“I procured 5 LP term sheets and we just signed with a major $24B asset manager. This is testament that your models are accurate. I have gone head to head with major PE groups and there was no doubt on the model’s solidity.”

– Ali Lotfi, President, Intergulf Development Group

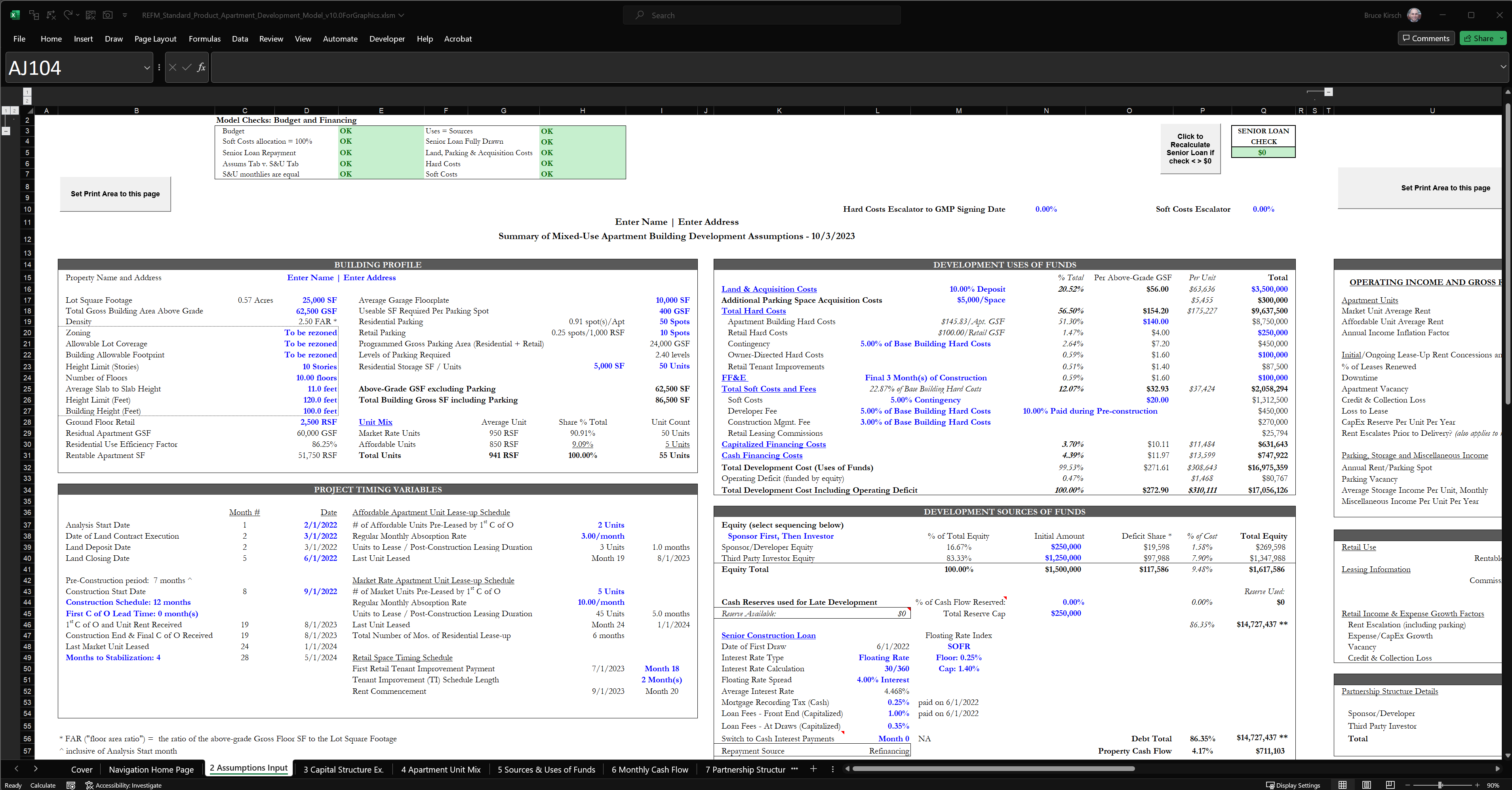

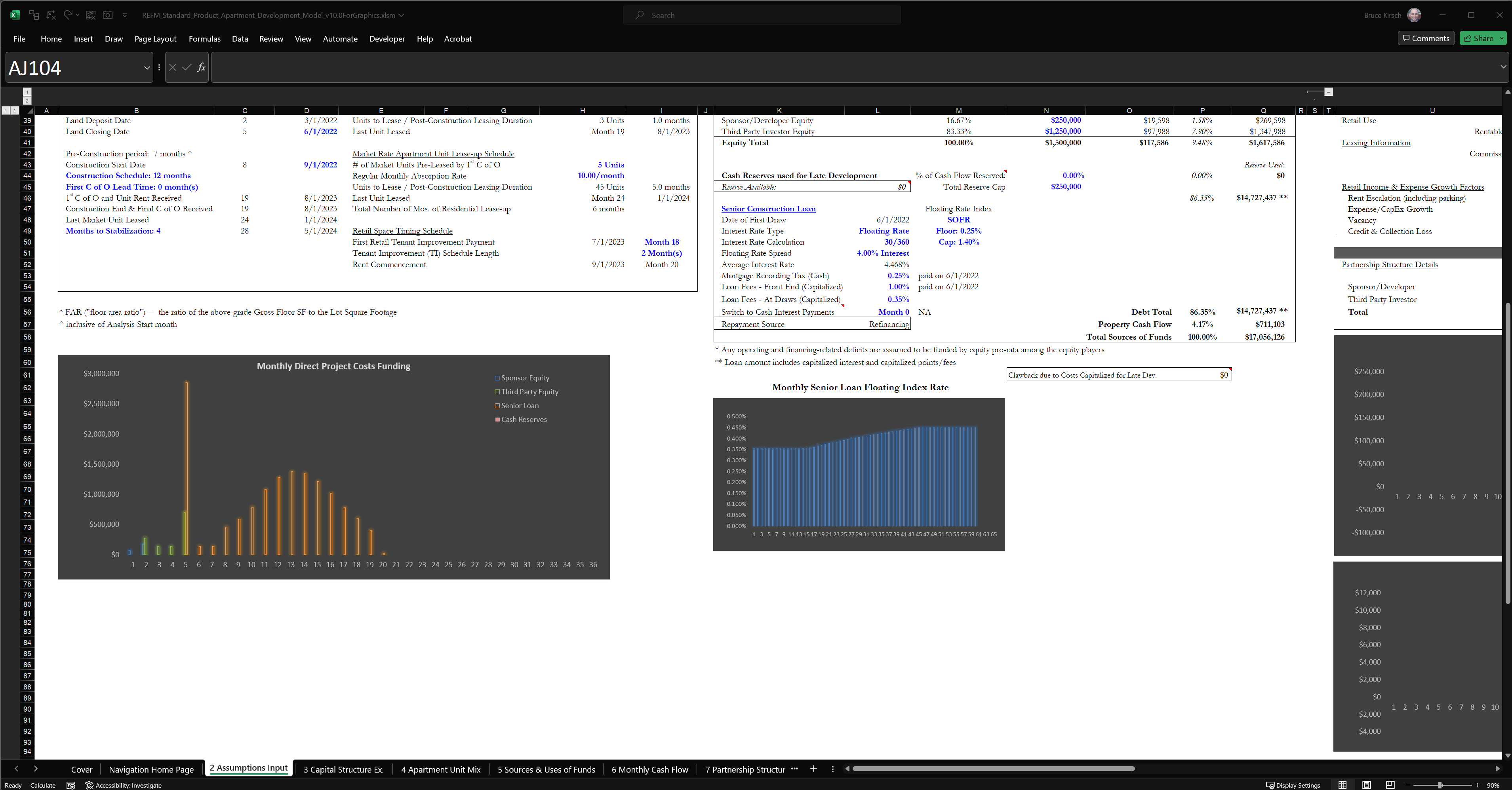

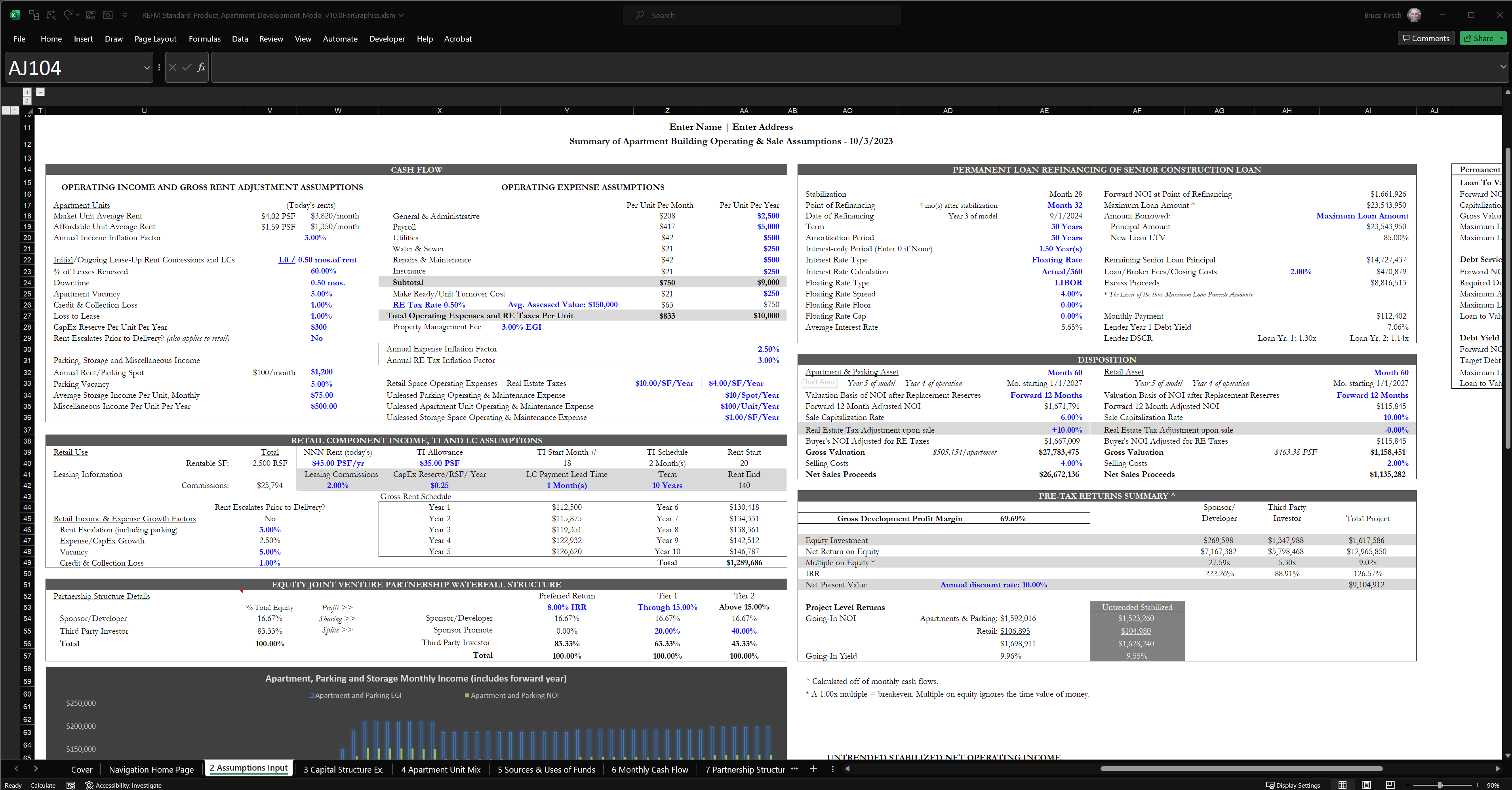

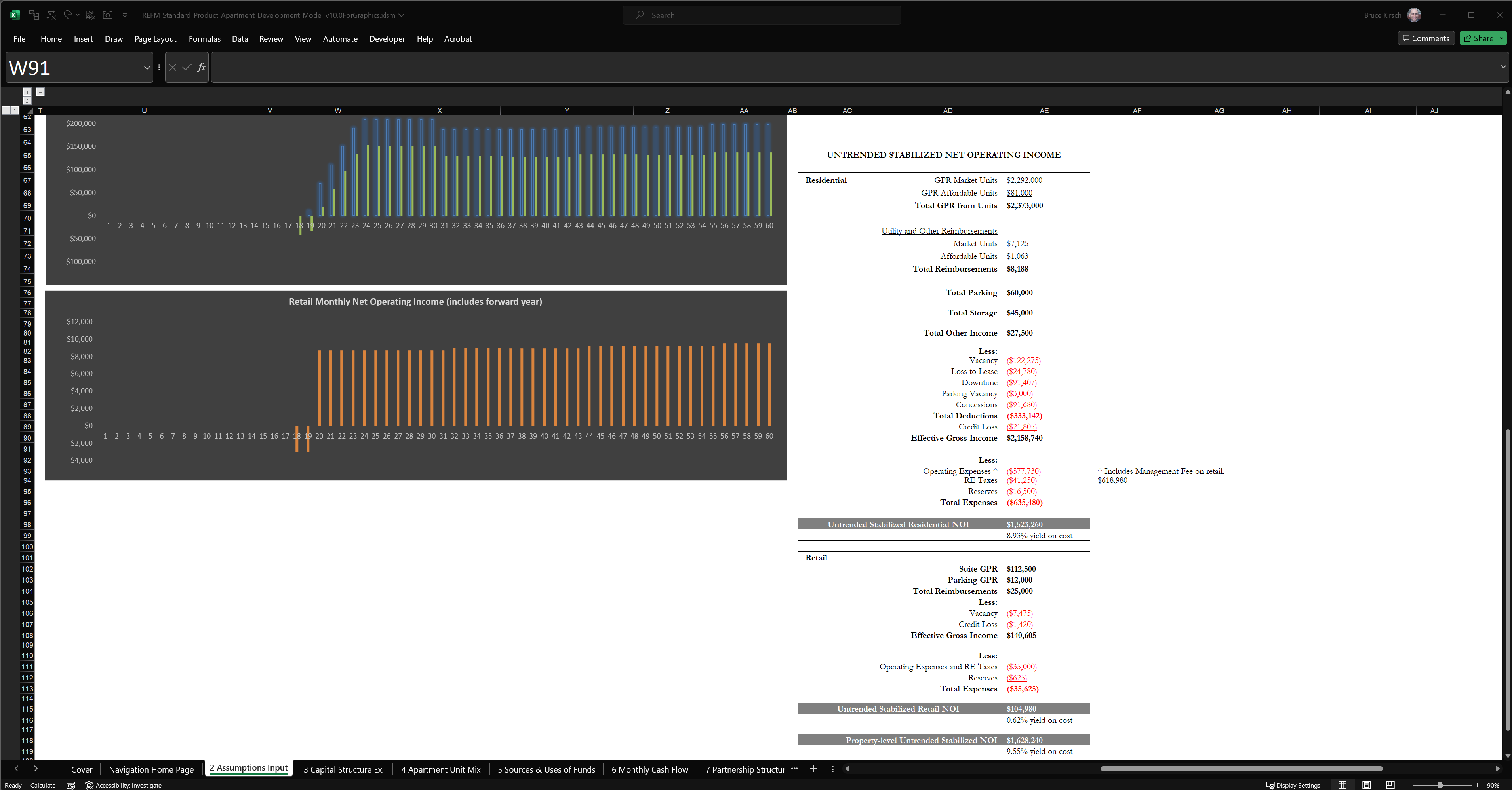

Standard Version: Mixed-Use Apartment/Multi-Family Building Ground-Up Development Pro-Forma Excel Tool

Overview and Video Tour

The Standard Pro Forma is a robust Excel-based analysis tool for modeling the ground-up development, operation and sale of an apartment/multi-family rental building with or without ground-floor retail and income-producing parking. It is suited for detailed monthly-based analysis and it generates before-tax IRR, net profit, cash on cash, equity multiple and NPV outputs, among others.

Functions

- Compatible with Excel on both PC and Mac

- Supports a 10-year timeline for development, plus an additional 6 years of operation

- Separate unit mixes, rents and absorption for market and affordable rate units

- Dynamic construction hard cost allocation based off of a bell-shaped curve

- Retail tenant improvements (TIs) and leasing commissions (LCs)

- Option to value and dispose of the retail component independently

- Equity funding of operating and financing deficits on a pro-rata basis

Features

- Includes instructions for use, with detailed annotations tied to select cells

