Build your real estate

Get the Brochure

REFAI® Certification Adopters Include

REFAI® Certification Adopters Include

Take this course to:

Take the REFAI course to:

Gain insight into the risks and opportunities in commercial real estate investment

Learn how to frame risk related to investment and development opportunities and how to model and assess the potential rewards

Learn practical knowledge and skills from Dr. Peter Linneman and Bruce Kirsch

The ultimate teaching collaboration with over 50 combined years of course design, teaching, skills training and CRE investing experience

Read “the one book that’s kept forever” by top real estate students after they graduate

In publication for 20 years, the co-authored course textbook has been nicknamed the “Blue Bible of real estate” by former students

Acquire not one but four industry-recognized Certifications

Earn your first REFM Excel for Real Estate Certification in as little as a day, and graduate to earn the overarching REFAI® designation

Position yourself to enter, or move laterally or vertically within the CRE business

Apply yourself and REFAI can help you upskill, get in the know, and potentially accelerate your career by up to a year

Get lifetime access to professional analysis tools and job interview prep training

Evaluate and analyze investment opportunities with real world tools, and prepare for technical Excel testing

Discuss REFAI with course co-author Bruce Kirsch

Discuss REFAI with course co-author Bruce Kirsch

REFAI Student Stories

The Real Estate Finance and Investments Certification (REFAI) from Linneman Associates and REFM is a rigorous educational self-study program focused on practical, high-impact outcomes for its candidates.

The backbone of REFAI is Real Estate Finance and Investments: Risks and Opportunities, nicknamed “the Blue Bible of real estate” by readers, authored by Dr. Peter Linneman and Bruce Kirsch, REFAI®.

