“… this may well be the best textbook ever written concerning the subject …” Mark Munizzo, Principal, The Equity Network | Adjunct Professor, Roosevelt University Chicago ... read more →

We've written on what is a good IRR for a real estate transaction, and in that post we touched briefly upon the equity multiple. Here we will expand on... read more →

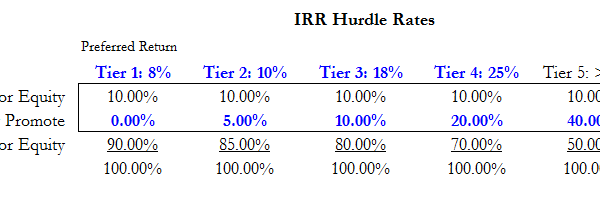

The look-back IRR waterfall can be tough to grasp conceptually if it's not explained intuitively (buy this Self Study tutorial if you have not mastered the concepts already). One of the... read more →

As a follow-on to last week's post on NPV, we note here that there is also a fundamental difference between solving for the IRR when cash flows are measured in... read more →

Cap rates (capitalization rates) are still one of the most-mentioned and least-understood elements of commercial real estate. What is a cap rate? The simplest way to define a cap rate... read more →

An REFM customer asks three terrific questions about IRR. What's a good IRR? In other words, at what IRR is an investment worthwhile? As we teach in our REFM... read more →

A monthly-based IRR is imperative for a development analysis, but how useful is it for calculating a longer-term hold? If you have made monthly projections, then on the margin, a... read more →