“I procured 5 LP term sheets and we just signed with a major $24B asset manager. This is testament that your models are accurate. I have gone head to head with major PE groups and there was no doubt on the model’s solidity.”

– Ali Lotfi, President, Intergulf Development Group

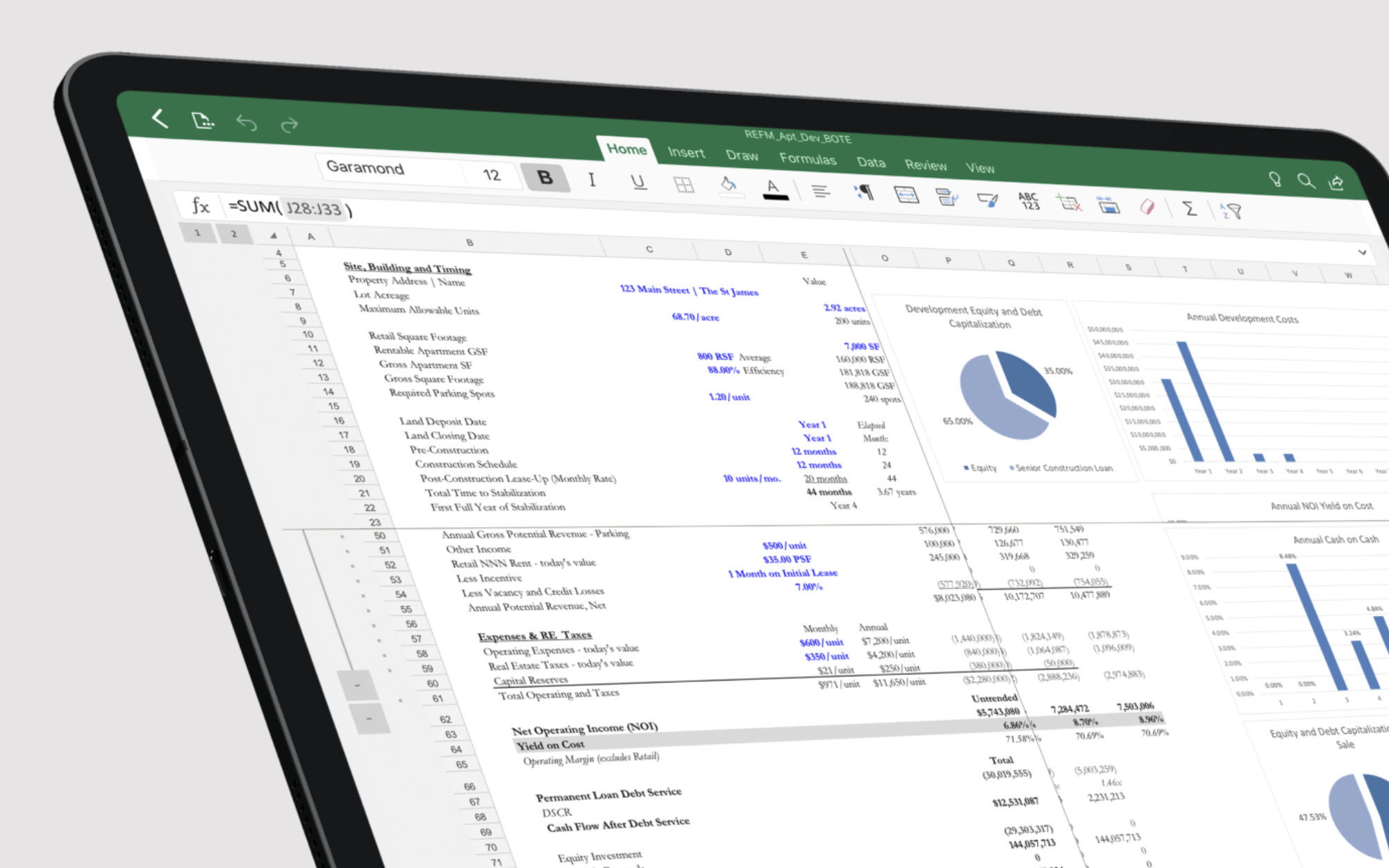

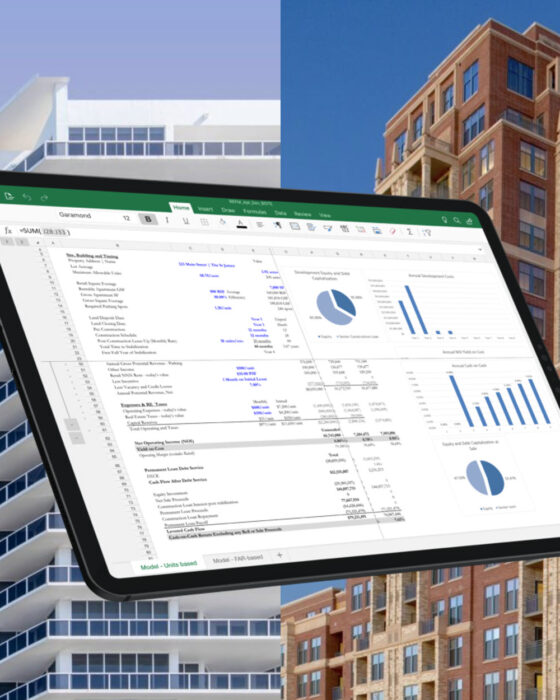

Multi-Year Back Of The Envelope Apartment Building Development Analysis Excel Tool

