Your cart is currently empty.

Pro Forma Analysis Excel Templates

REFM modeling services consulting clients include

REFM modeling services consulting clients

Fastest basic feasibility by solving for a post-renovation stabilized yield on cost and payback period

Rapid feasibility based on before-tax IRR, net profit, multiple on equity, payback period and NPV

Detailed analysis generating a before-tax IRR, net profit, multiple on equity, payback period and NPV

Detailed analysis generating after-tax IRR, net profit, multiple on equity, payback period and NPV

Discounted Academic and U.S. Military pricing is available. Get verified here.

Fastest possible basic feasibility for an apartment property acquisition by solving for an existing stabilized or a post-renovation stabilized yield on cost

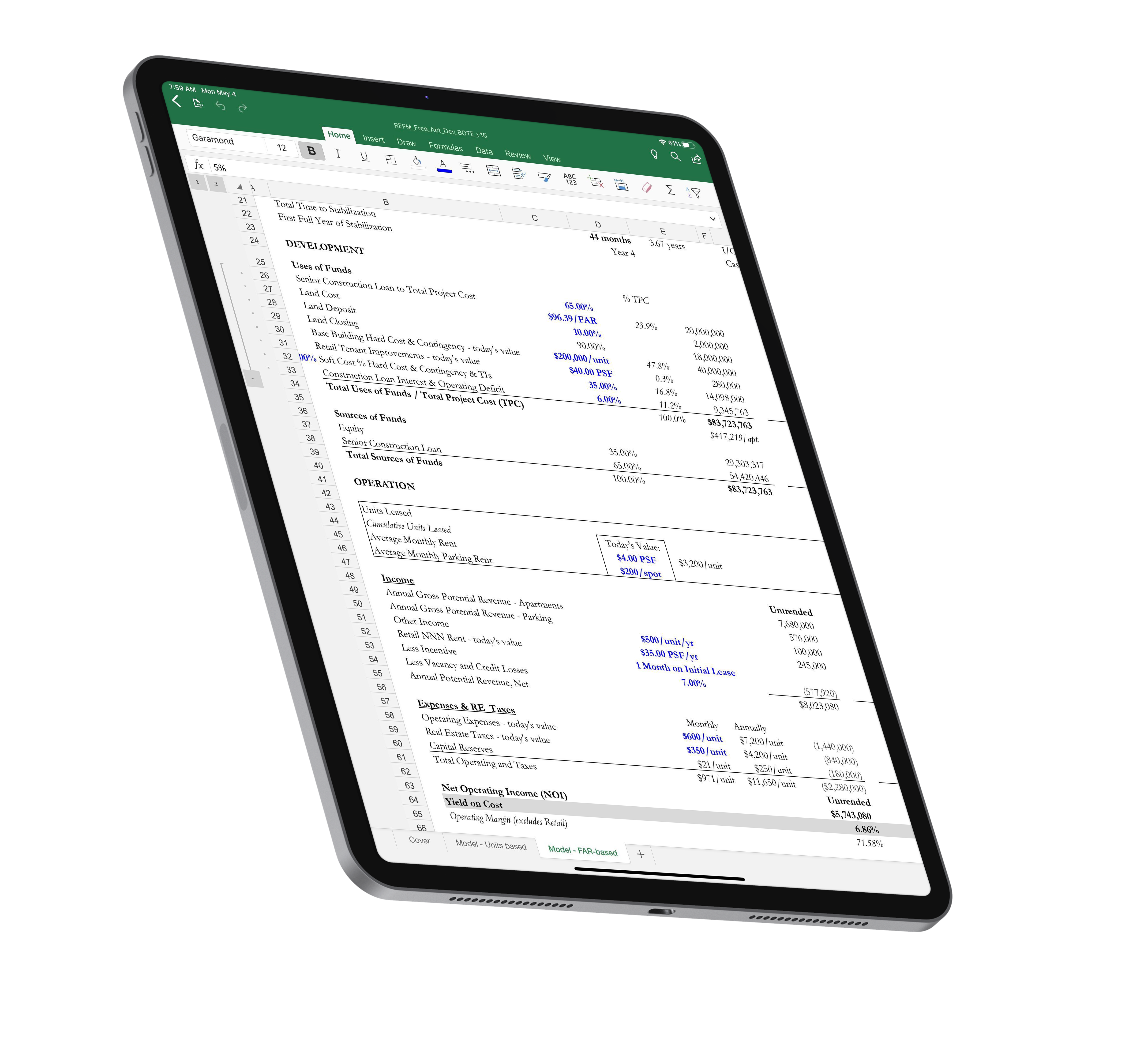

Trying to solve for a stabilized yield on cost following a renovation program, or for a core acquisition? Our B.O.T.E. free tool is a 100% unlocked Excel file suited for the fastest basic feasibility assessment. By design, it does not output profit or IRR values because it is purposefully not a multi-period analysis.

For value add, a blended average building-level approach is used to simulate the income and expense profiles of both pre- and post-renovated unit states. By design, there is no rent roll or unit mix, and the model does not key off of specific unit rollovers and renovations. Rather, it approximates the unknown sequencing of the unit rollovers using an average unit renovation budget and the aforementioned blended average income and expense values.

The model has fully transparent formulas that can be further tailored to suit the particulars of your transactions.

A back of the envelope, or “BOTE” analysis, is intended to give you a broad brushstroke view of the economic feasibility of a potential transaction. This is known as checking to see if a deal will “pencil” i.e., whether the reward is sufficient for the risk. BOTE-level analysis is used to quickly screen potential deals in and out of one’s deal pipeline. A high level of detail is purposefully forfeited in BOTEs for the sake of speed of execution. Sometimes BOTEs are referred to as a “quick and dirty” analysis or a “static” analysis, as the passage of time is deliberately ignored. As this is a value add context, we do however provide 2 years’ worth of projection capability to allow you to simulate stabilization following a Year 1 renovation program.