Free Platform and Content Previews

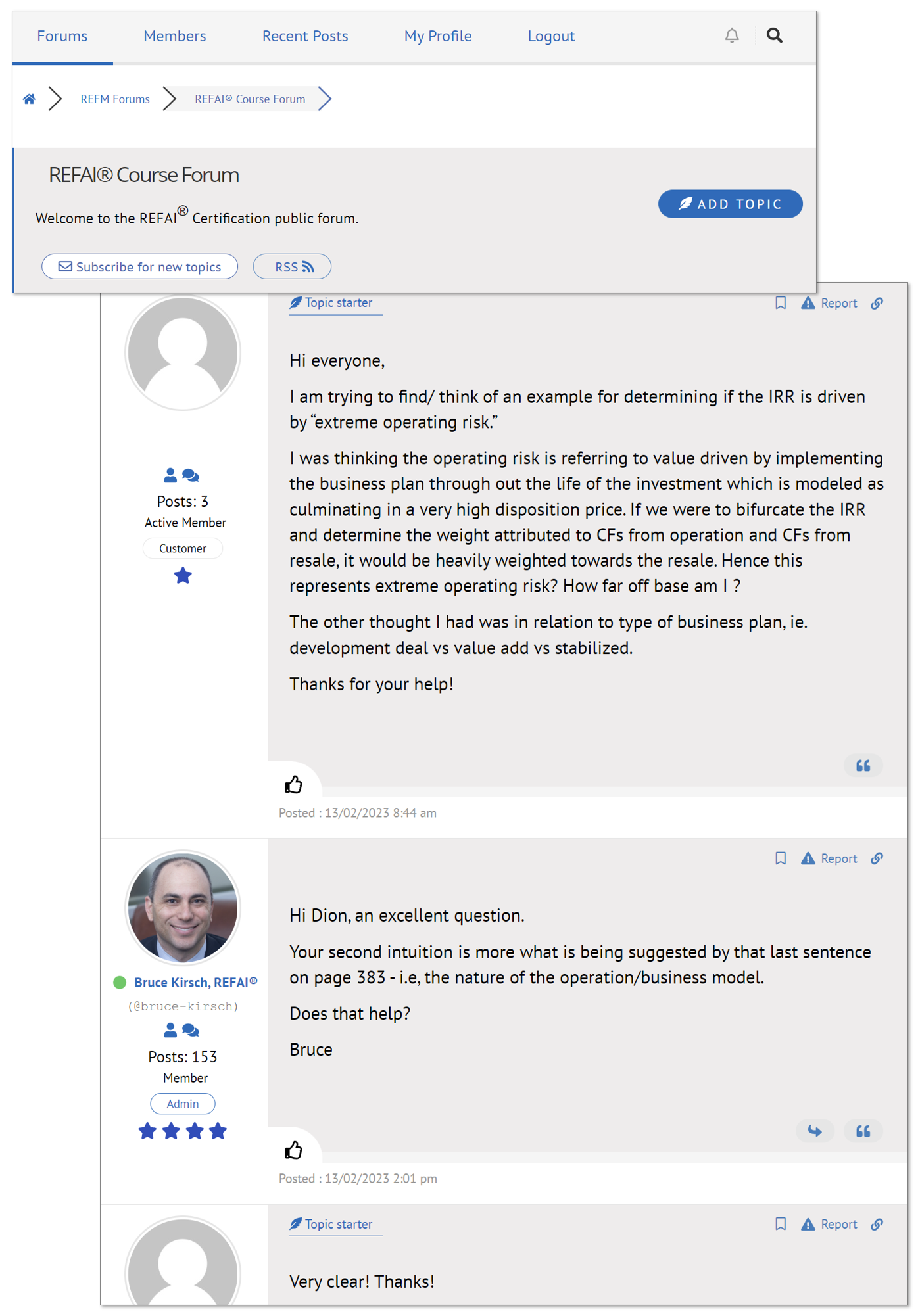

Course Support Provided By The Course Co-Creator

Course Support Provided By The Course Co-Creator

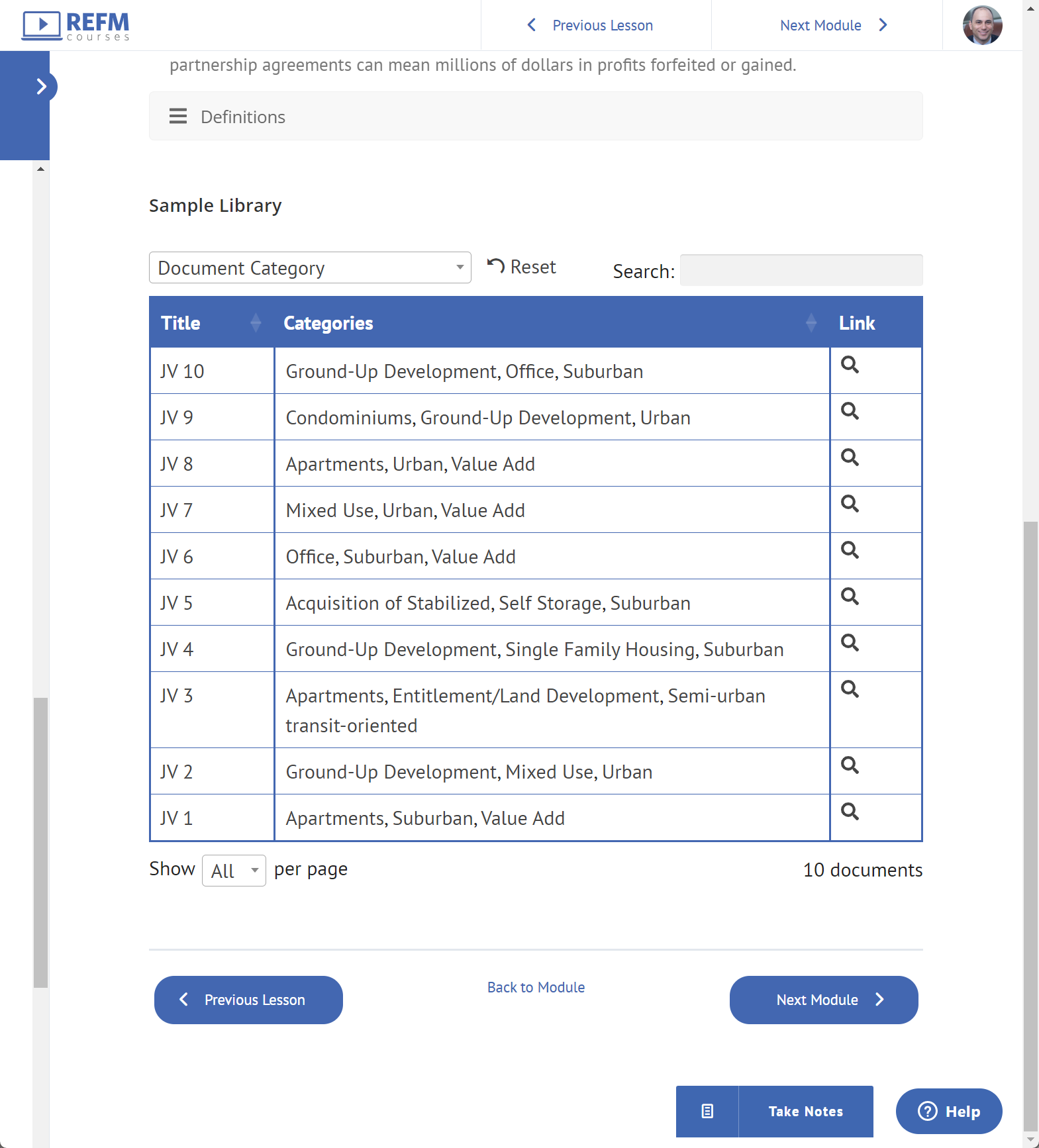

Custom Bonus Resources are included that are not available in any other course

Professional Tools

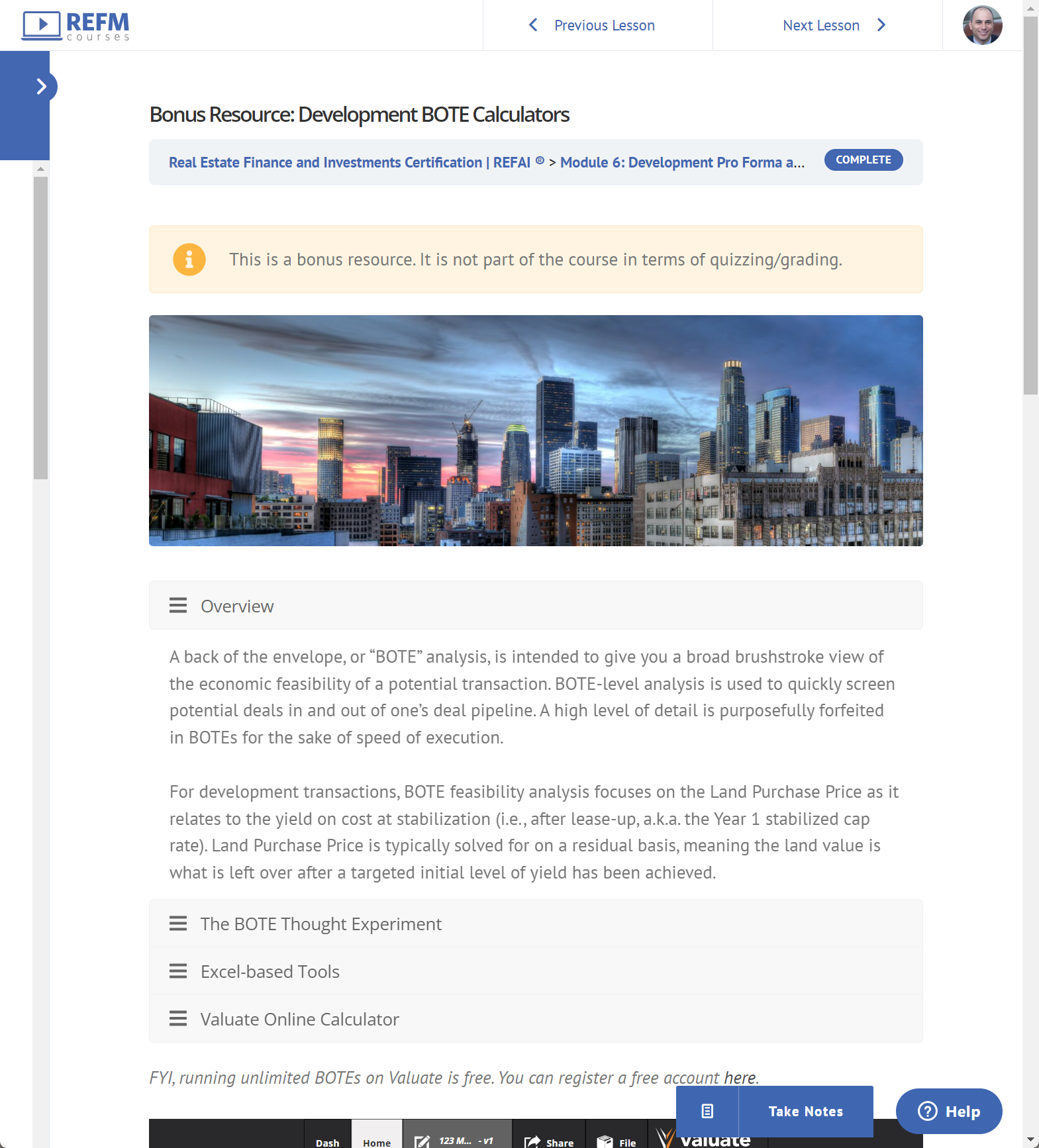

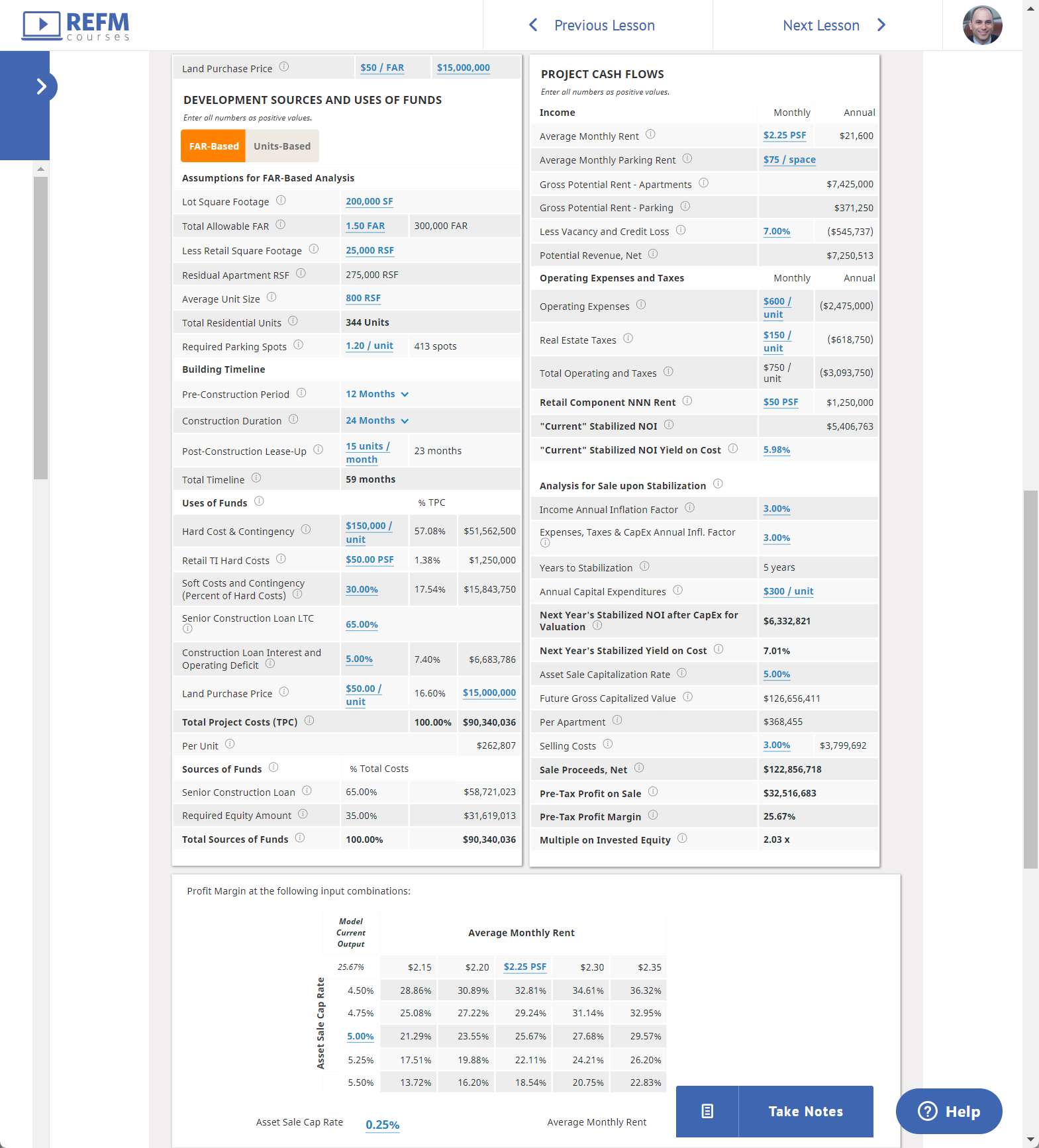

Downloadable and online value add and ground-up development back of the envelope (BOTE) analysis tools

Proprietary Data

Library of actual equity joint venture partnership waterfall structures across strategies and geographies

Interview Training

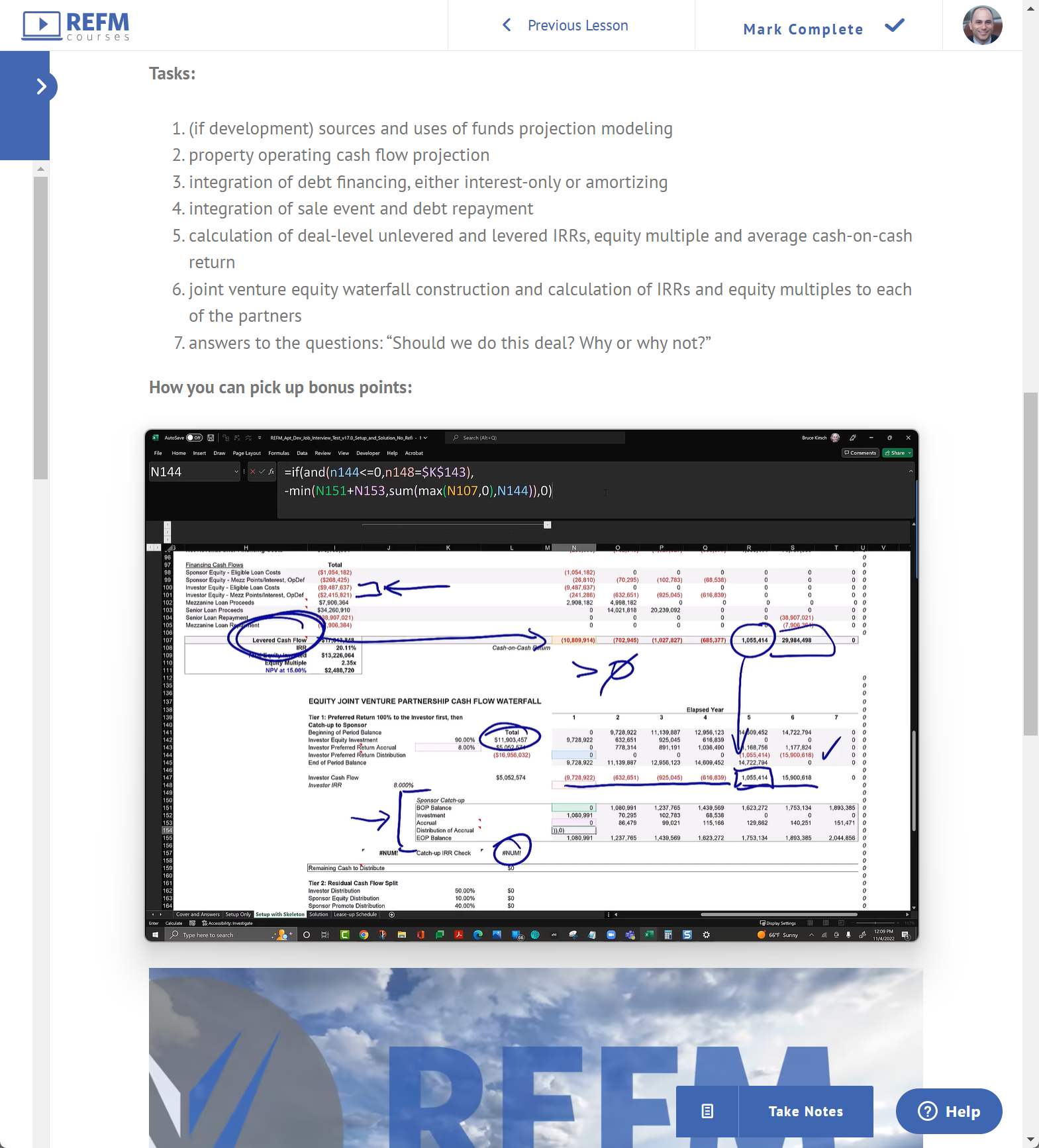

3.5-hour video tutorial with Excel-based answer key for a simulated technical Excel modeling job interview test

What REFAI Certification Holders and Candidates Are Saying

I’m glad that I took the REFAI Certification. As a college student who wants to start a career in the commercial real estate industry, this course provided me with the necessary tools and concepts used currently in the industry.

The course is organized in an enjoyable format, being well-proportioned yet sufficiently challenging, with each module building on the previous modules. Both instructors, Peter Linneman and Bruce Kirsch, are extremely knowledgeable. I definitely would recommend this course to anyone who wants to build a career in the commercial real estate industry!

