This week we upgraded the REFM website to serve you better. Here's what you need to know: The website and blog are now consolidated and they are mobile-friendly, so you can shop... read more →

How did you get started in the commercial real estate business? Like many real estate professionals, my initial exposure to the business was through my Dad. An attorney by trade,... read more →

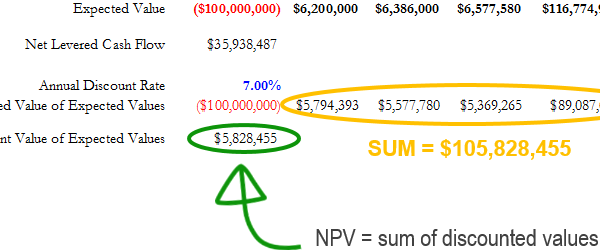

Just like a company traded on the stock market, an income-producing real estate property can be valued based on the sum of the discounted values of its future expected cash flows. This is known... read more →

Let's say you are modeling an acquisition transaction and want to quickly compare how two debt financing alternatives impact cash flows: a senior amortizing loan only a senior amortizing loan... read more →

Learn more about REFM Certification In Excel For Real Estate here; it's a great way to learn/sharpen your skills and add to your resume and LinkedIn profile. More than 900... read more →

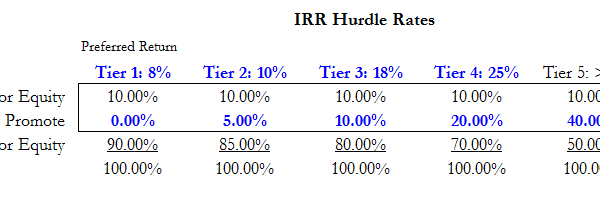

The look-back IRR waterfall can be tough to grasp conceptually if it's not explained intuitively (buy this Self Study tutorial if you have not mastered the concepts already). One of the... read more →

** Note: be sure to see the bottom of this post, where we have links to another 10 posts on cap rates. ** A "cap rate" (short for capitalization rate)... read more →

This week marks the fifth anniversary and the 500th blog post of Model for Success. Here's how you can get the most out of the wealth of valuable free information and... read more →

If you're working with equity joint venture partnership structures, you may come across the term pari passu in the operating agreement between the partners. Pari-passu (sometimes you'll see it hyphenated)... read more →