The model supports the following:

2 years

1 tab

The analysis prints neatly on a single 8.5 x 11 page in portrait orientation.

Support is available through our online ticket system.

$0.00

-

Your cart is currently empty.

Pricing from $69.00 | Academic and U.S. Military pricing from $29.00 (get verified)

Rapid feasibility for a core or value add apartment building acquisition based on before-tax IRR, net profit, multiple on equity, average cash on cash, payback period and NPV outputs

Trying to solve for both a stabilized yield on cost following a renovation program and an IRR after exit, whether core or value add? Our Multi-Year B.O.T.E. tool is a 100% unlocked Excel file suited for more nuanced, yet quick, feasibility assessment.

For value add, a blended average building-level approach is used to simulate the income and expense profiles of both pre- and post-renovated unit states. By design, there is no rent roll or unit mix, and the model does not key off of specific unit rollovers and renovations. Rather, it approximates the unknown sequencing of the unit rollovers using an average unit renovation budget and the aforementioned blended average income and expense values.

The model has fully transparent formulas that can be further tailored to suit the particulars of your transactions.

11 years

1 tab

The analysis prints neatly on a single 8.5 x 11 page in landscape orientation.

Licenses are sold on a per-user basis

Multi-user pricing quotes are available here

Standard and Priority Support are available.

-

Your cart is currently empty.

Pricing from $499.00 | Academic and U.S. Military pricing from $299.00 (get verified)

Detailed monthly-based analysis of a core or value add apartment building acquisition generating a before-tax IRR, average cash on cash, net profit, multiple on equity, payback period and NPV

Trying to solve for equity partner-level pre-income tax returns on a value-add or core play? Our Standard Version tool is a 100% unlocked Excel file suited for a highly granular level of property and investment analysis across the entire risk profile spectrum.

