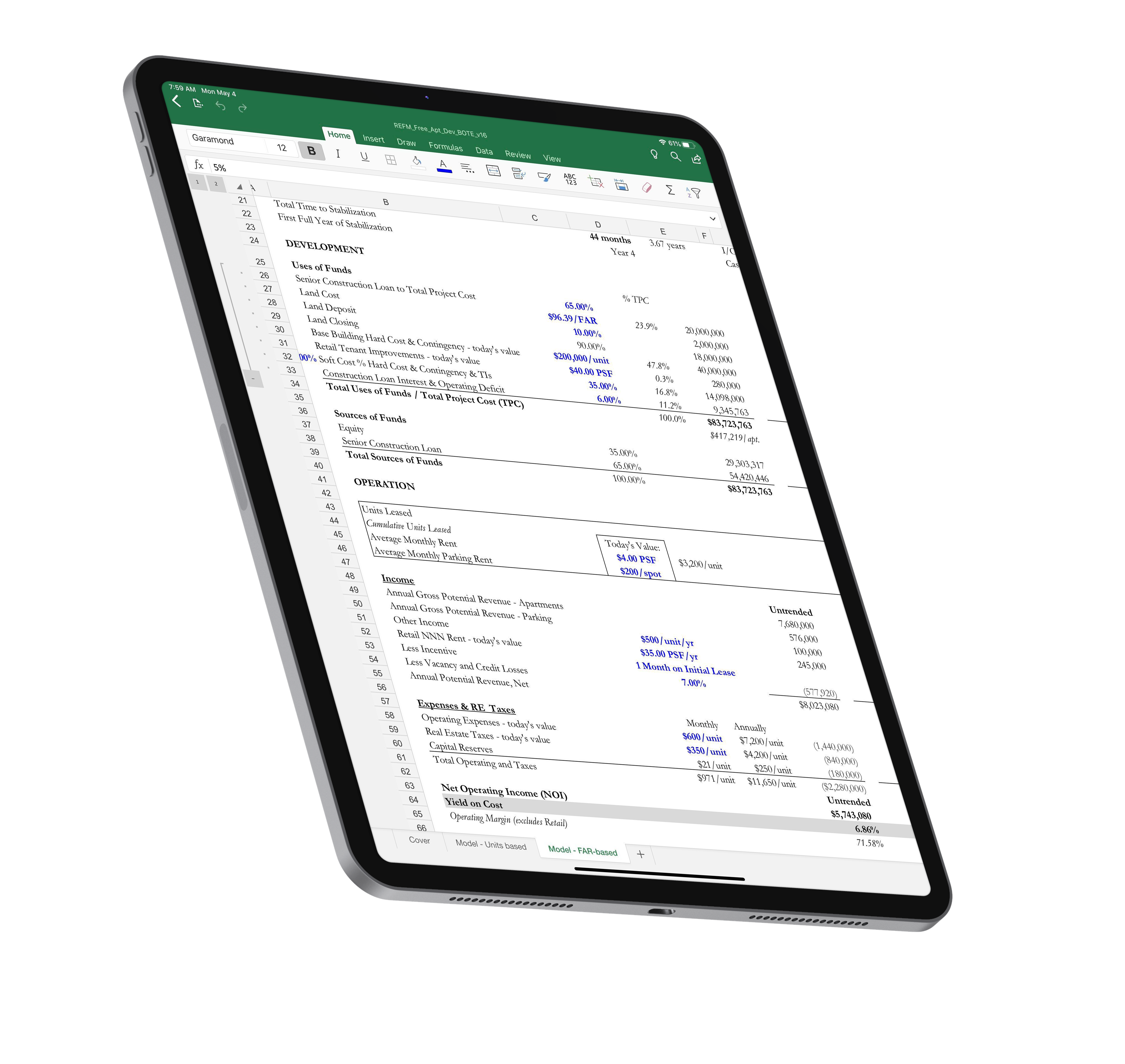

Our B.O.T.E. free tool is suited for the fastest basic feasibility assessment by solving for a stabilized yield on cost and residual land value. By design, it does not output profit or IRR values because it is purposefully not a multi-period analysis.