- Two-page assumptions input and reporting screen dashboard

- Hyperlink navigation for fast, intuitive access to all tabs

- Institutional-quality print-ready reporting tabs that are brandable to your company

- S-curve distribution of soft costs by individual line item

- No circular references impacting construction loan sizing and interest

Debt Capabilities

- Senior construction loan

- funds on a residual basis to all equity

- fixed rate or floating interest only, with default funded interest reserve, and user ability to switch to cash interest payments at specified milestone

- floating rate floor and cap

- repaid from net sales proceeds of apartment building and retail unit dispositions, or from refinancing proceeds from Permanent Loan

- Permanent loan

- sized by the lesser of three tests (LTV, DSCR, Debt Yield)

- option to do a cash-out refi with excess proceeds to equity

- fixed or floating rate (with floor and cap), with interest-only option

Equity Capabilities

- Equity positions supported

- sponsor/developer

- third party investor

- Equity investment options

- pari passu (pro-rata, simultaneously)

- sponsor first, then third party investor

- Equity profit sharing

- Pari Passu Preferred Return (includes return of capital) with monthly compounding

- Cumulative IRR hurdle based on the performance of the third party investor’s invested dollars

- Residual profit split with sponsor promote share defined as share of residual profit above and beyond the sponsor deal ownership position share