Alejandro Tellez Vazquez, Student at Texas Tech University

I have been an investment sales professional for the last seven years and was looking to improve my real estate financial modeling skills to best service my clients. After researching the REFAI course offered by Bruce Kirsch and Dr. Peter Linneman, I decided to give it a try.

I was able to improve my modeling skills through extremely detailed tutorials, and, to my surprise, I learned even more through their textbook and online lectures. I am very satisfied with their program and would highly recommend it to anyone looking to learn the real estate business or, like me, improve their knowledge and skill set.

JS, CFA

I just want to say how amazing this course was overall. I really am pushing around twenty other younger college students to take this to get them ahead of the curve. It really does a great job of teaching you a topic through the book, then pounding it in your head through the lecture then understanding it analytically with the Excel. Thank you again.

Chris Comet, Student at University of Southern California

I just took the final exam for the REFAI course after completing all prior tasks. Incredible course, especially for an experienced analyst looking to get a very in-depth understanding of the equity side of acquisitions. Thanks again for a great course – best CRE training out there.

Connor Nolan, Underwriting Analyst – Structured Finance, Freddie Mac

For the real estate brokers out there looking to improve in their knowledge and impress their clients, the student right out of college looking to gain an edge on competing for highly desired entry level jobs, or the beginner looking to invest in real estate, I highly recommend earning these certifications and taking the course. You will be astonished as to how much you learn.

The textbook is well written and the interviews, lectures, and practice questions are very well thought out. The instructors are very helpful with any extra questions or clarifying misunderstandings, giving you everything you need to succeed. I have enjoyed this course immensely and cant wait to start applying what I have learned in my career moving forward.

Dan Litt, Commercial Real Estate Salesperson in Philadelphia

As a career switcher who is entering into real estate, the course provided an opportunity to gain a credible industry-known certification (a simple LinkedIn search reveals just how many RE professionals list REFM as an accomplishment), develop practical skills, and stand out among job candidates with MBAs.

The disciplined, logical, clear, and methodical way in which the material was presented should be the benchmark for how real estate finance and investing is taught in top-tier universities. I feel much more confident in my ability to “talk real estate finance” after reading the book and working on the exercises. I also have a better sense of my strengths and weaknesses. Likewise, I have a lifetime to improve my skills with the course materials and textbook.

U.C. Berkeley MRED+D Graduate

The course provides a ton of helpful review material, hands-on modeling exercises, and insightful real estate stories and lessons. When combined with the Real Estate Finance and Investments textbook, the entire experience gives you an invaluable leg up in the industry. All in all, I would recommend this course to anyone trying to learn more about the business and master the technical side of real estate risks and opportunities.

Brooks Arundel, Analyst, Cushman & Wakefield NYC

It was great! The videos and models were very interactive and helpful, and I’ve already recommended the course to all my real estate classmates. Thank you once again for an amazing curriculum, it certainly made for a great foundation of real estate knowledge on which to build.

Alejandro Banuelos, BS Candidate in Economics, The Wharton School

The course was fantastic! It really helped me stand out while applying for Analyst positions in the Commercial Real Estate world. I feel more confident in my excel skills and more comfortable with my terminology and critical thinking.

I am really glad I used my free time on something as productive as REFM.

Thank you for everything.

Zachary Bertucci, Wisconsin School of Business BBA, Real Estate and Finance

REFAI is a phenomenal course. Thanks for your hard working putting this together.

I have taken financial modeling courses before. REFAI/REFM is unique because it’s the only one that shows how you lose money as a real estate investor through the Excel work, historic examples and scenarios.

The chapter interviews and insights are gold.

Brian Dentry, Associate, Weitzman

REFAI is an exploration of the key concepts of real estate finance and investment strategy, not a mere formulaic analysis of numbers designed to give you “the answer” to any and all real estate investment decisions. Holding the REFAI Certification signifies the ability to proficiently apply proven, trusted analytical frameworks to real world problems.

Earn shareable badges as you complete each Module on your way to achieving the full Certification.

REFAI. Created Just For You.

Targeting a career in commercial real estate, or seeking to move up faster or go out on your own?

REFAI can help move you along in your career if you are a:

Current student or recent graduate

Current student or recent graduate Financial or development analyst/associate

Financial or development analyst/associate Investment sales or leasing broker

Investment sales or leasing broker Land use or transaction attorney

Land use or transaction attorney Real estate entrepreneur

Real estate entrepreneur Construction executive

Construction executive Current student or recent graduate

Current student or recent graduate Investment sales or leasing broker

Investment sales or leasing broker Real estate entrepreneur

Real estate entrepreneur Financial or development analyst/associate

Financial or development analyst/associate Land use or transaction attorney

Land use or transaction attorney Construction executive

Construction executiveProgram Overview

The REFAI program curriculum is equal to that of “Real Estate Finance and Investment Analysis 101” semester-long courses delivered in the traditional classroom format in top MBA and Masters in real estate programs.

The backbone of REFAI is Real Estate Finance and Investments: Risks and Opportunities, “the Blue Bible of real estate,” authored by Dr. Peter Linneman and Bruce Kirsch. In circulation for 17 years and based on his Wharton classes, the book reflects Dr. Linneman’s frustration with texts that concentrate excessively on theoretical detail and literature, while ignoring important aspects of financial analysis and decision making. This book balances the “real world” aspects of real estate finance without compromising key theoretical underpinnings. It covers the basic mathematics of real estate finance and investments, while stressing the ambiguity of decision making.

The book, and the REFAI program by extension, is an exploration of the key concepts of real estate finance and investment strategy, not a mere formulaic analysis of numbers designed to give you “the answer” to any and all real estate investment decisions.

Holding the REFAI Certification signifies proficiency in this material and the ability to apply that knowledge by overlaying sound analytical frameworks on real world problems. Candidates must earn a minimum passing grade of 70% to complete the requirements for the Program and receive the Certification. Candidates are forewarned that this grade depends upon their performance and passing is not guaranteed.

Content Highlights

- Basic financial analysis and metrics

- Dynamic financial modeling in Excel

- Selection of discount and capitalization rates

- Dynamic financial modeling in Excel

- Development feasibility

- Lease negotiation

- Preferred return, promote and catch-up structures

- Corporate rent versus own decisions

- Owner exit strategies

- Investing internationally

- Dynamic financial modeling in Excel

- Valuation of properties subject to ground leases

- REITs

- Going public as a real estate company

- Real estate entrepreneurship

Skills Objectives

- Forecasting property income and expense cash flows

- Building a mortgage payment schedule with an Interest-Only component

- Calculating IRR and NPV

- Allocating construction costs according to a bell-shaped curve

- Valuing a ground-up development site on a residual basis

- Forecasting an asset’s future stabilized Net Operating Income

- Performing sensitivity analyses around the driving variables in a transaction

- Calculating loan interest for multiple layers of debt financing

- Evaluating whether a corporation should own or rent facilities.

You can even go directly to these modules if you wish and complete them first.

Format & Time Commitment

This self-paced program requires up to 120-135 hours to complete the course content, exercises, quizzes, midterm and final exams. Lifetime access is provided to all course materials.

REFAI Program Curriculum

In this module, we make sure you have the needed foundational finance knowledge in place so that you can thrive during the course. We also teach you how to best leverage Excel to your advantage with REFM Excel for Real Estate skills Level 1 Certification.

Readings: 29 pages

Video running time: 5.3 hours

There are 3 quizzes and 1 REFM Certification Exam.