Overview and Video Tour

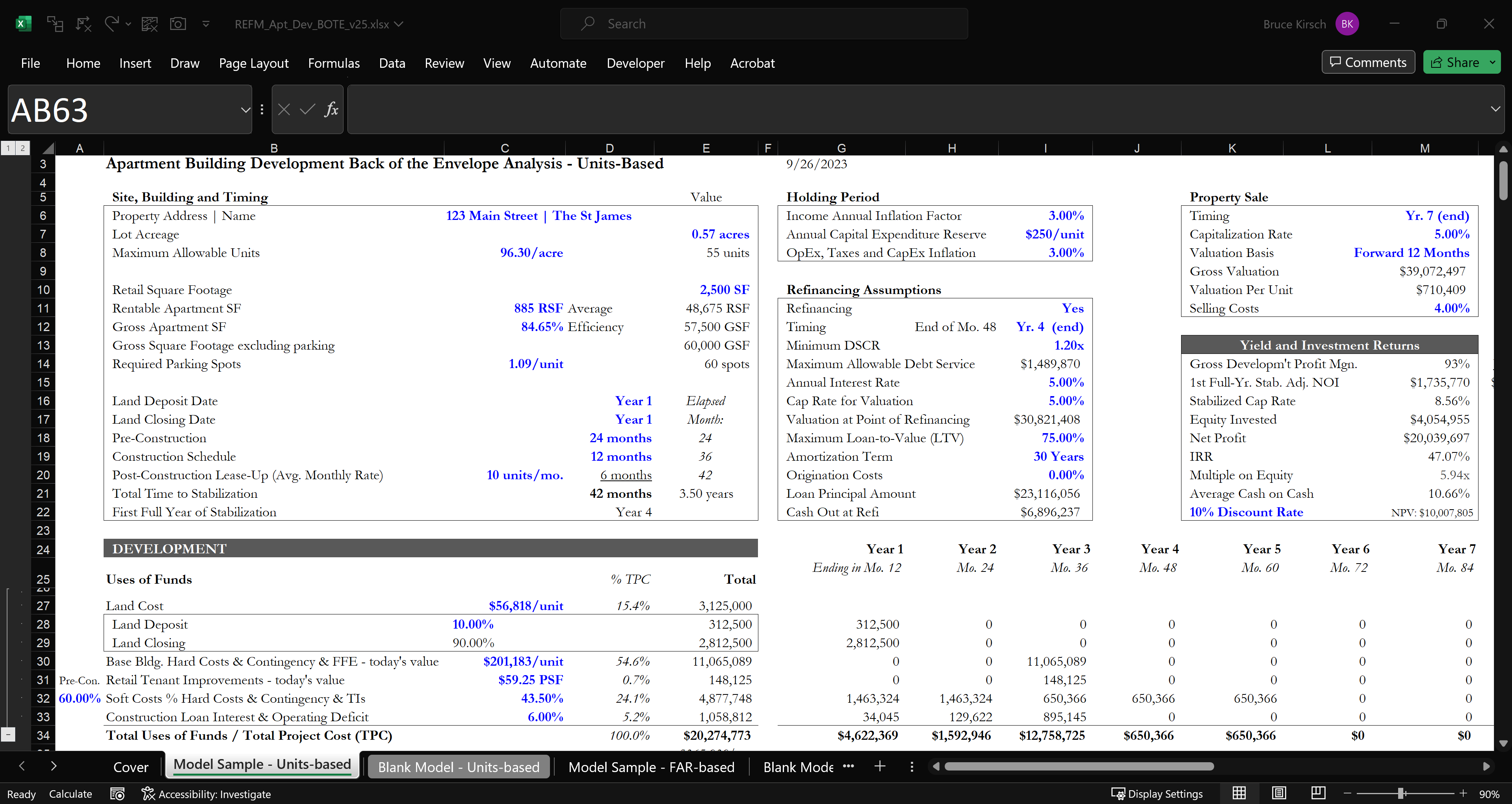

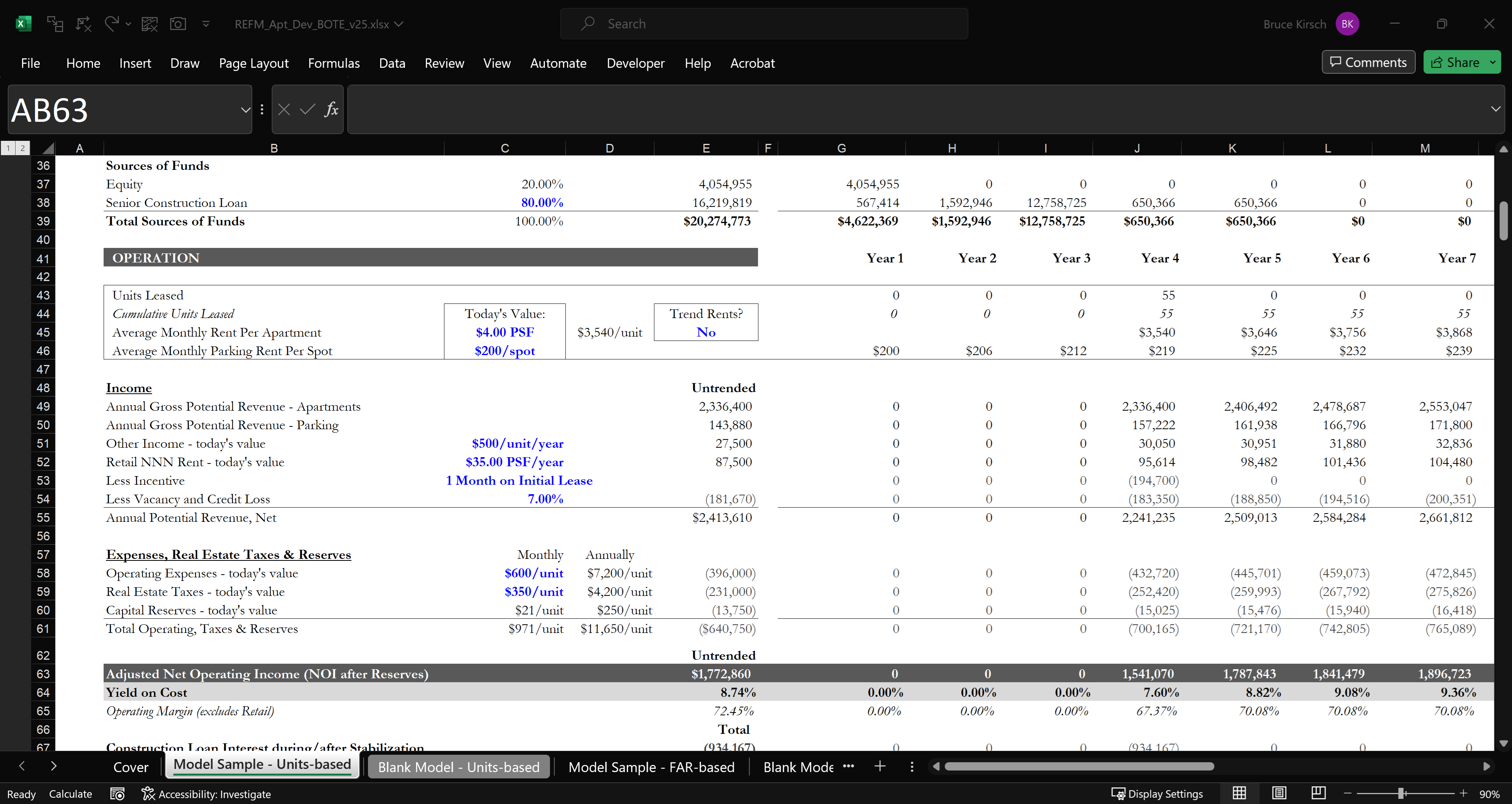

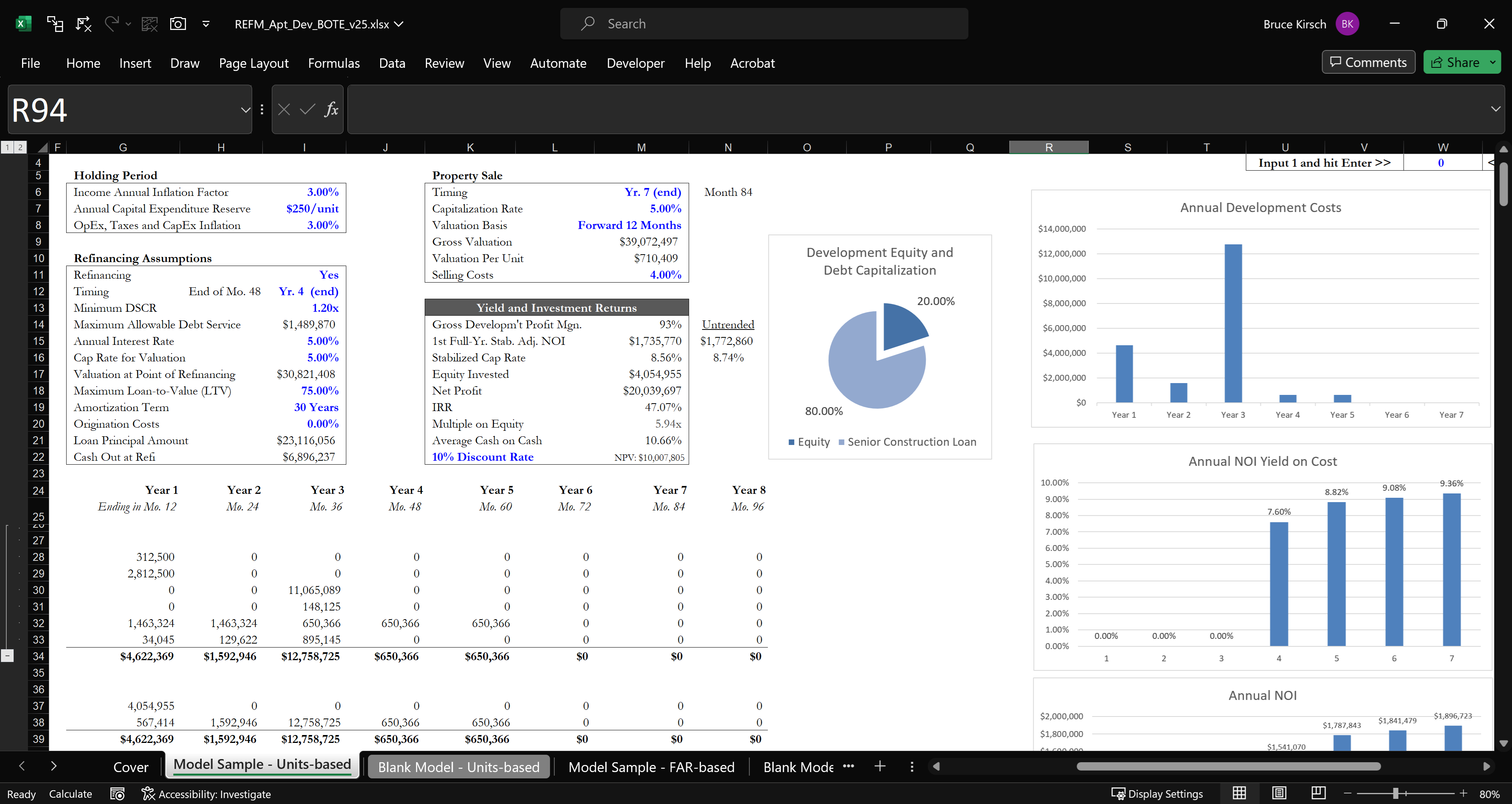

The Multi-Year B.O.T.E. Excel tool is suited for rapid apartment building development feasibility and residual land valuation based not only on a stabilized yield on cost, but also on goal-seeking to any of a targeted before-tax IRR, net profit, multiple on equity or NPV metric.

Functions

- Compatible with Excel on PC, Mac, iPad and Android tablets

- Supports an 11-year timeline of development and operation

- Allows for back-solving to a residual land value based on:

