Half of the challenge of working in real estate development is choosing on which potential deals you should spend your time. When deal flow is strong, it's hard to keep... read more →

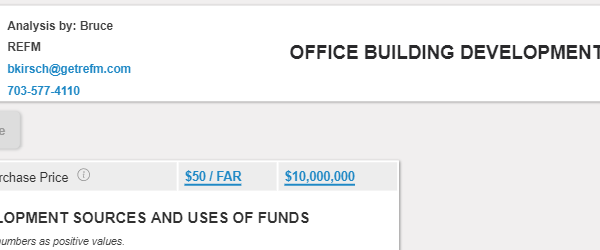

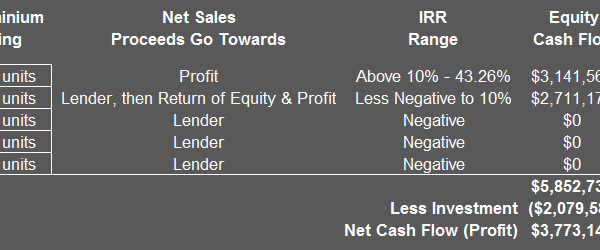

If you're trying to determine if the asking price for an office development site will allow it to pencil, your first pass analysis should be a quick, back of the... read more →

Learn more about REFM Certification In Excel For Real Estate here; it's a great way to learn/sharpen your skills and add to your resume and LinkedIn profile. Thousands of certifications have been granted since... read more →

If you are relatively new to real estate investing, you may have seen and heard the term "value add" but were not 100% sure what it means. You can learn... read more →

We've written on what is a good IRR for a real estate transaction, and in that post we touched briefly upon the equity multiple. Here we will expand on... read more →

Learn about how REFM's Valuate® software works together with REALTORS® Property Resource in this video featuring Bruce Kirsch from REFM and Nathan Graham from RPR.

Due to popular demand, we have created a Self Study version of our acclaimed 2-day live training "New York Course", and it's a terrific value for professionals and students. .... read more →

There's sometimes misunderstanding as it relates to cash flow waterfall modeling with mixing up of the terms catch-up, clawback and look-back. To be clear, each is completely its own concept. In this... read more →

Learn more about REFM Certification In Excel For Real Estate here; it's a great way to learn/sharpen your skills and add to your resume and LinkedIn profile. More than 2,000... read more →

Back by popular demand, this 2-day intensive training course available both in person and online provides you with foundations and a wide array of financial modeling skills specific to development... read more →