There's sometimes misunderstanding as it relates to cash flow waterfall modeling with mixing up of the terms catch-up, clawback and look-back. To be clear, each is completely its own concept. In this... read more →

** Note: be sure to see the bottom of this post, where we have links to another 10 posts on cap rates. ** A "cap rate" (short for capitalization rate)... read more →

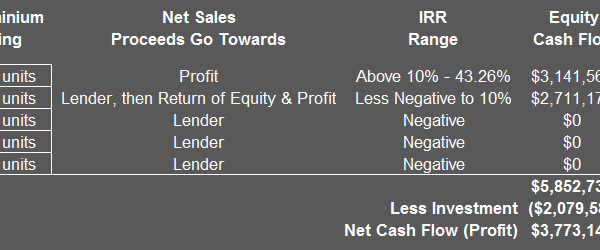

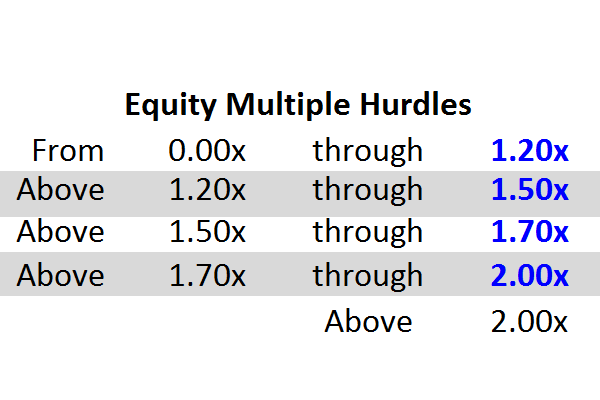

Recently we have received multiple requests for assistance with the equity joint venture partnership equity multiple hurdle concept and how to implement it in a spreadsheet. We explain it below.... read more →

As a follow-on to last week's post on NPV, we note here that there is also a fundamental difference between solving for the IRR when cash flows are measured in... read more →

Here are definitions of two sometimes misunderstood adjustment line items between Gross Potential Rent and Effective Gross Income for apartment/multi-family properties: Loss to Lease: a charge taken against Gross... read more →

We get requests from time to time to explain what is known as the "catch-up" mechanism as it relates to real estate private equity funds. See below. (Please read the... read more →

There is something of a mystery surrounding the mechanics of Senior Construction Loans. Here's our plain-English attempt to provide better clarity: 1. The Senior Construction Loan is not drawn down... read more →

The HP 12c is the most popular financial calculator used in the commercial real estate business. Learn all about it here in our free 27-page Self-Study guide and on our... read more →

What is a "double-promote" joint venture equity partnership structure? In short, a very lucrative opportunity for an investment's local... read more →