- stabilized cap rate

- net profit

- IRR

- multiple on equity

- average cash on cash

- NPV

- Streamlined set of assumptions inputs

- Units-based and FAR-based analysis types

- Supports a NNN retail component, sold with the apartments

- Sale valuation based off of forward or trailing 12 months values

Features

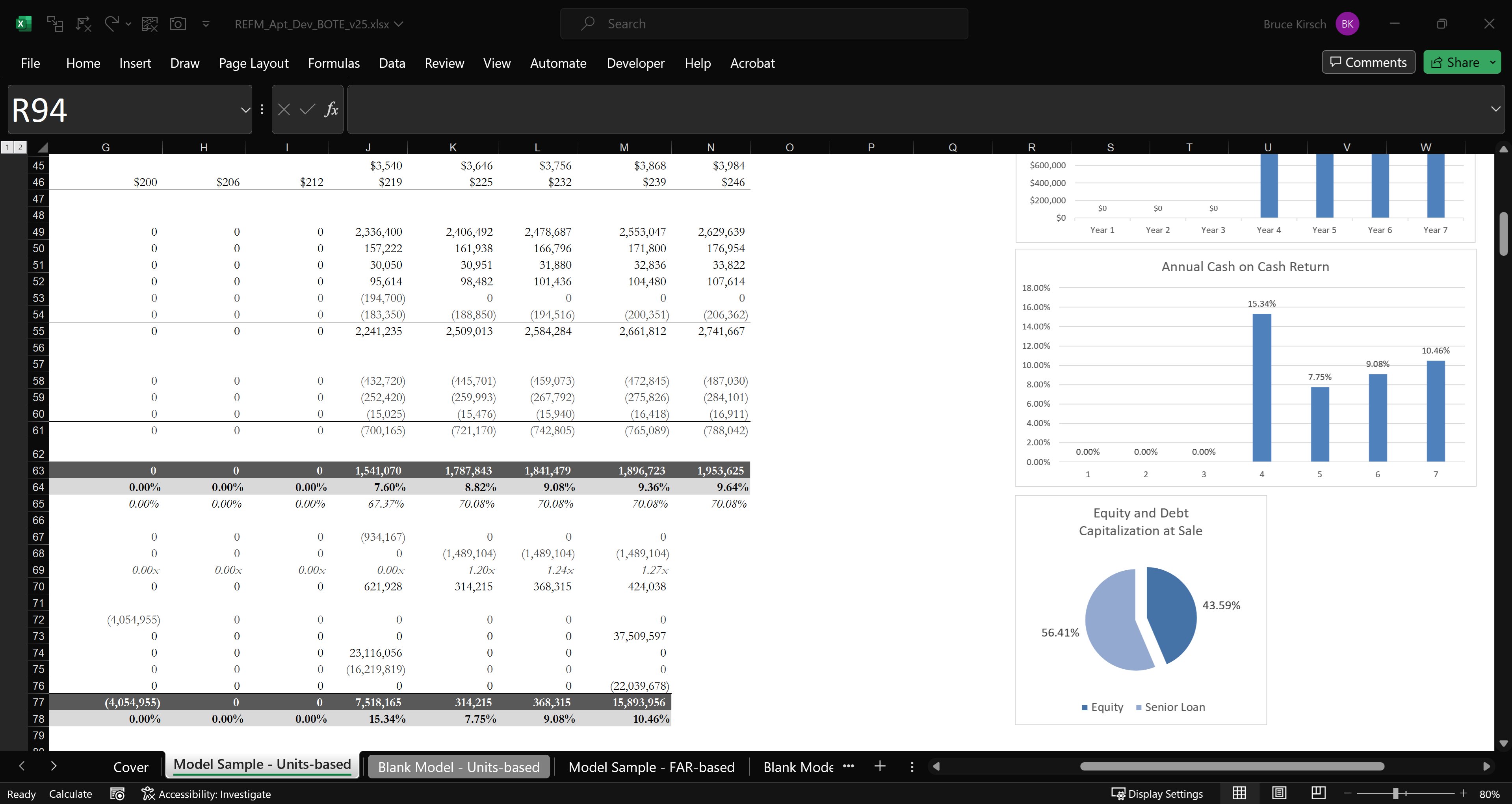

- Charts for:

- development equity and debt capitalization

- annual development costs

- annual NOI yield on cost

- annual NOI

- annual cash on cash

- equity and debt capitalization at sale

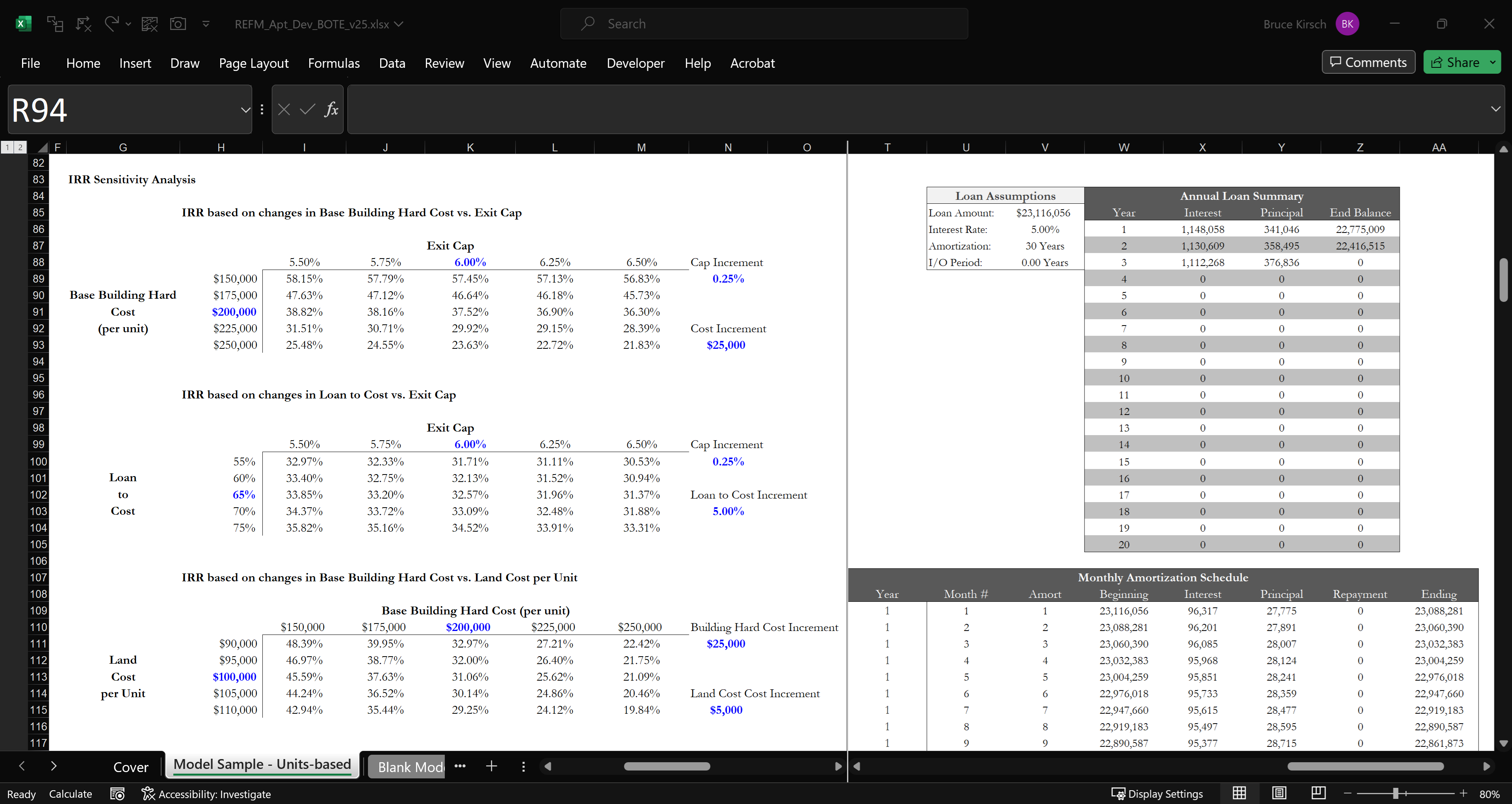

- IRR Sensitivity Analysis data tables based on:

- base building hard cost vs. exit cap

- senior construction loan LTC vs. exit cap

- land cost vs. base building hard cost.

