For more than 40 years, Dr. Peter Linneman's unique blend of scholarly rigor and practical business insight has won him accolades from around the world, including... read more →

When faced with modeling a commercial real estate refinancing (replacing an in-place loan by taking a new loan), you don't always have to rely upon building out a 360-row tall amortization... read more →

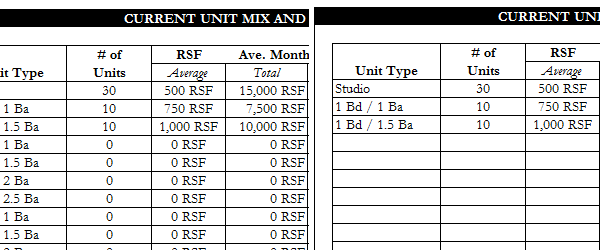

If you are looking to see if the asking price for a multi-family development site makes a potential development economically feasible, your first pass analysis should be a quick, back of... read more →

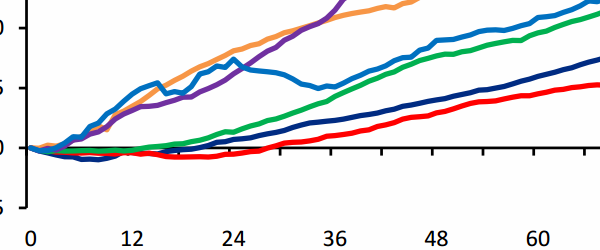

One of the challenges to both commercial real estate deal sponsors and investors with closing equity joint venture partnerships for individual property transactions is getting accurate information as to how... read more →

Unfortunately for us, Excel requires that literally every new tab we create be formatted from scratch. It's pretty awful and painstaking work with which we are all too familiar. In... read more →

The real estate industry hasn’t always been a fan of Twitter, but there’s a growing commercial real estate community on the platform that is sharing timely content, interesting industry trends... read more →

We have written before about job interview Excel modeling tests here, and wanted to provide a tip sheet as a complement to what we have already said. Here are our... read more →

It’s easy to get caught up in the excitement of purchasing an investment property and lose track of the basic financial equations that are necessary to ensure long-term success. One... read more →

For more than 40 years, Dr. Peter Linneman's unique blend of scholarly rigor and practical business insight has won him accolades from around the world, including PREA's prestigious Graaskamp Award... read more →

As a newer agent in commercial real estate, how can you stand out from the more established agents that seem to have all the business? The answer is: financial modeling.... read more →