For value add, a blended average approach for up to each of 4 unit types (e.g., studio, 1/1, 2/2, 3/2, or market rate vs. affordable) is used to simulate their construction and remarketing budgets and timelines, operating savings, rent premiums and rent growth schedules. A detailed renovation budget is provided that allows for a base program cost and variations on that base program by unit type, including an optional diminished scope for subsets of units within each unit type.

The model has fully transparent formulas that can be further tailored to suit the particulars of your transactions.

Cash flow waterfall

11 years

1 Rent Roll Inputs

2 Assumptions Inputs

3 Detailed Renovation Budget Inputs

4 Capital Structure Exhibit

5 Monthly Cash Flow Inputs

6 Annual Cash Flow Exhibit

7 Stabilized Pro-Forma Exhibit

8 Sensitivity Tables Exhibit

9 Renovation Timing Exhibit

10 Joint Venture Partnership Structure Exhibit

11 IRR Waterfall Exhibit

12 Joint Venture Returns Summary Exhibit

13 Floating Interest Rate Index Inputs

14 Acquisition Loan Monthly Amortization Schedule Exhibit

15 Permanent Loan Monthly Amortization Schedule Exhibit

See Sample Reports here

Standard and Priority Support are available.

$599.00 – $699.00

-

An Excel-based spreadsheet analysis tool for the acquisition of an existing apartment/multi-family rental building. Allows for modeling of the renovation of individual apartment units while continuing to operate the building, identifying and highlighting the income generation and cost savings resulting from the individual unit improvement program.

A blended average approach is used to simulate the income and expense profiles of both pre- and post-renovated unit states. In other words, while there is a rent roll input tab, the model does not key off of specific unit rollovers and renovations — it approximates the unknown sequencing of the unit rollovers using an average unit renovation budget and the aforementioned blended average income and expense values.

The model is monthly in nature, and it is a 100% unlocked Excel file with fully transparent formulas that can be further tailored to suit the particulars of your transactions.

The model supports the following:

Model Tabs

0 Model Overview and Instructions

1 Back of the Envelope Model

2 Rent Roll Inputs

3 Assumptions Inputs

4 Capital Structure Exhibit

5 Monthly Cash Flow Inputs

6 Annual Cash Flow Inputs

7 Renovation Timing Exhibit

8 Joint Venture Partnership Structure Inputs

9 Stabilized Pro-Forma Exhibit

10 Joint Venture Returns Summary Exhibit

11 Profit Splitting Exhibit

12 Sensitivity Tables Exhibit

13 Acquisition Loan Monthly Amortization Schedule Exhibit

14 Permanent Loan Monthly Amortization Schedule Exhibit

11 years (expandable)

Print-ready, brandable reports are included in the model. See the Sample Reports link above.

Licenses are sold on a per-user basis

Multi-user pricing quotes are available here

| Support Level | Standard Support, Priority Support |

|---|

Pricing from $999.00 | Academic and U.S. Military pricing from $649.00 (get verified)

Detailed monthly-based analysis of a core or value add apartment building acquisition generating a before- and after-tax IRR, average cash on cash, net profit, multiple on equity, payback period and NPV

Trying to solve for equity partner-level after-tax tax returns on a value-add or core play? Our Professional Version tool is a 100% unlocked Excel file suited for a highly granular level of property and investment analysis across the entire risk profile spectrum.

For value add, a blended average approach for up to each of 7 unit types (e.g., studio, 1/1, 2/2, 3/2, or market rate vs. affordable) is used to simulate their construction and remarketing budgets and timelines, operating savings, rent premiums and rent growth schedules. A detailed renovation budget is provided that allows for a base program cost and variations on that base program by unit type, including an optional diminished scope for subsets of units within each unit type.

The model has fully transparent formulas that can be further tailored to suit the particulars of your transactions.

