Let's say you are modeling an acquisition transaction and want to quickly compare how two debt financing alternatives impact cash flows: a senior amortizing loan only a senior amortizing loan... read more →

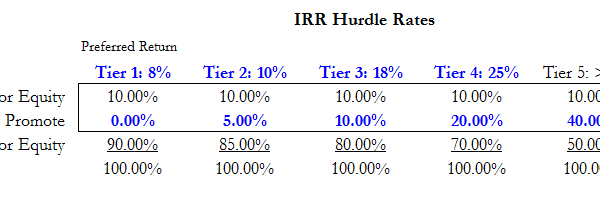

The look-back IRR waterfall can be tough to grasp conceptually if it's not explained intuitively (buy this Self Study tutorial if you have not mastered the concepts already). One of the... read more →

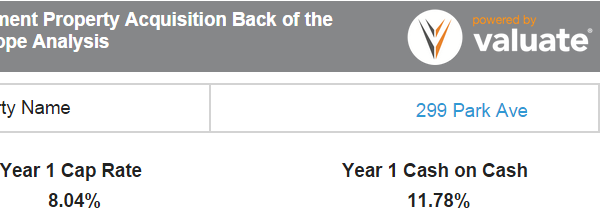

** Note: be sure to see the bottom of this post, where we have links to another 10 posts on cap rates. ** A "cap rate" (short for capitalization rate)... read more →

This week marks the fifth anniversary and the 500th blog post of Model for Success. Here's how you can get the most out of the wealth of valuable free information and... read more →

If you're working with equity joint venture partnership structures, you may come across the term pari passu in the operating agreement between the partners. Pari-passu (sometimes you'll see it hyphenated)... read more →

For all you multi-family property buyers and investors in the audience... please note that the Apartment Property Acquisition Back of the Envelope Excel template file previously offered at getrefm.com is... read more →

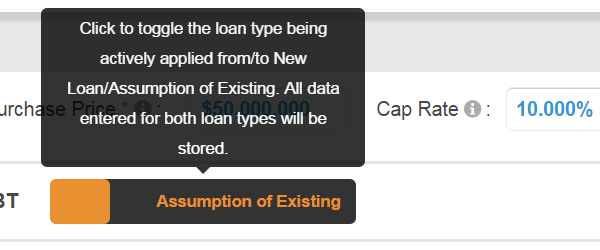

In some real estate acquisition transactions, the buyer has the legal option -- or is obligated -- to keep the in-place senior mortgage loan on the property. This is known as... read more →

Test your aim and blow off some steam here. Brought to you by Valuate.

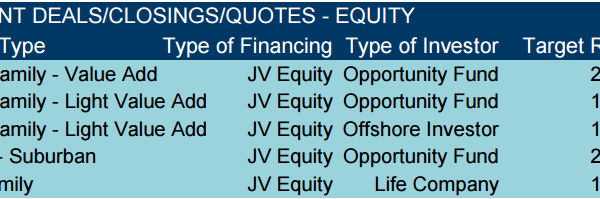

If you've ever asked the question "Where can I find current pricing quotes on equity and debt placements?", we have the answer for you: the Cushman & Wakefield Capital Markets... read more →

CMBS, or commercial/collateralized mortgage-backed securities, is a whole world unto itself in real estate finance that revolves around the bundling and packaging of pools of real estate loans that are... read more →