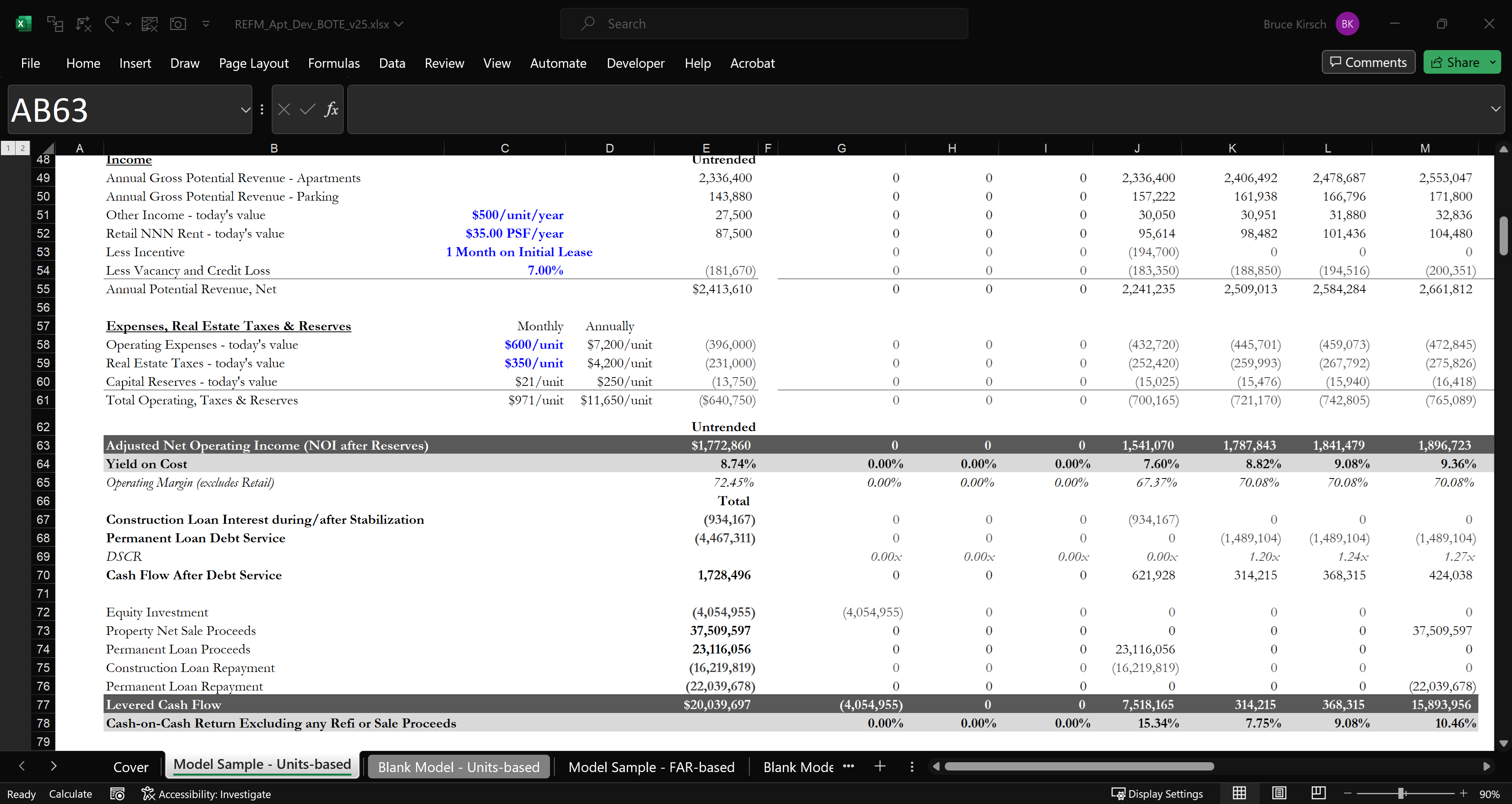

Debt and Equity Capabilities

- Sponsor Equity

- Senior Construction Loan

- Refinancing upon stabilization with a Permanent Loan

- Supports an upfront interest-only period and a cash out refi

Reports

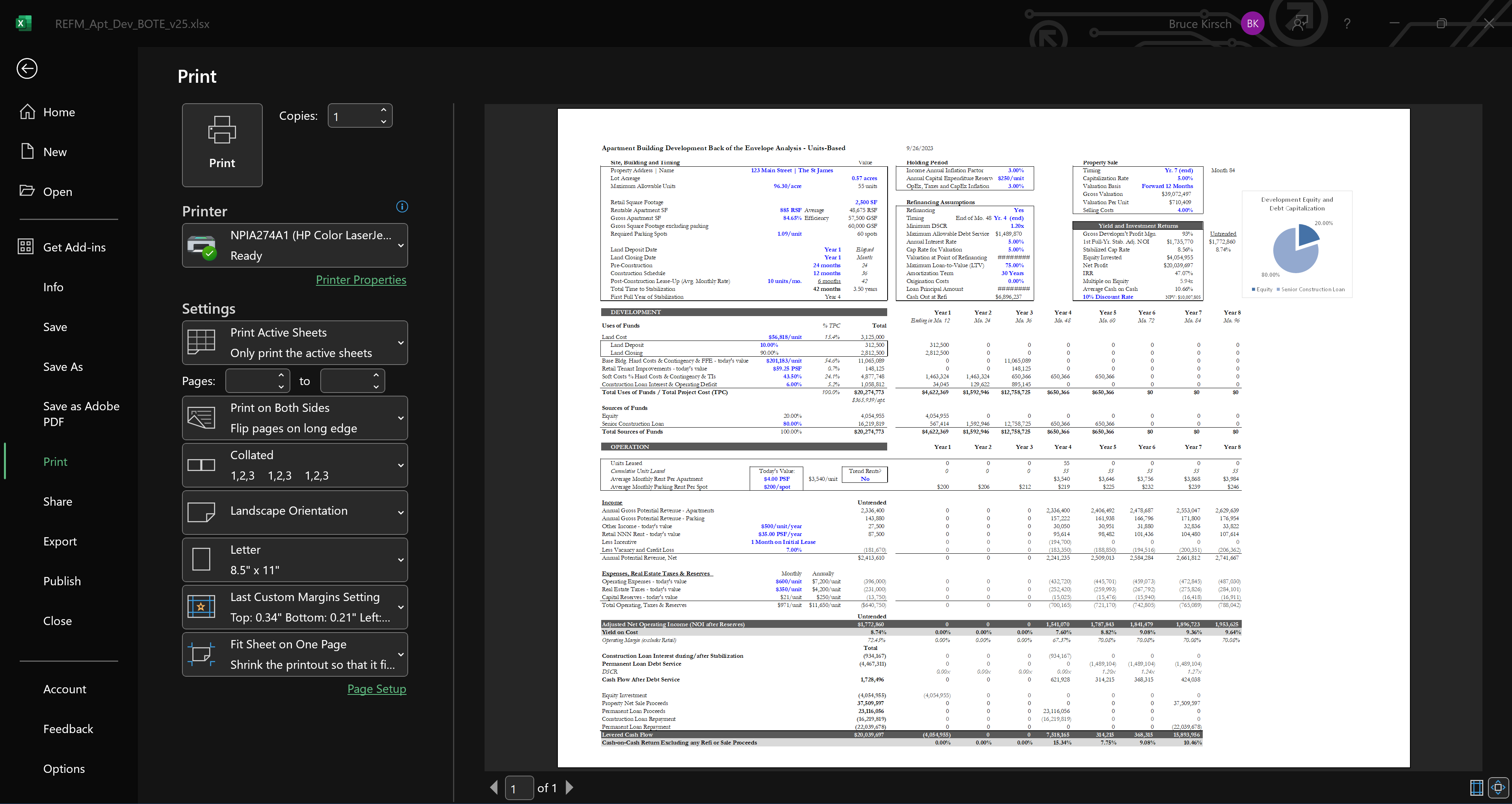

The analysis prints neatly on a single 8.5 x 11 page in landscape orientation.

Quality Controls

- Data validation to prevent faulty inputs

- Alerts to ensure accurate refi timing and sufficiency of proceeds

Support

Support is available through our online ticket system.

Included With Purchase

- Blank templates for Units- and FAR-based analyses

- Copies of the templates with a sample deal loaded in

- Credit of what you pay towards future purchase of the Tools Bundle

“I procured 5 LP term sheets and we just signed with a major $24B asset manager. This is testament that your models are accurate. I have gone head to head with major PE groups and there was no doubt on the model’s solidity.”

– Ali Lotfi, President, Intergulf Development Group

Multi-Year Back Of The Envelope Apartment Building Development Analysis Excel Tool

Overview and Video Tour

The Multi-Year B.O.T.E. Excel tool is suited for rapid apartment building development feasibility and residual land valuation based not only on a stabilized yield on cost, but also on goal-seeking to any of a targeted before-tax IRR, net profit, multiple on equity or NPV metric.

Functions

- Compatible with Excel on PC, Mac, iPad and Android tablets