Reports

- Assumptions and Project Returns

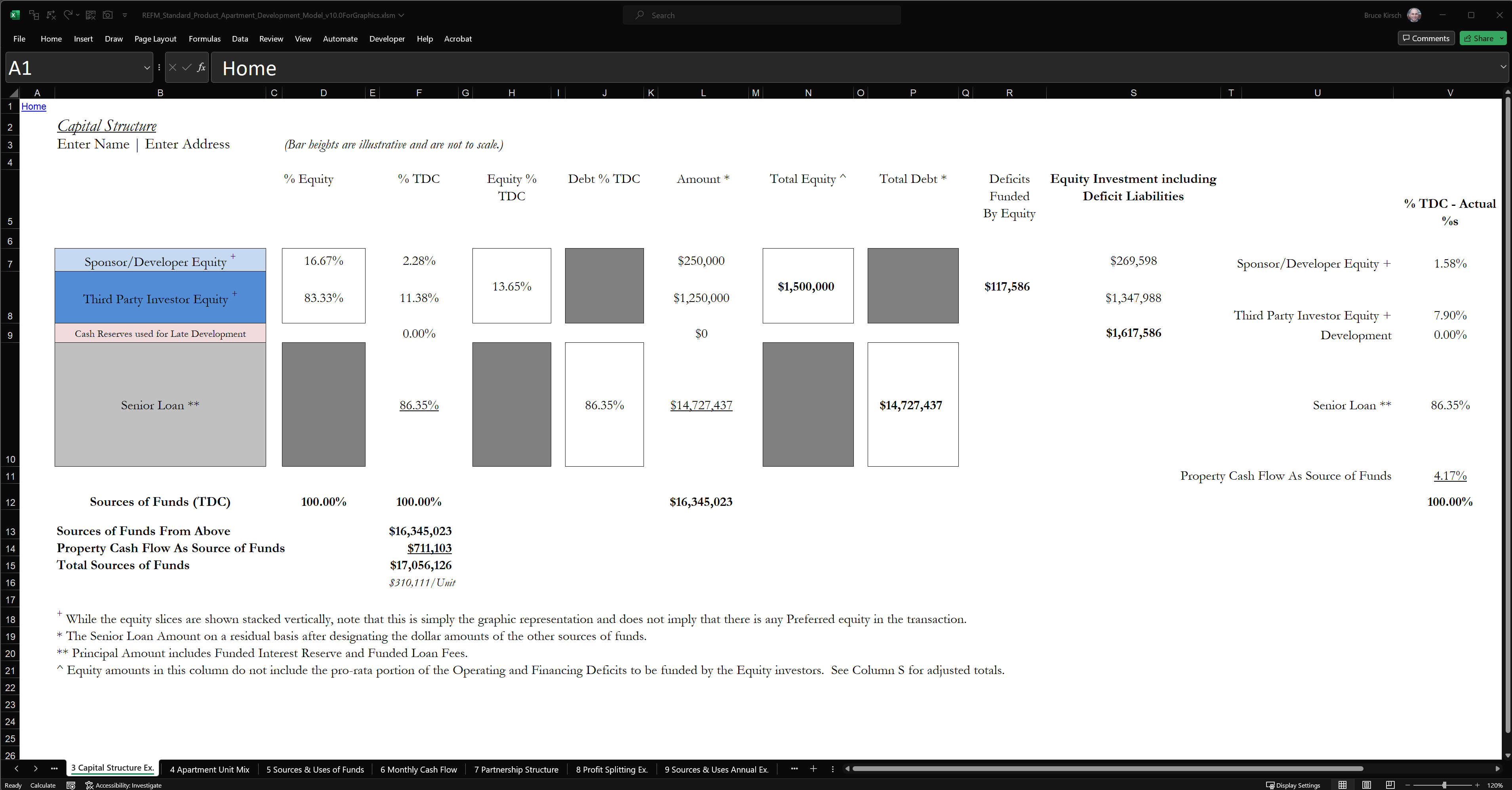

- Capital Structure

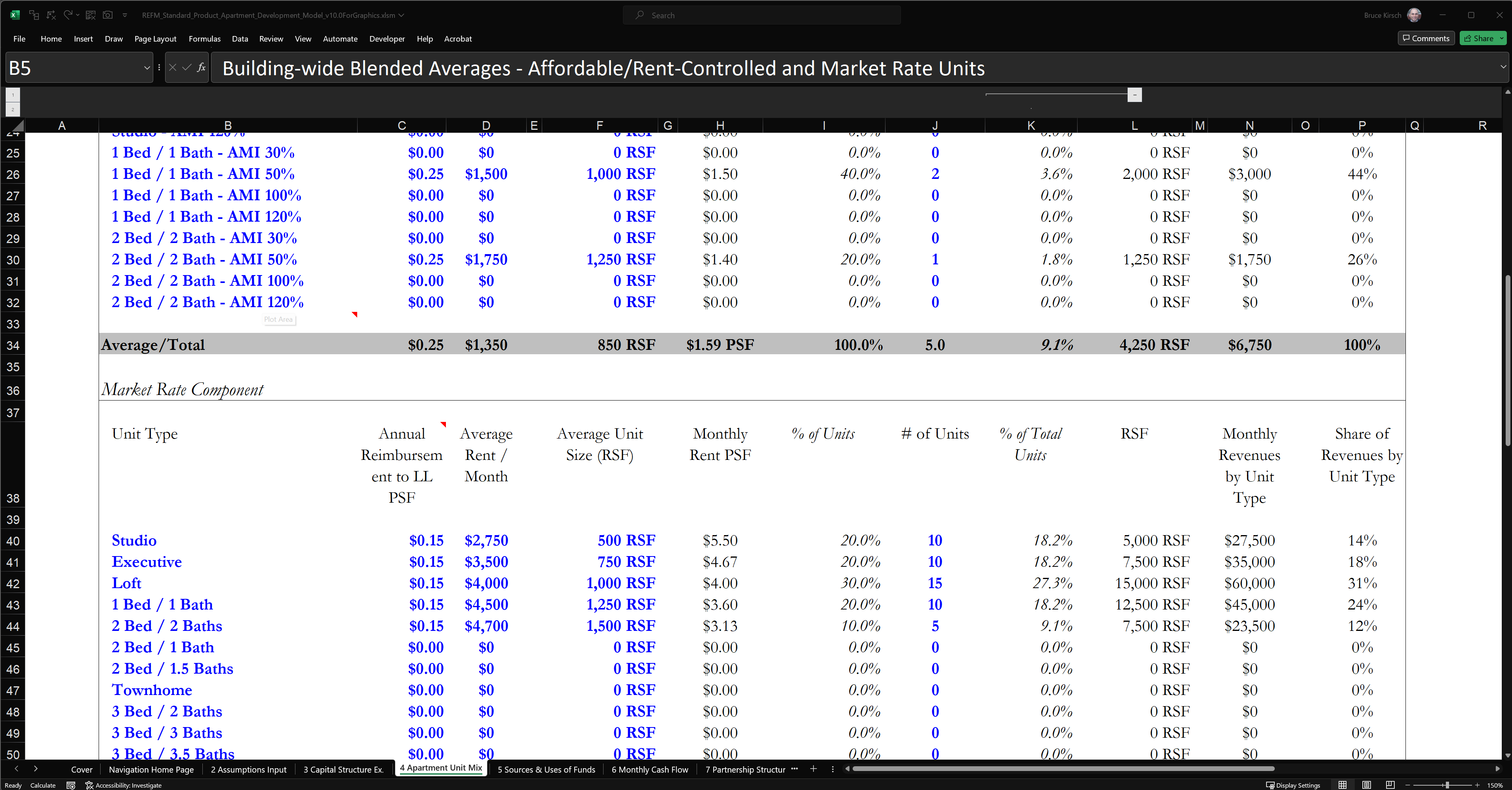

- Unit Mix