A back of the envelope, or “BOTE” analysis, is intended to give you a broad brushstroke view of the economic feasibility of a potential transaction. BOTE-level analysis is used to quickly screen potential deals in and out of one’s deal pipeline. A high level of detail is purposefully forfeited in BOTEs for the sake of speed of execution.

For an apartment building development, BOTE feasibility analysis focuses in on the Land Purchase Price as it relates to the going-in (Year 1) yield on cost (the Year 1 stabilized cap rate). Land Purchase Price is typically solved for on a residual basis, meaning the land value is what is left over after a targeted initial level of yield has been achieved.

The development back of the envelope thought experiment

Development BOTE analysis assumes the hypothetical situation where you could purchase the land at an assumed price today and then snap your fingers and the contemplated building would instantly appear and be at stabilized occupancy. As such, today’s hard and soft development costs, cost of debt and rents and expenses are used as inputs. The logic behind doing this is that if the deal does not look good using today’s values, about which we have a very high level of certainty, it’s not worth pursuing because we have significantly less certainty about the amounts to use for these variables years into the future.

FAR-Based vs. Units-Based analysis

A development site zoned for multi-unit residential use will typically have a density constraint in terms of the total gross square footage of building allowed on the site or a ceiling on the residential unit count. Our calculator has the ability to analyze a site both on an FAR basis as well as on a Units basis, and you can toggle between the two within a single analysis file. FAR stands for “floor area ratio”, but we like to think of it as “floor area to lot size ratio”. FAR is simply the ratio of the allowable above-ground gross building area to the site area. An example of an FAR ratio of 5.00 would be a 10,000 square foot development parcel with an allowable above-ground building area of 50,000 gross square feet.

Sponsor Equity and a Senior Construction Loan are supported.

The analysis prints neatly on a single 8.5 x 11 page in portrait orientation.

Support is available through our online ticket system.

Our Multi-Year B.O.T.E. free tool is suited for rapid feasibility and residual land valuation based on goal-seeking to any of a targeted before-tax IRR, net profit, multiple on equity or NPV metric.

The analysis prints neatly on a single 8.5 x 11 page in landscape orientation.

Support is available through our online ticket system.