- Supports an 11-year timeline of development and operation

- Allows for back-solving to a residual land value based on:

- stabilized cap rate

- net profit

- IRR

- multiple on equity

- average cash on cash

- NPV

- Streamlined set of assumptions inputs

- Units-based and FAR-based analysis types

- Supports a NNN retail component, sold with the apartments at a single cap rate

- Sale valuation based off of forward or trailing 12 months values

Features

Charts for:

- development equity and debt capitalization

- annual development costs

- annual NOI yield on cost

- annual NOI

- annual cash on cash

- equity and debt capitalization at sale

IRR Sensitivity Analysis data tables based on:

- base building hard cost vs. exit cap

- senior construction loan LTC vs. exit cap

- land cost vs. base building hard cost.

Debt & Equity Capabilities

- Sponsor Equity

- Senior Construction Loan

- Refinancing upon stabilization with a Permanent Loan that supports an upfront interest-only period and a cash out refi

Reports

The analysis prints neatly on a single 8.5 x 11 page in landscape orientation.

Quality Controls

Data validation to prevent faulty inputs, and alerts to ensure accurate refi timing and sufficiency of proceeds.

Support

Support is available through our online ticket system.

Included With Purchase

- Blank templates for Units- and FAR-based analyses

- Copies of the templates with a sample deal loaded in

- Credit of what you pay towards future purchase of the Tools Bundle