In this module, you are introduced to the real estate asset class in the US and internationally, and how real estate investment can be viewed through an analytical lens of risk and opportunity. We also fortify your knowledge of real estate finance as it is represented in Excel with REFM Excel for Real Estate skills Level 2 Certification.

Readings: 42 pages

Video running time: 5.2 hours

Audio running time: 2.2 hours

There are 3 quizzes and 1 REFM Certification Exam.

Bonus Excel Tutorials are included on Stabilized Asset Levered Acquisition Modeling and Advanced Amortization Schedule Modeling.

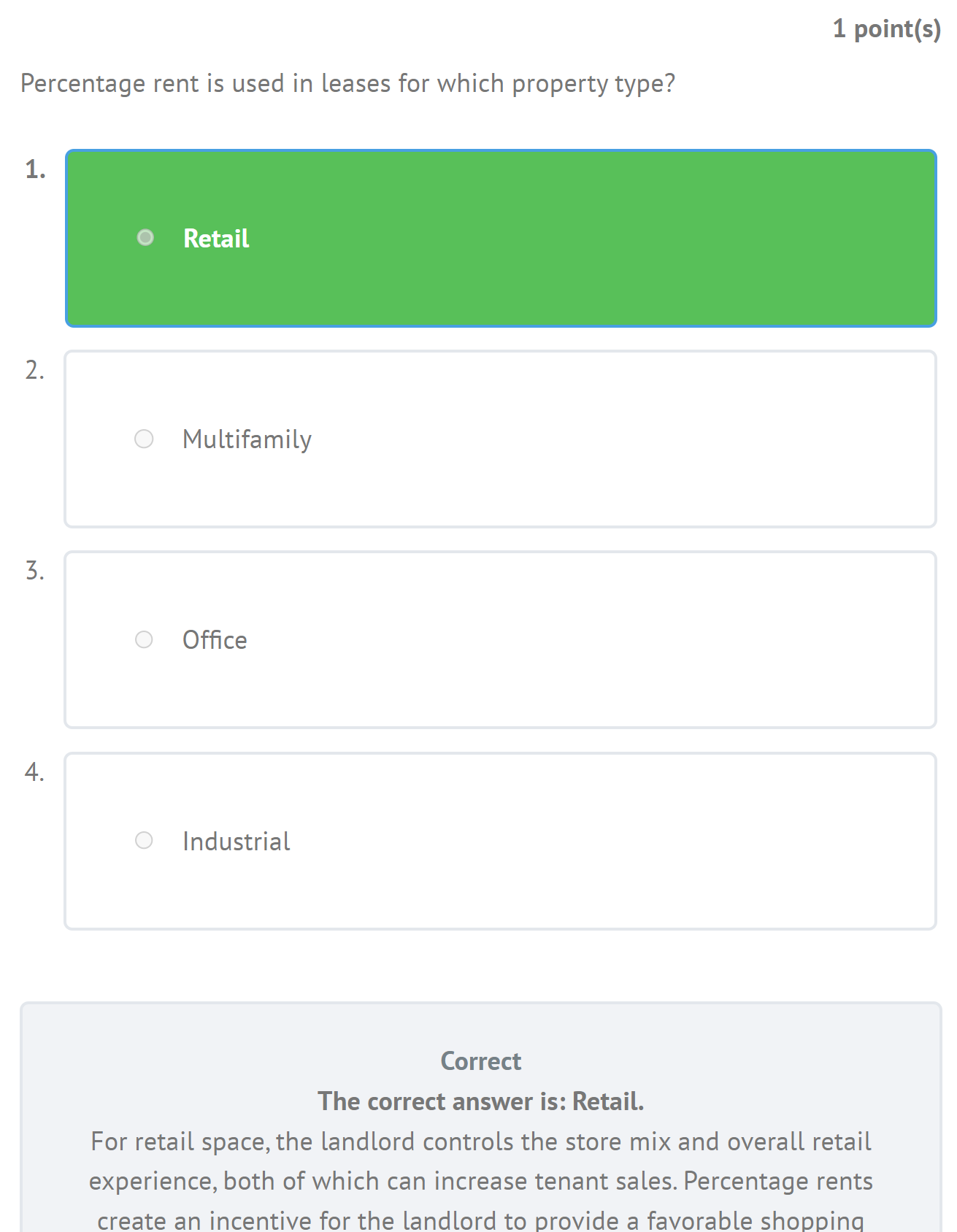

In this module, you learn about the economic and non-economic terms of commercial leases, including the pervasive risk mitigation structures. You also learn how to model office, industrial and retail leases from both the tenant and landlord perspectives.

In this module, you learn about the economic and non-economic terms of commercial leases, including the pervasive risk mitigation structures. You also learn how to model office, industrial and retail leases from both the tenant and landlord perspectives.

Readings: 8 pages

Video running time: 1.2 hours

Audio running time: 0.5 hours

There is 1 quiz.