Cash flow waterfall 1 (GP/LP structure)

Hybrid LP IRR- and LP Equity Multiple-based, with return of capital coming either from both operating cash flow and capital events, or exclusively from capital events

Cash flow waterfall 2 (GP/Co-GP structure)

Hybrid Co-GP IRR- and Co-GP Equity Multiple-based (same mechanics as waterfall 1, with return of capital coming from the setting in waterfall 1)

11 years

0 Model Overview and Instructions

1 Back of the Envelope Model

2 Rent Roll Inputs

3 Assumptions Inputs

4 Capital Structure Exhibit

5 Master Retail Leasing Exhibit

6 Retail Tenant 1 Inputs

7 Retail Tenant 2 Inputs

8 Retail Tenant 3 Inputs

9 Retail Tenant 4 Inputs

10 Retail Tenant 5 Inputs

11 Monthly Cash Flow Inputs

12 Annual Cash Flow Inputs

13 Renovation Timing Exhibit

14 Joint Venture Partnership Structure Exhibit

15 Monthly IRR Waterfall #1 Exhibit

16 Monthly IRR Waterfall #2 Exhibit

17 Sensitivity Tables Exhibit

18 Stabilized Pro Forma Executive Summary Exhibit

19 Joint Venture Partnership Returns Summary – 3 Players Exhibit

20 Joint Venture Partnership Returns Summary – 2 Players Exhibit

21 Senior Acquisition Loan Monthly Amortization Schedule Exhibit

22 Mezzanine Acquisition Loan Monthly Amortization Schedule Exhibit

23 Permanent Loan Monthly Amortization Schedule Exhibit

24 Retail TI and LC Amortization Exhibit

Institutional-quality

Brandable

Standard and Priority Support are available.