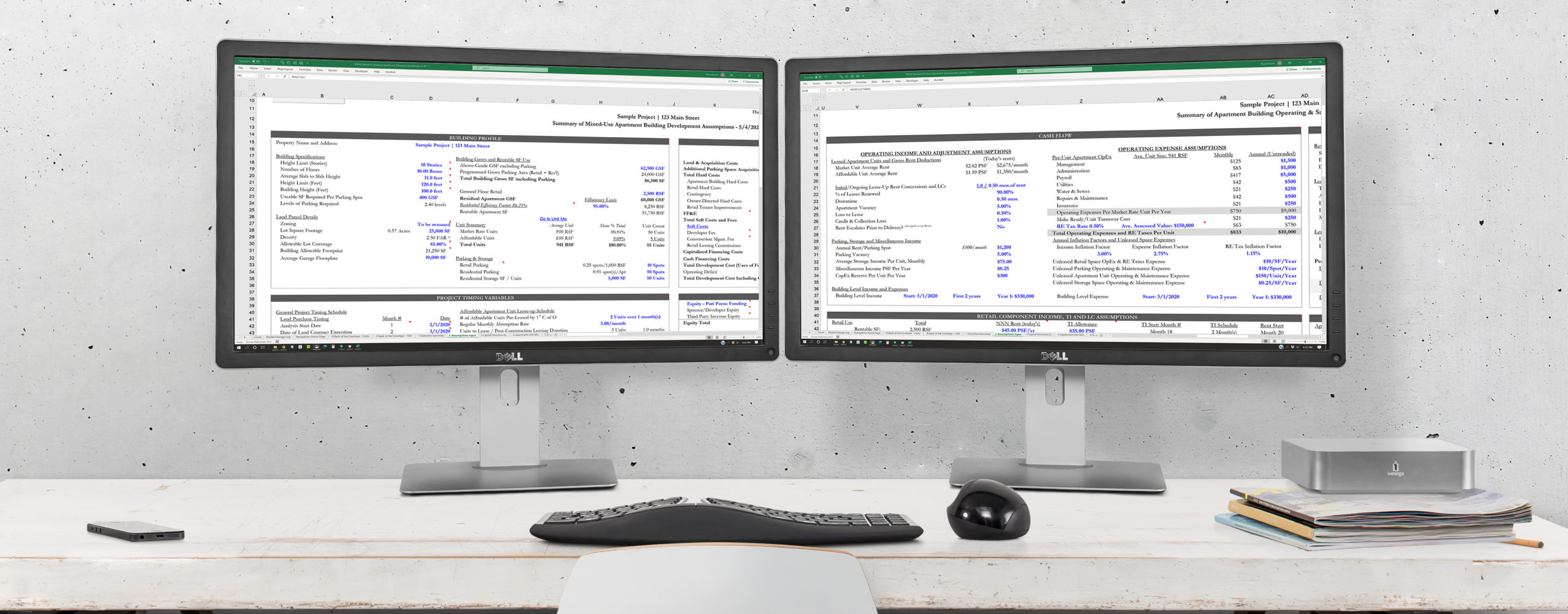

Our Standard Pro Forma is suited for detailed analysis that generates a before-tax IRR, net profit, multiple on equity and NPV outputs, among others.

The analysis prints neatly on a single 8.5 x 11 page in portrait orientation.

Support is available through our online ticket system.

Our B.O.T.E. free tool is suited for the fastest basic feasibility assessment by solving for a stabilized yield on cost and residual land value. By design, it does not output profit or IRR values because it is purposefully not a multi-period analysis.

For an apartment building development, BOTE feasibility analysis focuses in on the Land Purchase Price as it relates to the going-in (Year 1) yield on cost (the Year 1 stabilized cap rate). Land Purchase Price is typically solved for on a residual basis, meaning the land value is what is left over after a targeted initial level of yield has been achieved.

The development back of the envelope thought experiment

Development BOTE analysis assumes the hypothetical situation where you could purchase the land at an assumed price today and then snap your fingers and the contemplated building would instantly appear and be at stabilized occupancy. As such, today’s hard and soft development costs, cost of debt and rents and expenses are used as inputs. The logic behind doing this is that if the deal does not look good using today’s values, about which we have a very high level of certainty, it’s not worth pursuing because we have significantly less certainty about the amounts to use for these variables years into the future.

FAR-Based vs. Units-Based analysis

A development site zoned for multi-unit residential use will typically have a density constraint in terms of the total gross square footage of building allowed on the site or a ceiling on the residential unit count. Our calculator has the ability to analyze a site both on an FAR basis as well as on a Units basis, and you can toggle between the two within a single analysis file. FAR stands for “floor area ratio”, but we like to think of it as “floor area to lot size ratio”. FAR is simply the ratio of the allowable above-ground gross building area to the site area. An example of an FAR ratio of 5.00 would be a 10,000 square foot development parcel with an allowable above-ground building area of 50,000 gross square feet.

Sponsor Equity and a Senior Construction Loan are supported.

The analysis prints neatly on a single 8.5 x 11 page in portrait orientation.

Support is available through our online ticket system.

REFAI pricing is USD $1,499 for professionals, and USD $599 for current students and academic faculty/staff and active duty and retired U.S. military.

The cost of the hard copy textbook is included no matter where you live. Shipping is free within the US, but it is an additional $35 to ship to Canada, and an additional $65 to ship internationally other than to Canada.

You can learn about Academic and U.S. military status verification here.

Yes, we offer the chance to pay for the course over time through Affirm. You can apply for this option during the checkout process.