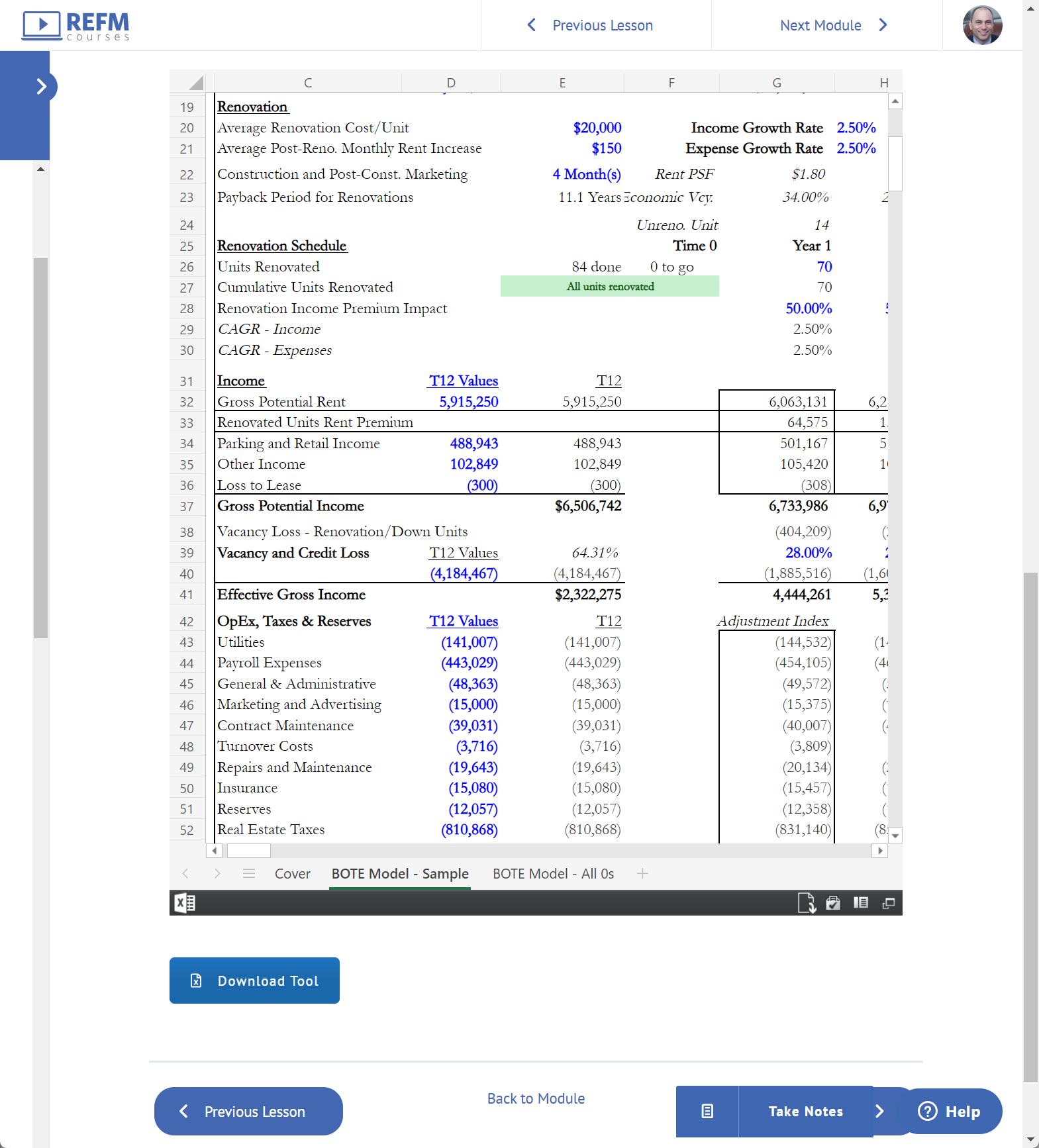

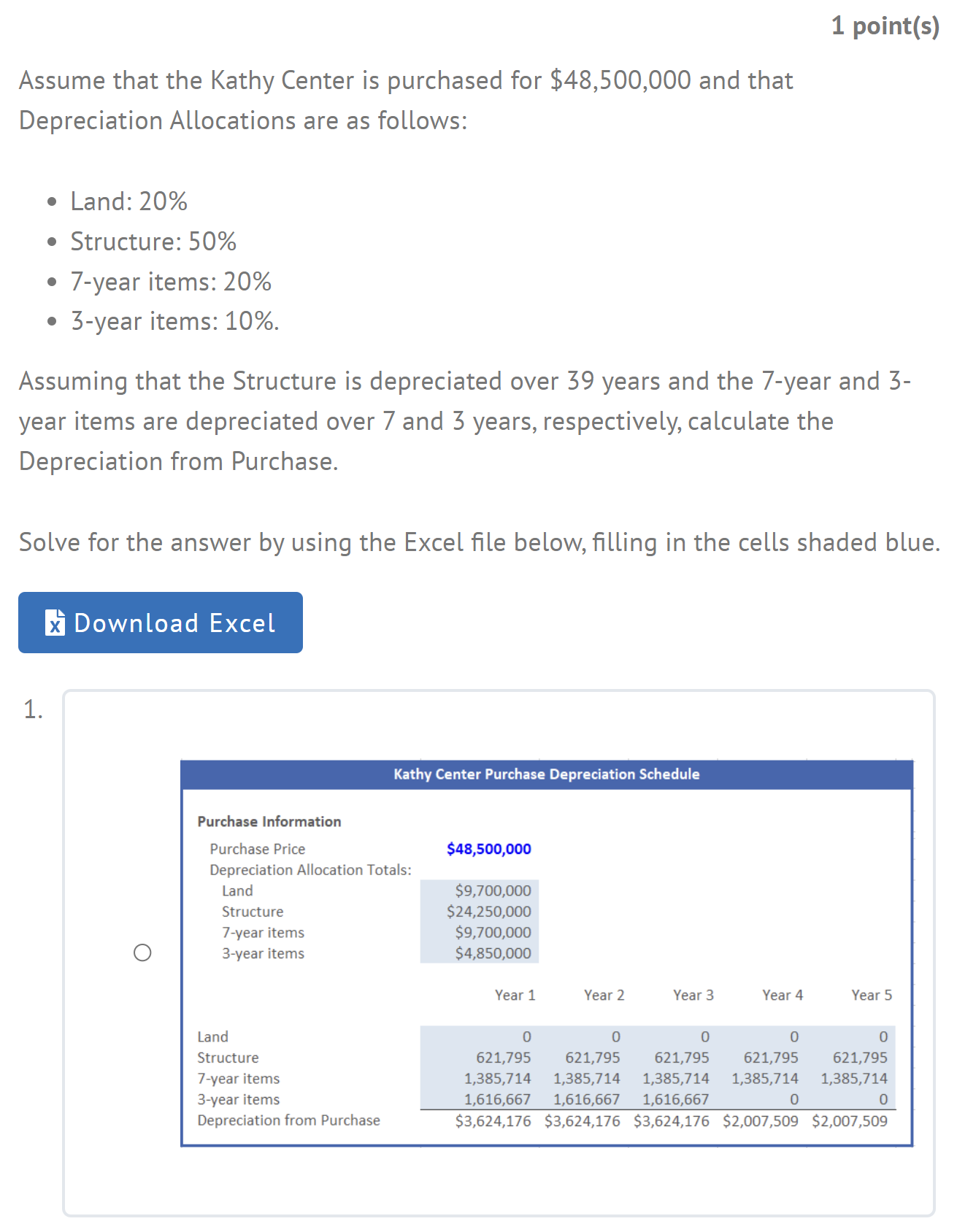

In this module, we lead you line by line in Excel through a multi-family operating pro forma and a levered investment analysis, starting at Gross Potential Rent and ending at After-Tax Cash Flow to equity. We also teach you in line by line detail how to model the ground-up development of a multi-tenant industrial property.

In this module, we lead you line by line in Excel through a multi-family operating pro forma and a levered investment analysis, starting at Gross Potential Rent and ending at After-Tax Cash Flow to equity. We also teach you in line by line detail how to model the ground-up development of a multi-tenant industrial property.

Readings: 35 pages

Video running time: 8.5 hours

Audio running time: 0.9 hours

There are 2 quizzes.

Optional Case Study on development.

Bonus Tool: Multi-Period Value Add Apartment BOTE (back of the envelope) Excel template

In this module, we give you exposure to the litany of risks that can potentially be mitigated, or must be accepted, when investing in commercial real estate. In addition, we give capitalization rates and their use for property valuation the tremendous attention and nuanced discussion they deserve.

In this module, we give you exposure to the litany of risks that can potentially be mitigated, or must be accepted, when investing in commercial real estate. In addition, we give capitalization rates and their use for property valuation the tremendous attention and nuanced discussion they deserve.

Readings: 46 pages

Video running time: 2.3 hours

Audio running time: 1.1 hours

There are 2 quizzes.

The Midterm examination covers all course content from the first 5 modules, with an emphasis on the content from the textbook readings.

The Midterm examination covers all course content from the first 5 modules, with an emphasis on the content from the textbook readings.

The Midterm contains 56 questions and must be completed in a single sitting of up to 120 minutes.

In this module, you will learn about the development business model and how to construct a detailed pro forma for an industrial property that simulates construction and operation, allowing you to solve for land value on a residual basis.

In this module, you will learn about the development business model and how to construct a detailed pro forma for an industrial property that simulates construction and operation, allowing you to solve for land value on a residual basis.

Readings: 26 pages

Video running time: 4.1 hours

Audio running time: 0.9 hours

There are 2 quizzes.

Bonus Excel Tutorial: Technical Job Interview Modeling Test.

