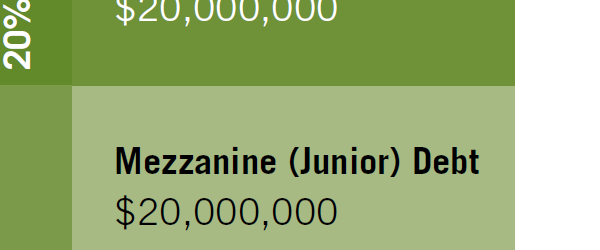

Mezzanine financing is a sometimes confusing part of the capital structure in a real estate transaction. Part of the reason for this is that the term mezzanine is really a... read more →

This is long overdue, but better late than never... Model for Success is now mobile-friendly! Enjoy.

Let's say you have an existing waterfall model in Excel that is built out to support 5 tiers (hurdles). The equity JV waterfall structure is cumulative and compounding in nature,... read more →

2-way sensitivity tables allow you to show a spectrum of equity IRR, Multiple and NPV outputs at the intersection of variable values of two key inputs. By viewing these differing outputs... read more →

Many companies these days will include a technical Excel modeling skills test as part of their interviewing process for financial analyst and associate roles. The nature of the test can... read more →

Is there such a thing as the perfect sale comp (comparable sale)? Sure, but it's a rare bird. Let's assume we have a two-tower office complex and that the buildings... read more →

Take a look inside to see what top firms have found to be invaluable for the development of their analysts and associates (click here to download it). Custom-tailored programs and testing... read more →

Property buyers are inundated with deal flow right now, so they are forced to get picky with which deals to screen into their pipeline. In the e-book below, you will... read more →

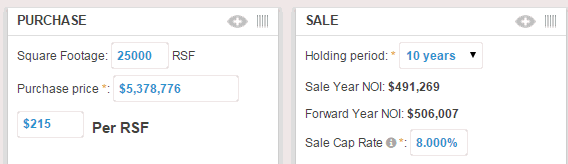

Let's say you know you want to purchase properties at a particular going-in cap rate, say 6%. If you know that much, you can back-solve to the Purchase Price that... read more →

This is a re-post of an article that originally appeared at Investment News Article by Jeff Benjamin The proliferation of digital platforms puts added emphasis on due diligence Financial advisers are... read more →