Below is an interview with Ashleigh Coaxum, the Senior Program Manager for Real Estate for SEO. What is SEO and who is it for? SEO Career is the nation’s premier... read more →

Our 2019-2020 catalog of training offerings is embedded in the page below. All topics are available through our corporate, university and private coaching offerings. Custom-tailored programs and testing are available... read more →

“… this may well be the best textbook ever written concerning the subject …” Mark Munizzo, Principal, The Equity Network | Adjunct Professor, Roosevelt University Chicago ... read more →

Now you can do back of the envelope analyses for ground-up development of condominium buildings including taking into account: pre-sales parking and storage sales affordable units. Check out the video... read more →

For more than 40 years, Dr. Peter Linneman's unique blend of scholarly rigor and practical business insight has won him accolades from... read more →

Our new catalog of training offerings is embedded in the page below. All topics are available through our corporate, university and private coaching offerings. Custom-tailored programs and testing are available... read more →

This event has already taken place. You can watch the recording here. For more than 40 years, Dr. Peter Linneman's unique blend... read more →

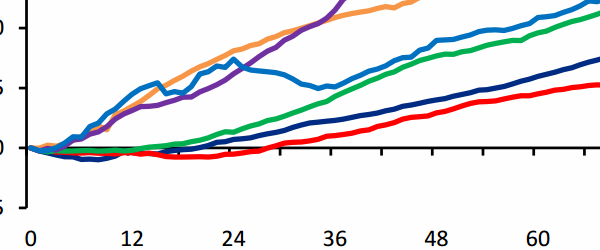

Value-add investing in apartment properties is the oldest play in the book for how to create wealth in the real estate game. While it's easy to get lost in... read more →

For more than 40 years, Dr. Peter Linneman's unique blend of scholarly rigor and practical business insight has won him accolades from... read more →

For more than 40 years, Dr. Peter Linneman's unique blend of scholarly rigor and practical business insight has won him accolades from around the world, including... read more →