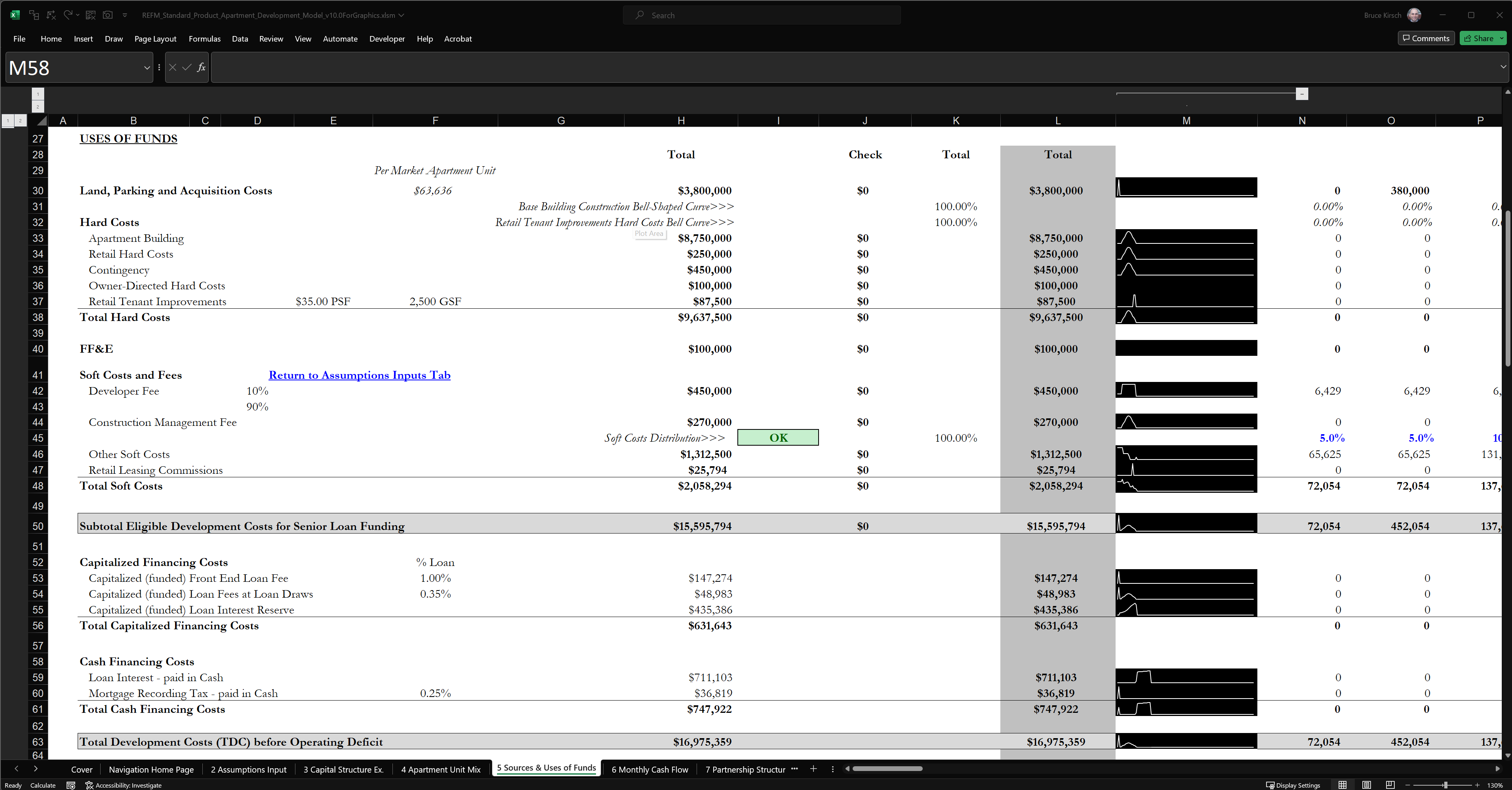

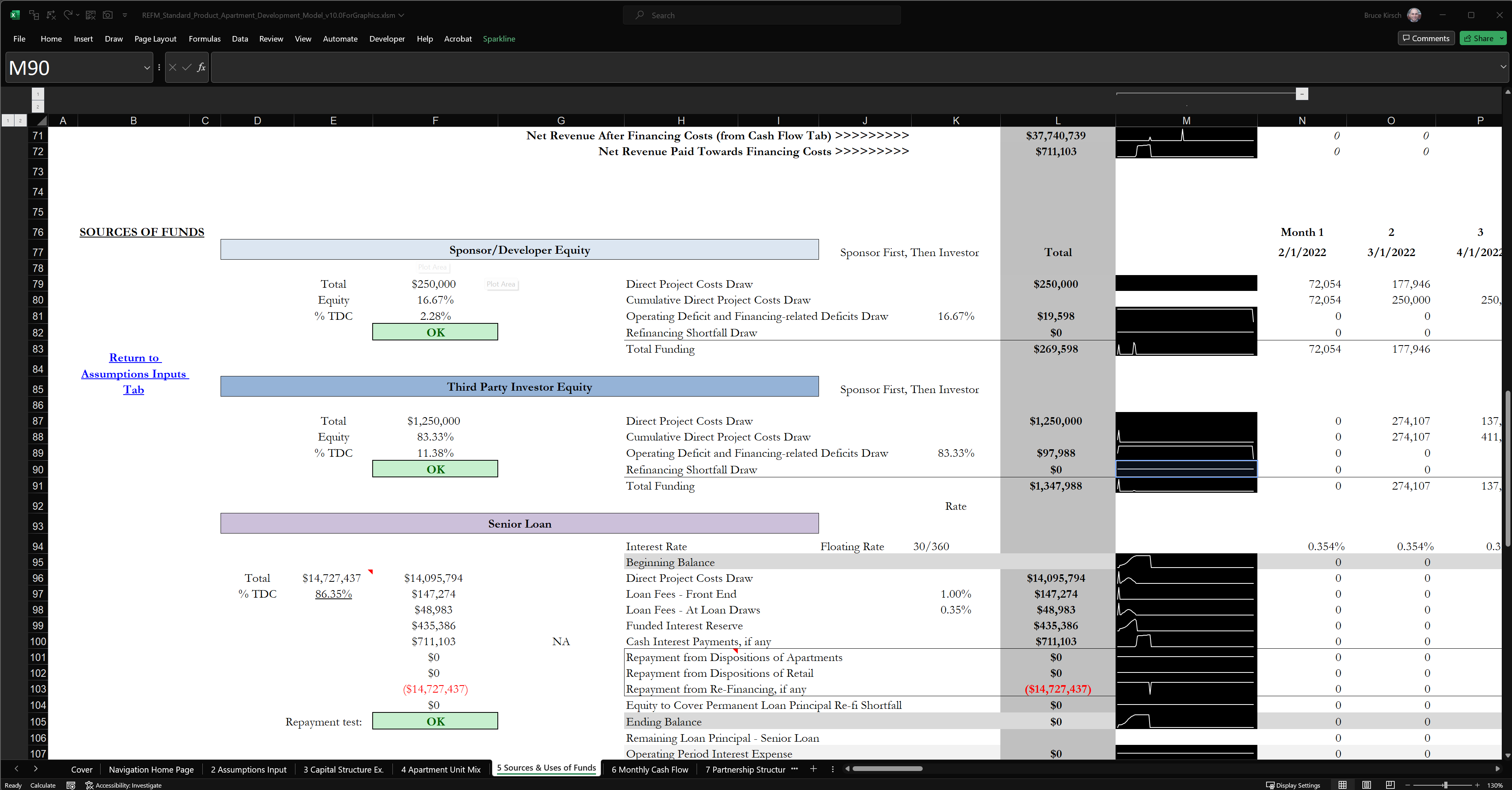

- Partnership Structure

- Annual Sources and Uses

- Annual Cash Flow

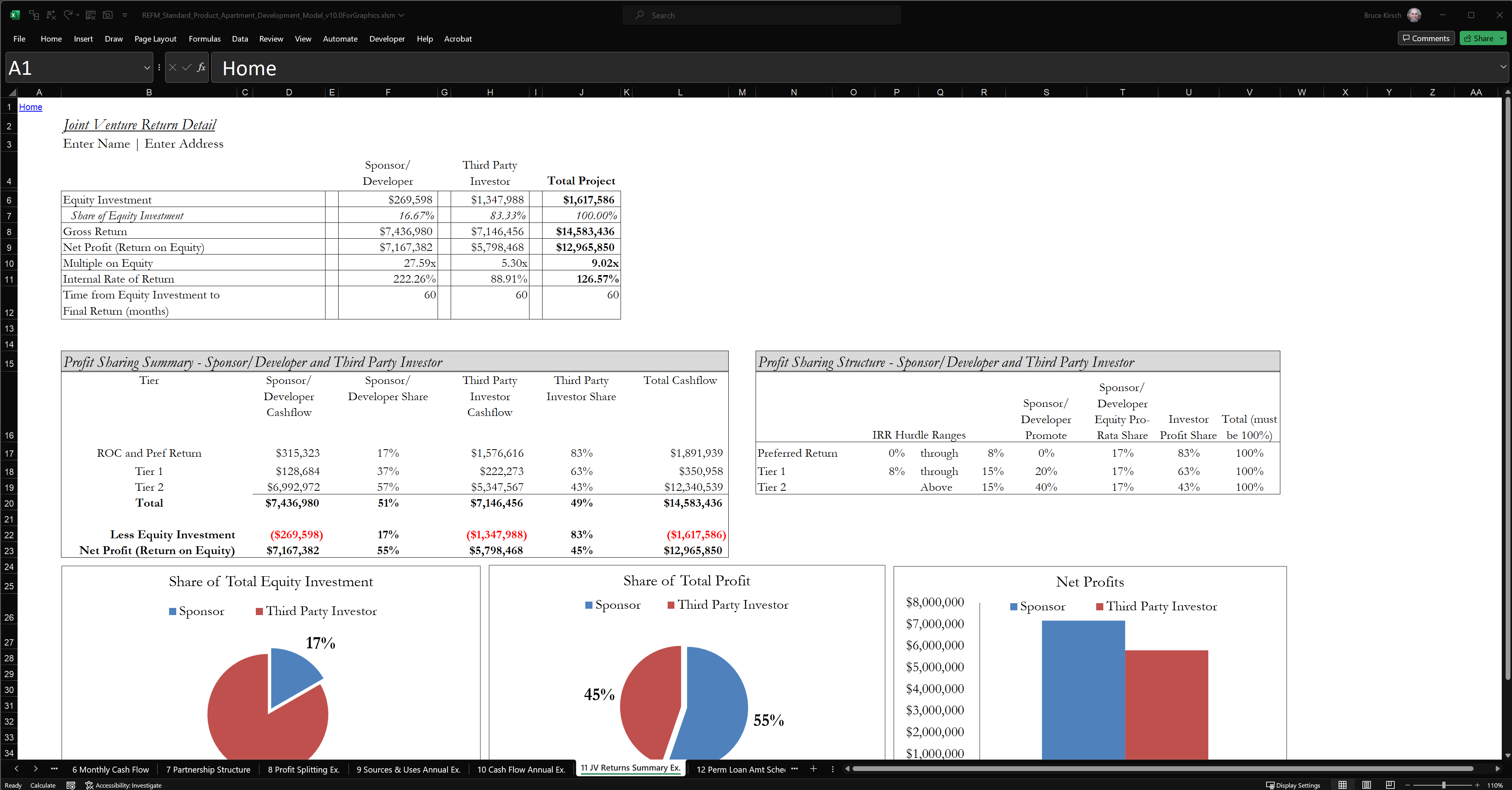

- JV Returns Summary

Quality Controls

- Persistent calculation checks and associated visual alerts, and data validation protections to prevent faulty inputs or faulty conclusions