Yes, a 20% discount is available for groups of 2 or more. Please email refai@getrefm.com to inquire.

Current students, academic faculty and staff are eligible for Academic pricing. They must prove their academic status by providing a current and valid Academic ID from any high school, college or university (both US-based and international), as well as government-issued ID that verifies their identity. Academic status credentials can be uploaded here.

Yes. You can do so here.

No, as each individual candidate must pass quizzes and exams tied to their username, and the quizzes and exams are not accessible again once taken by a candidate.

The cost of the hard copy textbook is included no matter where you live. Shipping is free within the US, but it is an additional $35 if shipping to Canada, and an additional $65 if you shipping internationally excluding Canada.

No, the book is provided to you in hard copy only. The book is not offered in PDF.

If you already have the Fifth Edition of the book, you can get a $149 discount. To be granted a coupon code for the discount, please contact us at refai@getrefm.com.

Yes. The course content is tied directly to the Fifth Edition of the book, which is majorly enhanced and updated from prior editions.

No, the videos are streaming only. You must have a stable broadband Internet connection to view them without experiencing interruptions and file buffering.

No, you have lifetime access to everything.

You can start the course at any time once you have the textbook in your possession. The course is self-paced and the online platform is available 24/7/365.

It applies to both. A key chapter on projection modeling uses an apartment building as the case study.

No. The course is self-paced, and you have lifetime access to it.

In addition to reading the textbook, candidates will learn on the online course platform through various media, including recorded video and audio lectures, spreadsheet modeling exercises, multiple choice quizzes and exams.

This program requires 120-160 hours to complete the course content, and complete the exercises, quizzes, midterm and final exams. Lifetime access is provided to all course materials.

You are welcome to take the course just for your own educational enrichment and skill building if you wish.

Yes, the learning platform is optimized for phones and tablets. However, we recommend working on Excel on a desktop or laptop for the best experience.

Any computer purchased in the last 5 years, and Excel 2013 or more recent. For best results, we recommend using Google Chrome as your web browser.

The course is available on-demand, 24/7/365. All of the videos have been produced in a studio environment and edited to achieve the highest production value.

There is an online course forum, with discussion monitored and responded to by Bruce Kirsch, one of the course creators and textbook authors.

Yes, in your learner profile you have a list of all of the quizzes and links to view the quiz and answer explanations. There are also optional duplicate review quizzes that are ungraded, which you can use an unlimited number of times to study for the midterm and final.

You cannot take a quiz/test more than once a graded basis. However, there are also optional duplicate review quizzes that are ungraded, which you can use an unlimited number of times to study for the midterm and final.

REFAI was designed to be demanding but fair. Not everyone who takes the course will receive the Certification, as a 70% average score is required to pass. It is your chance to both learn and to demonstrate you have mastered the material.

REFAI is the equivalent of a semester-long “Real Estate Finance and Investment Analysis 101” course given in a traditional university setting. REFM’s Excel for Real Estate Certifications are short-format tutorials focused solely on technical skills in Excel as they apply to real estate analyses.

If you have already earned any of Level 1, 2 or 3 Excel for Real Estate Certification and do not wish to repeat the content and exam in the course, please email refai@getrefm.com to be verified and automatically passed through the relevant lesson(s) and quiz(zes).

No, it is much more. This course is the equivalent of a semester-long “Real Estate Finance and Investment Analysis 101” course given in a traditional university setting. Financial modeling is one aspect of the course, and a critical one, but one of many. The full syllabus and textbook contents can be viewed below.

To pass the course, you must achieve an average score of 70% or better across the entire set of graded quizzes, midterm and final exam. To pass With Distinction, you must achieve an average score of 85% or better.

You can be a complete beginner and you will be fine. We start from zero and build from there.

You will receive a high-resolution PDF certificate with your name on it, and the With Distinction designation if applicable. You may print the certificate yourself or have it professionally printed and framed.

Have a question that’s not addressed above? Email refai@getrefm.com.