$1,499.00

-

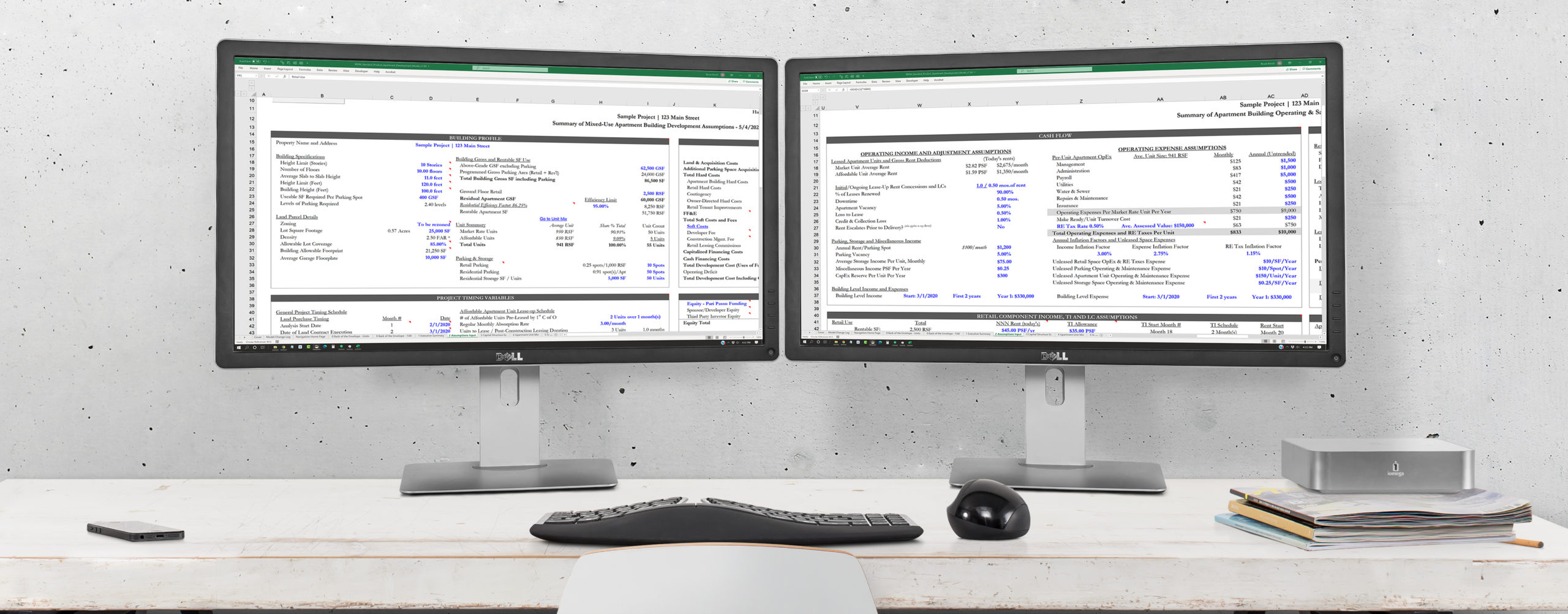

An Excel-based spreadsheet analysis tool for the acquisition of an existing apartment/multi-family rental building with or without retail and income-producing parking components. Allows for modeling of the renovation of individual apartment units while continuing to operate the building, identifying and highlighting the income generation and cost savings resulting from the individual unit improvement program.

A blended average approach is used to simulate the income and expense profiles of both pre- and post-renovated unit states. In other words, while there is a rent roll input tab, the model does not key off of specific unit rollovers and renovations — it approximates the unknown sequencing of the unit rollovers using an average unit renovation budget and the aforementioned blended average income and expense values.

The model is monthly in nature, and it is a 100% unlocked Excel file with fully transparent formulas that can be further tailored to suit the particulars of your transactions.

The model supports the following:

0 Model Overview and Instructions

1 Back of the Envelope Model

2 Rent Roll Inputs

3 Assumptions Inputs

4 Capital Structure Exhibit

5 Master Retail Leasing Exhibit

6 Retail Tenant 1 Inputs

7 Retail Tenant 2 Inputs

8 Retail Tenant 3 Inputs

9 Retail Tenant 4 Inputs

10 Retail Tenant 5 Inputs

11 Monthly Cash Flow Inputs

12 Annual Cash Flow Inputs

13 Renovation Timing Exhibit

14 Joint Venture Partnership Structure Exhibit

15 Monthly IRR Waterfall #1 Exhibit

16 Monthly IRR Waterfall #2 Exhibit

17 Sensitivity Tables Exhibit

18 Stabilized Pro Forma Executive Summary Exhibit

19 Joint Venture Partnership Returns Summary – 3 Players Exhibit

20 Joint Venture Partnership Returns Summary – 2 Players Exhibit

21 Senior Acquisition Loan Monthly Amortization Schedule Exhibit

22 Mezzanine Acquisition Loan Monthly Amortization Schedule Exhibit

23 Permanent Loan Monthly Amortization Schedule Exhibit

24 Retail TI and LC Amortization Exhibit

11 years (expandable)

Print-ready, brandable reports are included in the model. See the Sample Reports link above.

Bruce Kirsch, REFAI

Founder & CEO

REFM is the premier financial modeling solutions provider for Excel-based pro forma for real estate transactions of all types.

Based in Atlanta, GA, REFM was founded by Bruce Kirsch in 2009. Mr. Kirsch is a recognized expert in Microsoft Excel-based financial modeling for real estate transactions. REFM has built Excel-based tools for Hines, Skanska, Four Seasons, CBRE Global Investors, Howard Hughes, Trammell Crow Residential and many others. Mr. Kirsch is the co-author of Real Estate Finance and Investments: Risks and Opportunities, along with the founding chairman of The Wharton School’s Real Estate Department, Dr. Peter Linneman.

Mr. Kirsch holds an MBA in Real Estate from The Wharton School of the University of Pennsylvania, where he was awarded the Benjamin Franklin Kahn/Washington Real Estate Investment Trust Award for academic excellence. Prior to Wharton, Mr. Kirsch performed quantitative equity research on the technology sector at The Capital Group Companies. Mr. Kirsch served as an Adjunct Faculty member in real estate finance at Georgetown University School of Continuing Studies. Mr. Kirsch graduated with a BA in Communication from Stanford University.