Let's say you have an existing waterfall model in Excel that is built out to support 5 tiers (hurdles). The equity JV waterfall structure is cumulative and compounding in nature,... read more →

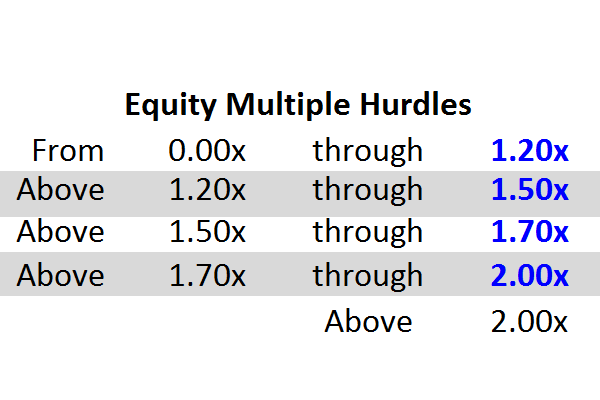

Recently we have received multiple requests for assistance with the equity joint venture partnership equity multiple hurdle concept and how to implement it in a spreadsheet. We explain it below.... read more →

Question from one of our readers: What is a preferred return? Answer: At its most basic, a preferred return ("pref") is a mechanism for measuring a negotiated level of cash flow... read more →

For the uninitiated, Fundrise is an online investment platform that gives one the ability to invest directly in shares of equity ownership in specific commercial real estate properties. But as much... read more →

[vc_tta_section... read more →

BRUCE KIRSCH: REITs came on to the scene in around 1960. Is the... read more →

Wharton Emeritus Professor Dr. Peter Linneman differentiates the two. Executive summary: Real estate syndications are investment vehicles raised to fund investment in one or more already identified commercial real estate... read more →

Wharton Emeritus Professor Dr. Peter Linneman explains.

We get requests from time to time to explain what is known as the "catch-up" mechanism as it relates to real estate private equity funds. See below. (Please read the... read more →

Want to know how $150 million in Equity Investments were structured in Joint Venture agreements in 2011? We've got that information courtesy of our Real Deals Database and are presenting... read more →