Bonus Tools: Development static back of the envelope calculators, and Multi-Period Apartment Development BOTE template.

In this module, you will learn in detail about the potentially good, bad and ugly of using senior mortgage financing for your transactions, as well as the potential use of mezzanine financing. The module includes a basic primer on bankruptcy and other forms of distressed debt resolution. In addition, you will learn about the rise and mechanics of the CMBS market and how the business is sometimes still misunderstood.

In this module, you will learn in detail about the potentially good, bad and ugly of using senior mortgage financing for your transactions, as well as the potential use of mezzanine financing. The module includes a basic primer on bankruptcy and other forms of distressed debt resolution. In addition, you will learn about the rise and mechanics of the CMBS market and how the business is sometimes still misunderstood.

Readings: 37 pages

Video running time: 3.7 hours

Audio running time: 1.9 hours

There are 4 quizzes.

In this module, you will learn about the nuances of ground leases and how they can serve as a financing method for an acquisition or development transaction. You will also learn about the four ways to exit a real estate investment and their respective trade offs, as well as the net wealth positions produced by each of the methods.

Readings: 16 pages

Video running time: 0.7 hours

Audio running time: 0.6 hours

There are 2 quizzes.

Optional Case Study on corporate headquarters decision analysis.

In this module, you will learn about real estate company modeling, the math behind the formation and proliferation of REITs, and the origins of the real estate PE business as well as common waterfall structures at the fund level. In addition, you will gain transaction-level joint venture waterfall modeling skills through your preparation for the REFM Excel for Real Estate skills Level 3 Certification.

In this module, you will learn about real estate company modeling, the math behind the formation and proliferation of REITs, and the origins of the real estate PE business as well as common waterfall structures at the fund level. In addition, you will gain transaction-level joint venture waterfall modeling skills through your preparation for the REFM Excel for Real Estate skills Level 3 Certification.

Readings: 36 pages

Video running time: 4.4 hours

Audio running time: 1.3 hours

There are 3 quizzes and 1 REFM Certification Exam.

Bonus Resource: Sample Joint Venture Structure Profiles.

In this module, you will learn about the necessarily prolonged supply and demand imbalances that contribute to real estate market cycles. In addition, you will gain insight into the factors that are most predictive of future metropolitan area growth.

In this module, you will learn about the necessarily prolonged supply and demand imbalances that contribute to real estate market cycles. In addition, you will gain insight into the factors that are most predictive of future metropolitan area growth.

Readings: 31 pages

Video running time: 0.6 hours

Audio running time: 1 hour

There are 2 quizzes.

In this module, you will learn about the primary investment strategies and how they have fared historically in both public and private contexts. You will also get a view into how the CRE business has consolidated and changed over the last 30 years, and how it is likely to continue to evolve going forward.

In this module, you will learn about the primary investment strategies and how they have fared historically in both public and private contexts. You will also get a view into how the CRE business has consolidated and changed over the last 30 years, and how it is likely to continue to evolve going forward.

Readings: 26 pages

Video running time: 0.5 hours

Audio running time: 0.6 hours

There are 2 quizzes.

In this module, you will learn about the fallacy of past models for analyzing the rent vs. own real estate decision for corporations, and how to correctly run the analysis. In addition, you will see what makes real estate entrepreneurs successful. We close the course content with thoughts on ethics in the CRE business.

In this module, you will learn about the fallacy of past models for analyzing the rent vs. own real estate decision for corporations, and how to correctly run the analysis. In addition, you will see what makes real estate entrepreneurs successful. We close the course content with thoughts on ethics in the CRE business.

Readings: 24 pages

Video running time: 0.5 hours

Audio running time: 1 hour

There are 3 quizzes.

The Final examination covers all course content cumulatively, with an emphasis on the content from the textbook readings after the Midterm exam.

The Final examination covers all course content cumulatively, with an emphasis on the content from the textbook readings after the Midterm exam.

The Final contains 50 questions and must be completed in a single sitting of up to 120 minutes.

The Course Textbook

A comprehensive look at real estate finance and investments, and also development. But perhaps more importantly, it is written in a way that is clear, direct, and immensely practical to the actual world of real estate.

Brandon Donnelly, MD of Development, Slate Asset Management

Authored by Peter Linneman, PhD and Bruce Kirsch, REFAI ®

Edition 5.2 | First Published in 2003 | 457 pages | 26 Chapters

Select Corporate Adoptions

125+ University Adoptions

Unique Features

Chapter 1 in Audiobook | Hands-on Excel modeling exercises integrated throughout | ARGUS platform overview

Testing & Assignments

– Online quizzes for each of the 12 Modules are open book, generally subject to a 15-minute time limit. Almost all Modules contain at least one quiz that requires working in Excel worksheets to get to solutions.

– Midterm and final exam are open book, subject to a 90-minute time limit; both require working in Excel worksheets.

– All quizzes, exams and provide correct answers and commentary once taken.

– There are 150 sample practice quiz questions, which you can use an unlimited number of times to study for the quizzes, midterm and final.

– Across the 30 quizzes and exams, candidates will answer more than 500 questions.

– There are 2 optional case studies for completion.

Peter Linneman, PhD

CEO of Linneman Associates

For over 40 years, Dr. Peter Linneman’s unique blend of scholarly rigor and practical business insight has won him accolades from around the world, including PREA’s prestigious Graaskamp Award for Real Estate Research, Wharton’s Zell-Lurie Real Estate Center’s Lifetime Achievement Award, Realty Stock Magazine’s Special Achievement Award, being named “One of the 25 Most Influential People in Real Estate” by Realtor Magazine and inclusion in The New York Observer’s “100 Most Powerful People in New York Real Estate”.

After receiving both his Masters and Doctorate in Economics under the tutelage of Nobel Prize winners Milton Friedman, Gary Becker, George Stigler, Ted Schultz and Jim Heckman, Peter had a distinguished academic career at both The University of Chicago and the Wharton School of Business at the University of Pennsylvania. For 35 years, he was a leading member of Wharton’s faculty, serving as the Albert Sussman Professor of Real Estate, Finance and Public Policy as well as the Founding Chairman of the Real Estate Department and Director of the prestigious Zell-Lurie Real Estate Center.

During this time, he was co-editor of The Wharton Real Estate Review. In addition, he published over 100 scholarly articles, four editions of the acclaimed book Real Estate Finance and Investments: Risks and Opportunities, and the widely read Linneman Letter quarterly report.

Peter’s long and ongoing business career is highlighted by his roles as Founding Principal of Linneman Associates, a leading real estate advisory firm; CEO of American Land Fund; and CEO of KL Realty. For more than 35 years, he has advised leading corporations and served on over 20 public and private boards, including serving as Chairman of Rockefeller Center Properties, where he led the successful restructuring and sale of Rockefeller Center in the mid-1990s.

Although retired from Wharton’s faculty, Dr. Linneman continues his commitment to education through his Save A Mind, Give A Choice educational charity for orphans and children of extreme poverty in rural Kenya. He has been married for over 40 years and is an exercise enthusiast.

Bruce Kirsch, REFAI®

CEO of Real Estate

Financial Modeling

As the founder of Real Estate Financial Modeling (REFM), Bruce Kirsch has trained thousands of students and professionals around the world in Excel-based projection analysis. In addition, REFM’s self-study products, Excel-based templates and its Valuate® property valuation and investment analysis software are used by more than 250,000 professionals. Mr. Kirsch’s firm has assisted with modeling for the raising of billions of dollars of equity and debt for individual property acquisitions and developments, as well as for major mixed-use projects and private equity funds. Mr. Kirsch has also maintained a blog on real estate financial modeling, Model for Success, authoring more than 500 posts.