- project budget must match allocation of budget over timeline

- senior loan must be repaid in full

- all units must be leased

- permanent loan must be sufficient to pay off senior loan

- waterfall profit splits must sum to match the deal-level profit

Support and User Guide

Support is available through our online ticket system.

A comprehensive, searchable, hyperlinked PDF User Guide is included with purchase. A sample is below.

Included With Purchase

- Blank template (inputs are all set to zero)

- Copy of the template with a sample deal loaded in

- Searchable, hyperlinked PDF User Guide

- Credit of what you pay towards future purchase of the Tools Bundle

Workbook Tabs

1 Home Page

2 Assumptions Input

3 Capital Structure Exhibit

4 Apartment Unit Mix Input

5 Monthly Sources and Uses of Funds Input

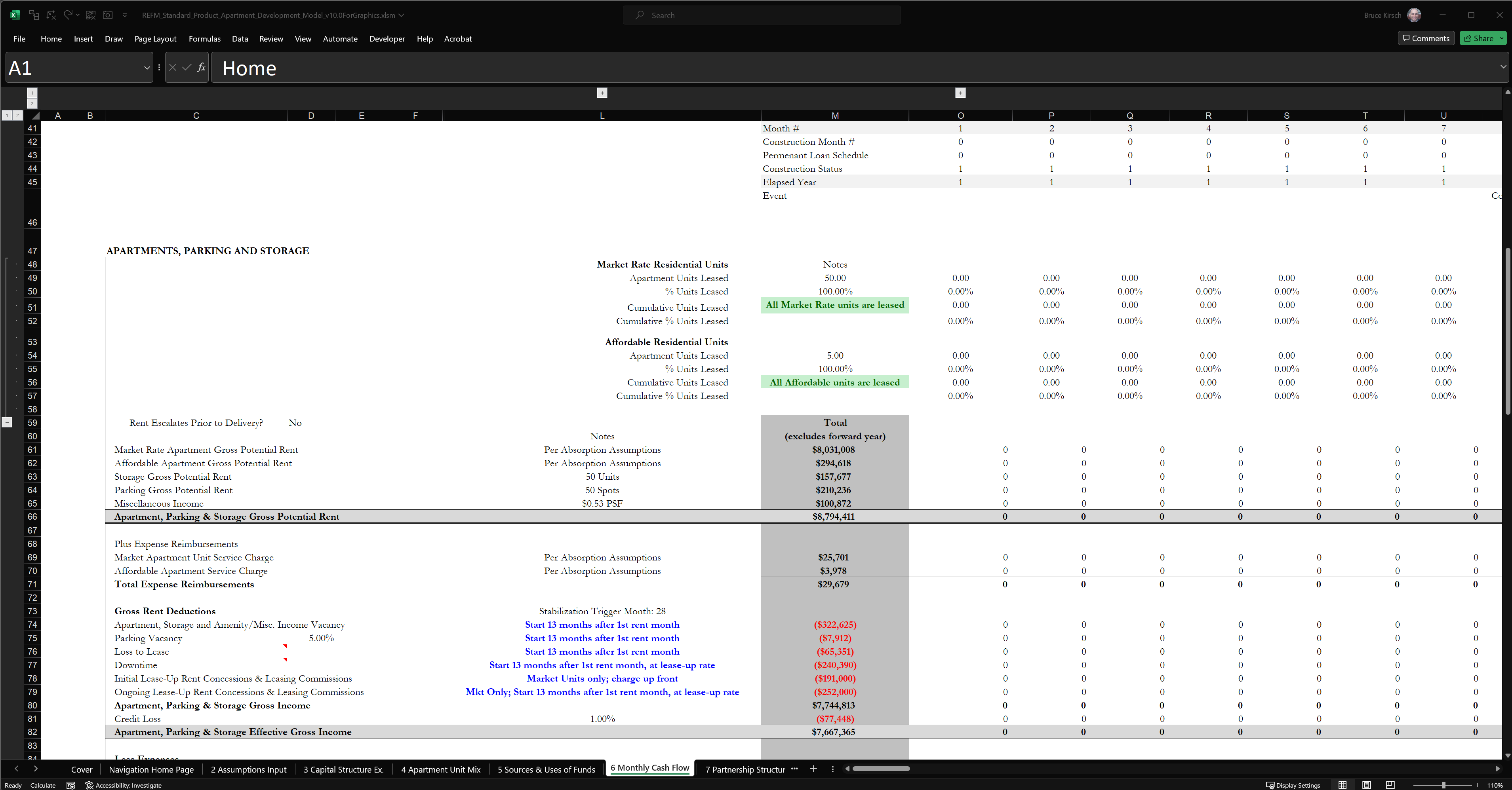

6 Monthly Cash Flow Exhibit

7 Partnership Structure Exhibit

8 Waterfall Profit Splitting Exhibit

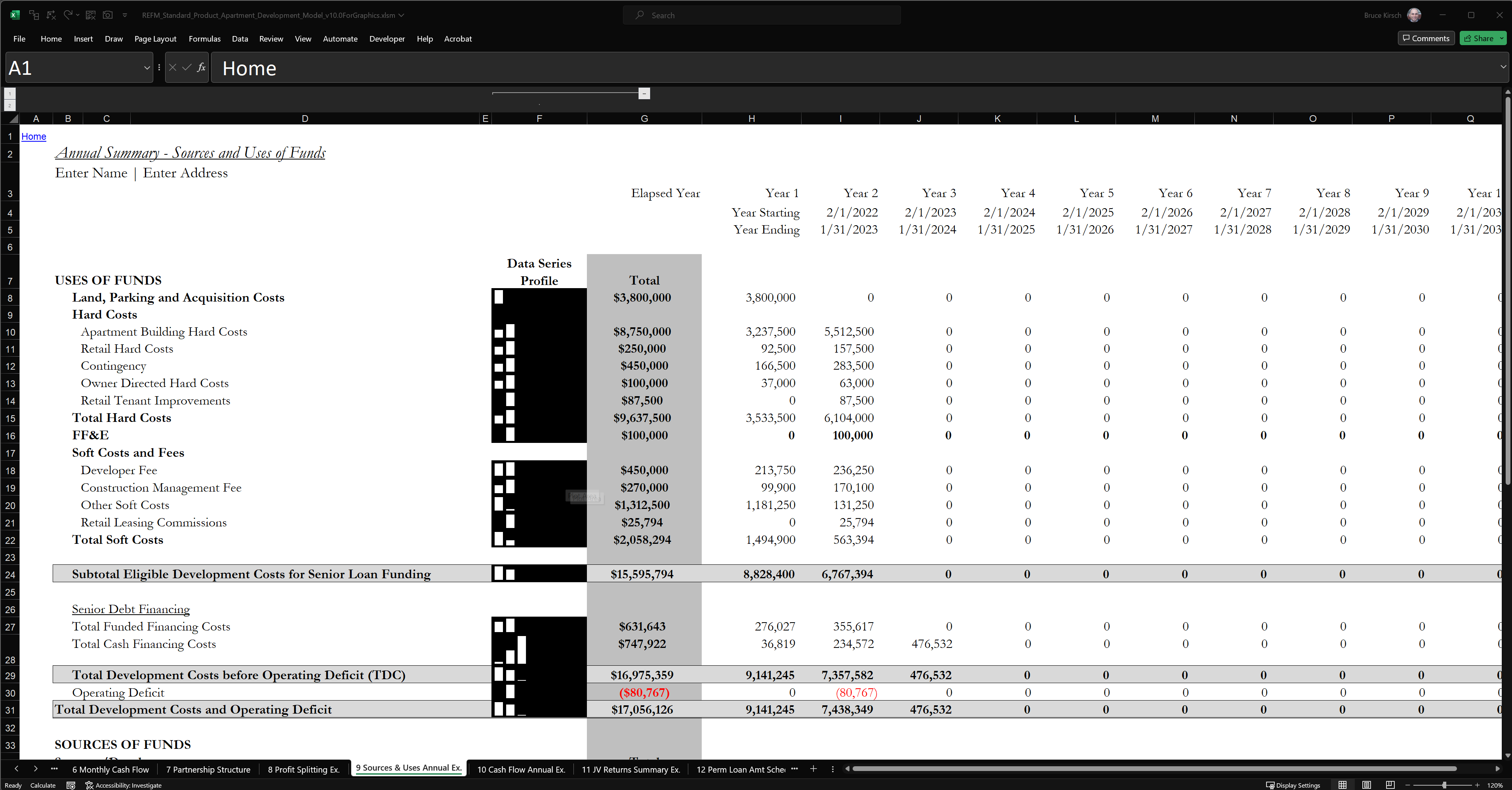

9 Annual Sources & Uses Exhibit

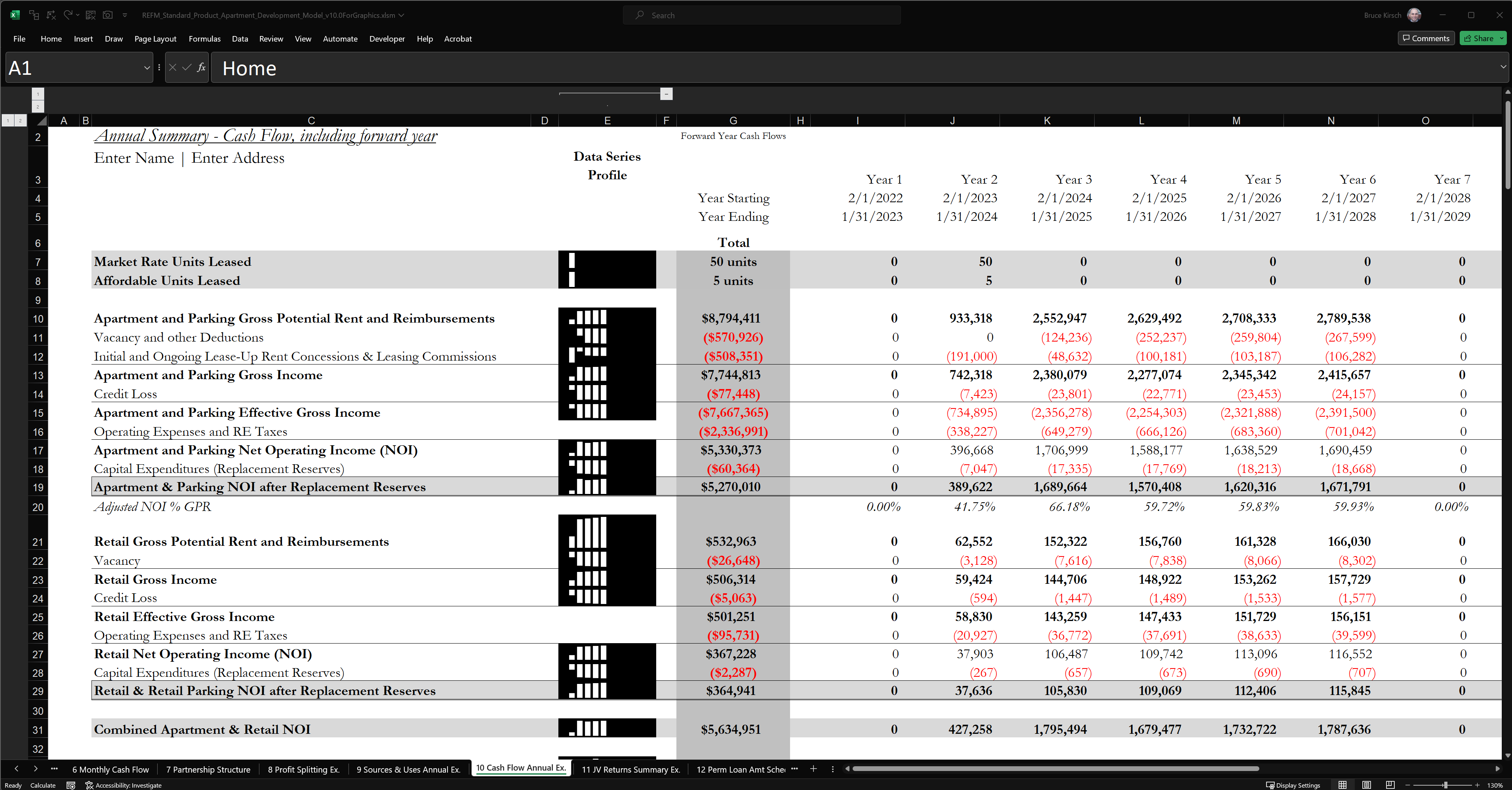

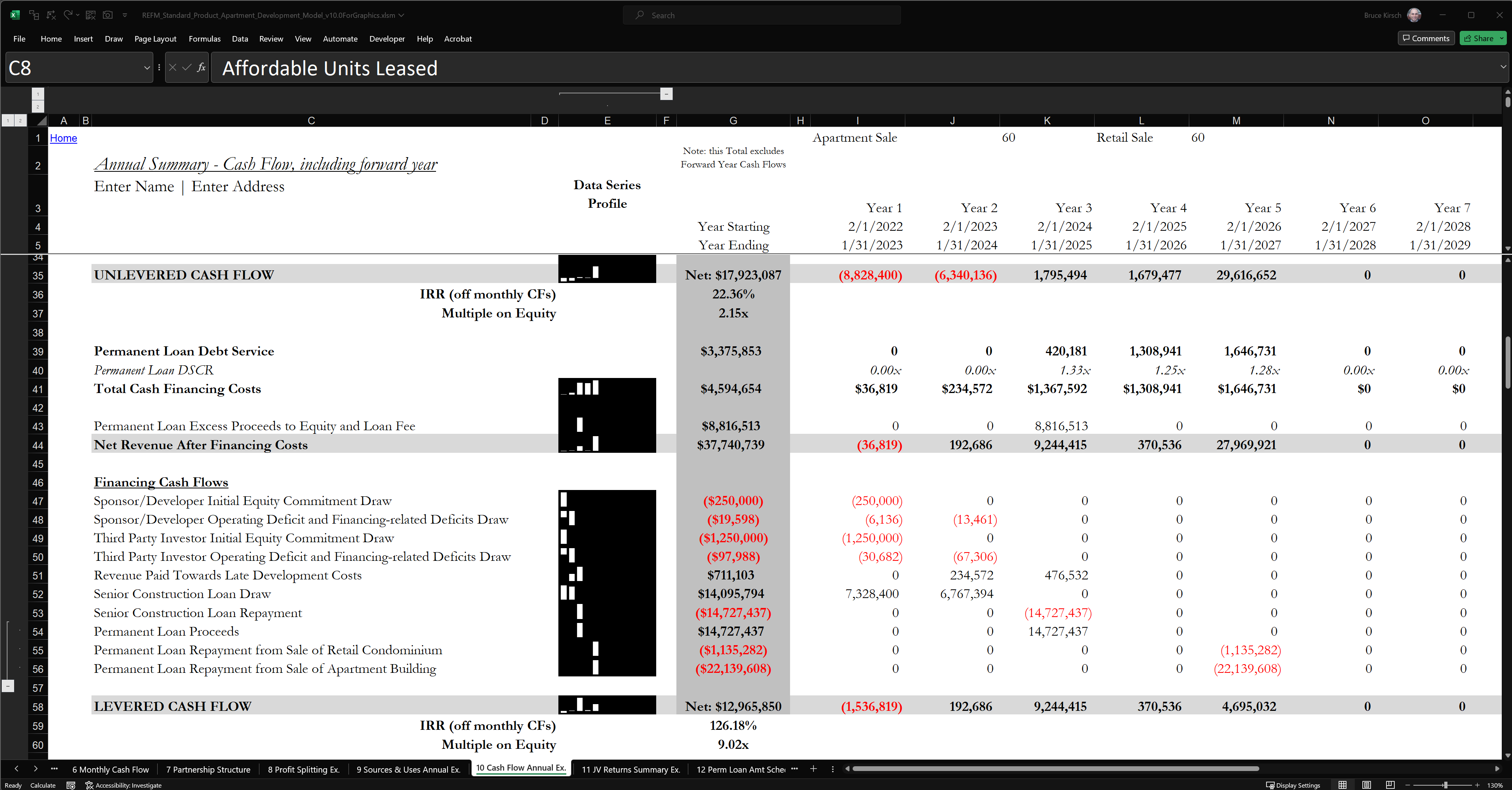

10 Annual Cash Flow Exhibit

11 Joint Venture Partnership Returns Summary Exhibit

12 Permanent Loan Amortization Schedule

13 Construction Loan Interest Rates

14 Monthly Construction Bell Curve Lookup Table

15 Land Acquisition Costs Schedule Input

16 Hard Costs Budget Schedule Input – Phase 1

17 Soft Costs Budget Schedule Input – Phase 2

18 Floating Rate Index

“I procured 5 LP term sheets and we just signed with a major $24B asset manager. This is testament that your models are accurate. I have gone head to head with major PE groups and there was no doubt on the solidity of the model.”

– Ali Lotfi, President, Intergulf Development Group

Standard Version:

Mixed-Use Apartment/Multi-Family Building Ground-Up Development Pro-Forma Excel Tool

Overview and Video Tour