Mr. Kirsch began his real estate career at CB Richard Ellis, where he marketed highrise New York City office buildings for re-development in the Midtown Manhattan Investment Properties Institutional Group. After CBRE, Mr. Kirsch was recruited to lead acquisitions at Metropolis Development Company, and later joined The Clarett Group, a programmatic development partner of Prudential.

While at The Clarett Group, Mr. Kirsch was responsible for making development site recommendations for office, condominium and multi-family properties in the greater Washington, D.C. metropolitan area. In addition, Mr. Kirsch had significant day-to-day project management responsibilities for the entitlement, financing and marketing of the company’s existing D.C.-area development portfolio.

Mr. Kirsch holds an MBA in Real Estate from The Wharton School of the University of Pennsylvania, where he was awarded the Benjamin Franklin Kahn/Washington Real Estate Investment Trust Award for academic excellence. Prior to Wharton, Mr. Kirsch performed quantitative equity research on the technology sector at The Capital Group Companies. Mr. Kirsch served as an Adjunct Faculty member in real estate finance at Georgetown University School of Continuing Studies. Mr. Kirsch graduated with a BA in Communication from Stanford University.

Frequently Asked Questions

Pricing

REFAI pricing is USD $1,999 for professionals, and USD $699 for current students and academic faculty/staff and active duty and retired U.S. military. Groups of 2+ receive a 25% discount. Email groups@getrefm.com for details.

The cost of the hard copy textbook is included no matter where you live. The book is a required material for the course. If you already have the book, you can choose to not receive another copy, and you will be instantly credited $149 during the checkout process.

Book shipping costs are shown below:

- UPS Standard (excludes AK and HI) – free

- UPS 2-Day (excludes AK and HI) – $36

- UPS Overnight (excludes AK and HI) – $65

- Alaska or Hawaii by UPS Standard – $56

- Canada by UPS Standard – $47

- International by UPS Standard – $70

We ship via UPS Monday through Friday, shipping same day for orders received before 2:30 PM Eastern time. International delivery generally takes 7-10 business days depending on the practices of your local Customs and UPS offices. Tracking information is sent to you by email typically the same day as the materials ship out.

You can learn about Academic and U.S. military status verification here.

If you already have Edition 5.1 or 5.2 of the book, you can get a $149 discount. To be granted a coupon code for the discount, please contact us at refai@getrefm.com.

Yes, we offer the chance to pay for the course over time through Affirm. You can apply for this option during the checkout process.

Yes, a 25% discount is available for groups of 2 or more. Please email refai@getrefm.com to inquire.

Current students, academic faculty and staff, and current and former U.S. military are eligible for discounted pricing. They must prove their status by providing a current and valid ID from any high school, college or university (both US-based and international), or military ID, as well as government-issued ID that verifies their identity. Credentials can be uploaded here.

Yes. You can do so here.

No, as each individual candidate must pass quizzes and exams tied to their username, and the quizzes and exams are not accessible again once taken by a candidate.

The Book and Course Materials

The cost of the hard copy textbook is included no matter where you live. Shipping is free within the US, but it is an additional $35 if shipping to Canada, and an additional $65 if you shipping internationally excluding Canada.

No, the book is provided to you in hard copy only. The book is not offered in PDF.

If you already have Edition 5.1 or 5.2 of the book, you can get a $149 discount. To be granted a coupon code for the discount, please contact us at refai@getrefm.com.

Yes. The course content is tied directly to Edition 5.1/5.2 of the book, which are majorly enhanced and updated from prior editions.

No, the videos are streaming only. You must have a stable broadband Internet connection to view them without experiencing interruptions and file buffering.

No, you have lifetime access to everything.

Course Design

You can start the course at any time once you have the textbook in your possession. The course is self-paced and the online platform is available 24/7/365.

It applies to both. A key chapter on projection modeling uses an apartment building as the case study.

No. The course is self-paced, and you have lifetime access to it.

In addition to reading the textbook, candidates will learn on the online course platform through various media, including recorded video and audio lectures, spreadsheet modeling exercises, multiple choice quizzes and exams.

This program requires 120-160 hours to complete the course content, and complete the exercises, quizzes, midterm and final exams. Some have finished in 5 days, some in 300, but the norm is around 90 days.

Lifetime access is provided to all course materials.

You are welcome to take the course just for your own educational enrichment and skill building if you wish.

Yes, the learning platform is optimized for phones and tablets. However, we recommend working on Excel on a desktop or laptop for the best experience.

Any computer purchased in the last 5 years, and Excel 2013 or more recent. For best results, we recommend using Google Chrome as your web browser.

The course is available on-demand, 24/7/365. All of the videos have been produced in a studio environment and edited to achieve the highest production value.

There is an online course forum, with discussion monitored and responded to by Bruce Kirsch, one of the course creators and textbook authors.

Yes, in your learner profile you have a list of all of the quizzes and links to view the quiz and answer explanations. You can also revisit your graded quizzes at any time and view the answer explanation.

You cannot take a quiz more than once, but you are given the option of one re-take for each of the three Excel for Real Estate Certification exams, as well as for the Midterm and Final.

The way it works for the Midterm and Final is as follows:

Before you submit your answers, if you are not feeling satisfied with your performance, you can elect to forfeit your test submission and forfeit your ability to view a graded version with the answer key for the initial take. This will allow you to retake the test at another time. Your last take of the Midterm/Final will be the score counted.

You can also learn from all of your graded quizzes, as well as the Midterm and Final, by revisiting them at any time.

REFAI was designed to be demanding but fair. While the pass rate is quite high, you’re not guaranteed passing and you need to get approximately 350 questions correct of the approximately 500 questions in the course. REFAI is your chance to both learn and to demonstrate you have mastered the material.

REFAI is the equivalent of a semester-long “Real Estate Finance and Investment Analysis 101” course given in a traditional university setting. REFM’s Excel for Real Estate Certifications are short-format tutorials focused solely on technical skills in Excel as they apply to real estate analyses.

You will receive them in real time as you complete them, and can list them on your resume and LinkedIn at those points in time. You can even go straight to these modules if you wish to do them before the rest of the REFAI course.

If you have already earned any of Level 1, 2 or 3 Excel for Real Estate Certification and do not wish to repeat the content and exam in the course, please email refai@getrefm.com to be verified and automatically passed through the relevant lesson(s) and quiz(zes).

No, it is much more. This course is the equivalent of a semester-long “Real Estate Finance and Investment Analysis 101” course given in a traditional university setting. Financial modeling is one aspect of the course, and a critical one, but one of many. The full syllabus and textbook contents can be viewed below.

To pass the course, you must achieve an average score of 70% or better across the entire set of graded quizzes, midterm and final exam. To pass With Distinction, you must achieve an average score of 85% or better and complete the course within 150 days of registration.

You can be a complete beginner and you will be fine. We start from zero and build from there.

You will receive a high-resolution PDF certificate with your name on it, and the With Distinction designation if applicable. You may print the certificate yourself or have it professionally printed and framed.

Have a question that’s not addressed above? Email refai@getrefm.com.