The Standard Pro Forma is a robust Excel-based analysis tool for modeling the ground-up development, operation and sale of an apartment/multi-family rental building with or without ground-floor retail and income-producing parking. It is suited for detailed monthly-based analysis and it generates before-tax IRR, net profit, cash on cash, equity multiple and NPV outputs, among others.

Functions

- Compatible with Excel on both PC and Mac

- Supports a 10-year timeline for development, plus an additional 6 years of operation

- Separate unit mixes, rents and absorption for market and affordable rate units

- Dynamic construction hard cost allocation based off of a bell-shaped curve

- Retail tenant improvements (TIs) and leasing commissions (LCs)

- Option to value and dispose of the retail component independently

- Equity funding of operating and financing deficits on a pro-rata basis

Features

- Includes instructions for use, with detailed annotations tied to select cells

- Two-page assumptions input and reporting screen dashboard

- Hyperlink navigation for fast, intuitive access to all tabs

- Institutional-quality print-ready reporting tabs that are brandable to your company

- S-curve distribution of soft costs by individual line item

- No circular references impacting construction loan sizing and interest

Debt Capabilities

Senior construction loan

- funds on a residual basis to all equity

- fixed rate or floating interest only, with default funded interest reserve, and user ability to switch to cash interest payments at specified milestone

- floating rate floor and cap

- repaid from net sales proceeds of apartment building and retail unit dispositions, or from refinancing proceeds from Permanent Loan

Permanent loan

- sized by the lesser of three tests (LTV, DSCR, Debt Yield)

- option to do a cash-out refi with distribution of excess proceeds to equity

- fixed or floating rate (with floor and cap), with option for interest-only period up front

Equity Capabilities

Equity positions supported

- sponsor/developer

- third party investor

Equity investment options

- pari passu (pro-rata, simultaneously)

- sponsor first, then third party investor

Equity profit sharing

- Pari Passu Preferred Return (includes return of capital) with monthly compounding

- Cumulative IRR hurdle based on the performance of the third party investor’s invested dollars

- Residual profit split with sponsor promote share defined as share of residual profit above and beyond the sponsor deal ownership position share

Reports

- Assumptions and Project Returns

- Capital Structure

- Unit Mix

- Partnership Structure

- Annual Sources and Uses

- Annual Cash Flow

- JV Returns Summary

Quality Controls

Persistent calculation checks and associated visual alerts, and data validation protections to prevent faulty inputs or faulty conclusions

- project budget must match allocation of budget over timeline

- senior loan must be repaid in full

- all units must be leased

- permanent loan must be sufficient to pay off senior loan

- waterfall profit splits must sum to match the deal-level profit

Support and User Guide

Support is available through our online ticket system.

A comprehensive, searchable, hyperlinked PDF User Guide is included with purchase.

Included With Purchase

- Blank template (inputs are all set to zero)

- Copy of the template with a sample deal loaded in

- Searchable, hyperlinked PDF User Guide

- Credit of what you pay towards future purchase of the Tools Bundle

Workbook Tabs

1 Home Page

2 Assumptions Input

3 Capital Structure Exhibit

4 Apartment Unit Mix Input

5 Monthly Sources and Uses of Funds Input

6 Monthly Cash Flow Exhibit

7 Partnership Structure Exhibit

8 Waterfall Profit Splitting Exhibit

9 Annual Sources & Uses Exhibit

10 Annual Cash Flow Exhibit

11 Joint Venture Partnership Returns Summary Exhibit

12 Permanent Loan Amortization Schedule

13 Construction Loan Interest Rates

14 Monthly Construction Bell Curve Lookup Table

15 Land Acquisition Costs Schedule Input

16 Hard Costs Budget Schedule Input – Phase 1

17 Soft Costs Budget Schedule Input – Phase 2

18 Floating Rate Index